The worth of Bitcoin (BTC) will proceed to expertise cyclical booms and busts, leading to a drawdown of as much as 70% through the subsequent market downturn, in response to Vineet Budki, CEO of enterprise agency Sigma Capital.

There will likely be a BTC retracement of 65% to 70% within the subsequent two years as a result of merchants don’t perceive the asset they’re holding, Budki informed Cointelegraph on the International Blockchain Congress 2025 in Dubai, UAE. He stated:

“Bitcoin won’t lose its utility if it comes right down to $70,000. The issue is that individuals do not know its utility, and when folks purchase property that they do not know and perceive, they promote them first; that’s the place the promoting strain comes from.”

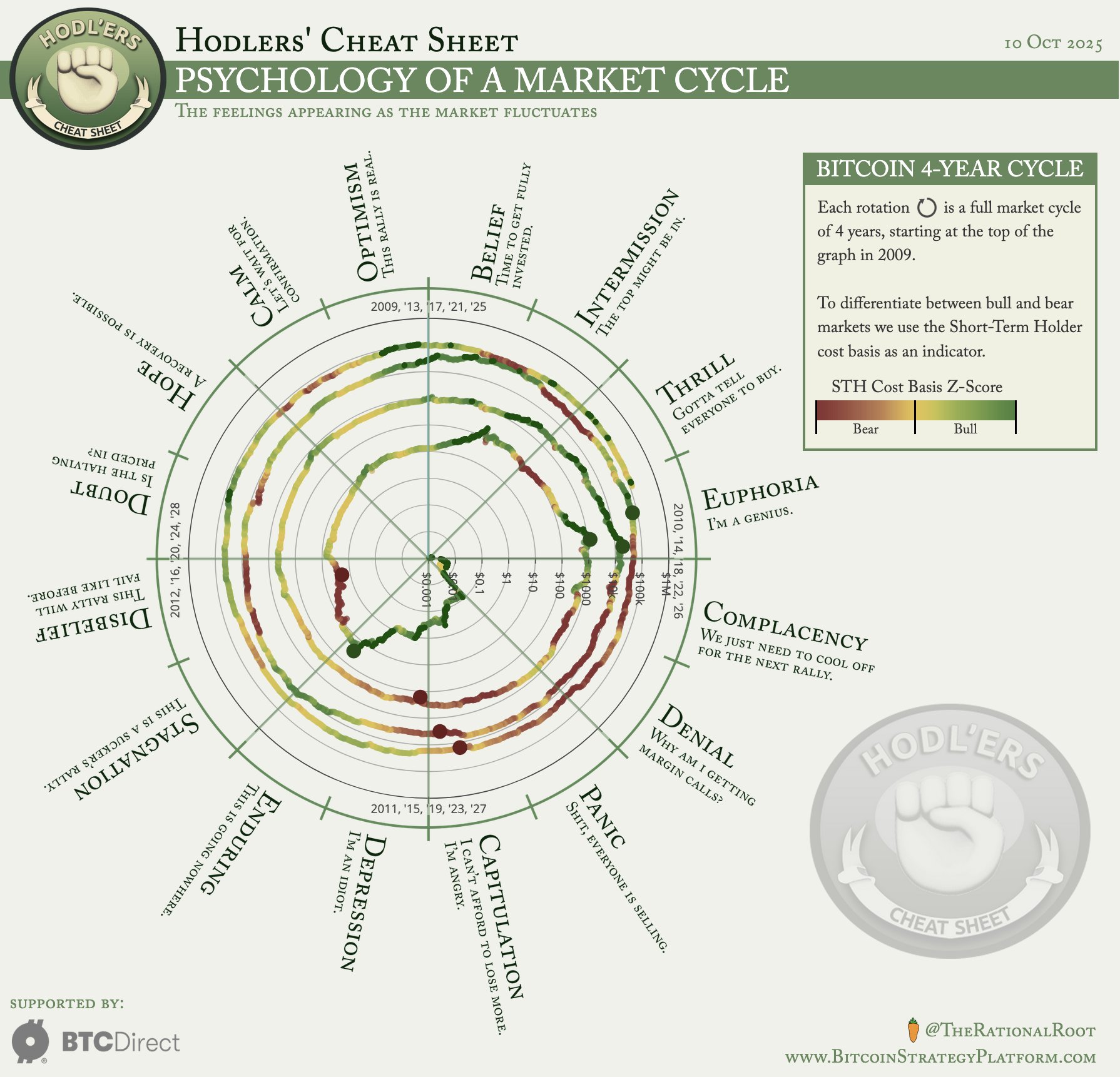

A chart breaking down investor pyschology patterns throughout totally different factors of the Bitcoin market cycle. Supply: Root

Regardless of this, Budki nonetheless forecasts that Bitcoin will attain $1 million or extra per coin inside the subsequent 10 years and acknowledged that person adoption will develop from a mix of worth hypothesis and, extra importantly, real-world BTC use instances.

Analysts, business executives and buyers proceed to forecast when Bitcoin will attain a seven-figure price ticket and whether or not the market dynamics which have outlined BTC cycles since its inception in 2009 stay legitimate in 2025.

Associated: Bitcoin white paper turns 17 as first crimson October in 7 years looms for BTC

Has Bitcoin outgrown the four-year cycle?

The four-year Bitcoin cycle is lifeless, in response to Arthur Hayes, market analyst and co-founder of the BitMEX crypto alternate.

Bitcoin’s worth is influenced extra by macroeconomic elements, resembling rates of interest and the expansion of the cash provide, and fewer by cyclical patterns, Hayes stated.

Different analysts level to rising institutional adoption and the presence of those monetary establishments as a stabilizing pressure that reduces worth volatility and calms the markets.

Monetary establishments, together with governments, digital asset treasury corporations’ exchange-traded funds (ETFs) and cryptocurrency exchanges collectively maintain over 4 million BTC, practically 20% of Bitcoin’s whole provide, in response to BitcoinTreasuries.NET.

Nonetheless, Seamus Rocca, the CEO of crypto-friendly financial institution Xapo Financial institution, informed Cointelegraph that the four-year cycle stays in play as a result of buyers presently view BTC as a risk-on asset, regardless of its store-of-value properties.

Journal: Bitcoin to see ‘yet one more huge thrust’ to $150K, ETH strain builds: Commerce Secrets and techniques