Ethereum worth has stumbled into November with renewed promoting. The value dropped 3.8% up to now 24 hours, falling close to $3,738, after a tough October that noticed losses of virtually 17%. The market had hoped for a rebound, however knowledge now present holders decreasing publicity.

Nonetheless, on-chain help zones and a key momentum sign counsel the dip might not final for lengthy.

Holders Pull Again, However On-Chain Help Stays Robust

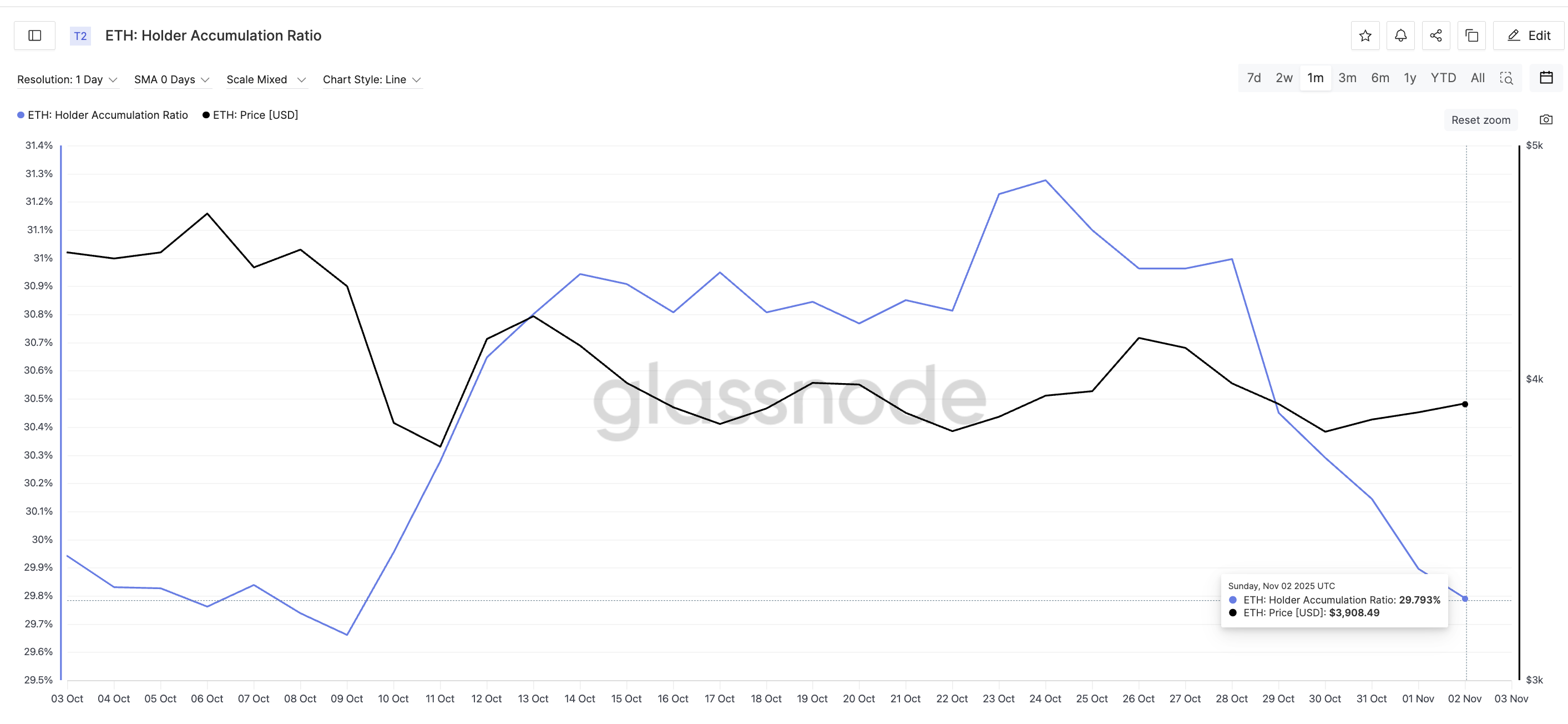

The holder accumulation ratio — which measures how a lot current Ethereum wallets are including to their balances — has slipped to 29.79%, its second-lowest stage in a month. The final comparable drop, on October 9 (29.66%), triggered a 14% fall from $4,370 to $3,750.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

Ethereum Holders Dump: Glassnode

This decline suggests long-term holders are trimming publicity or ready for higher costs. The dying cross predicted final week — when Ethereum’s short-term shifting common crossed under the long-term one — has additionally taken form, confirming that sellers briefly have the higher hand.

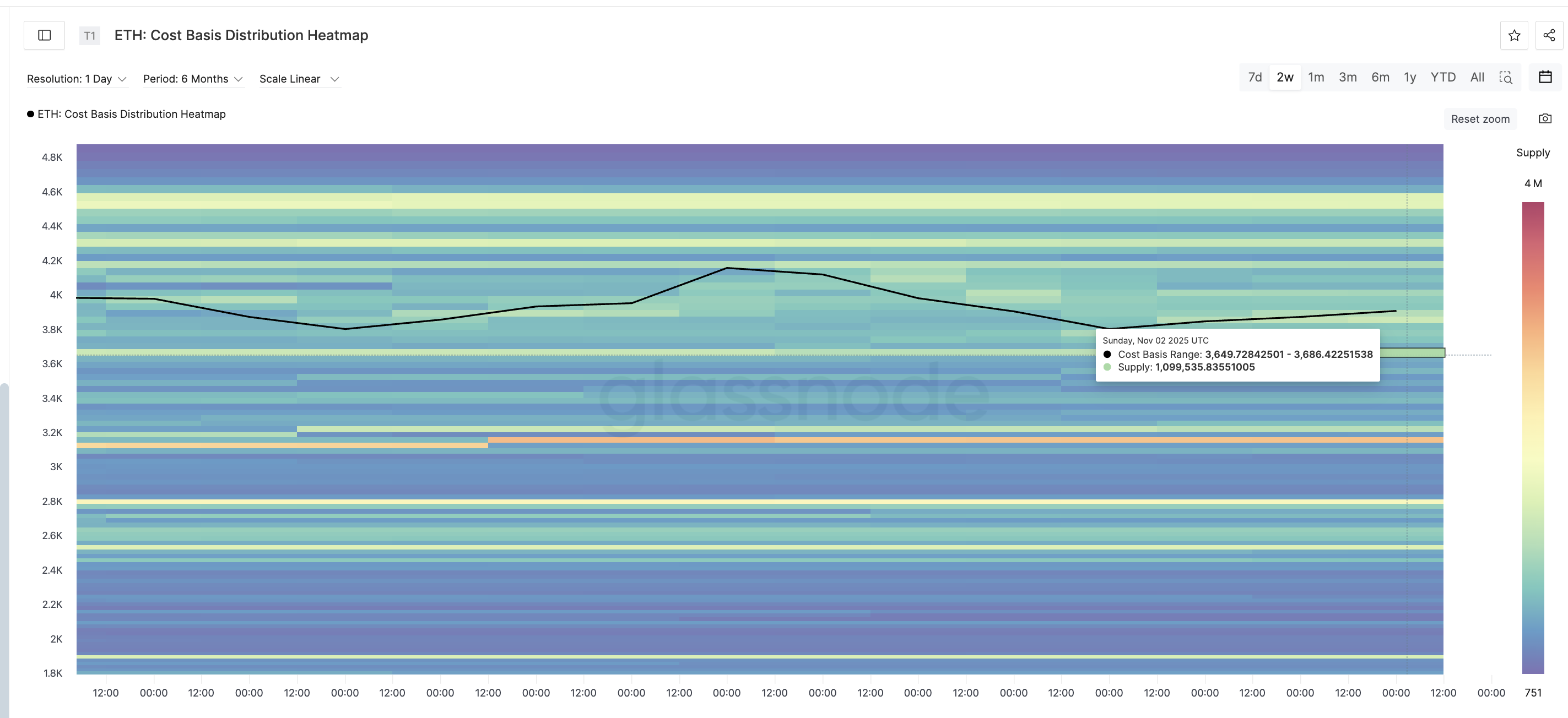

Nevertheless, knowledge from the price foundation distribution heatmap reveals a powerful help cluster between $3,649 and $3,686, the place about 1.09 million ETH have been final transacted.

Accumulation Zone Might Act As Help: Glassnode

The Price-Foundation Heatmap reveals the value ranges the place traders final purchased their cash. It helps determine key help or resistance zones based mostly on previous holder exercise.

Such dense accumulation typically acts as a cushion, that means that if the Ethereum worth slides additional, this area might set off dip-buying curiosity and restrict deeper losses.

Bullish Divergence and Ethereum Worth Motion Trace at Attainable Rebound

On the day by day chart, Ethereum trades inside an ascending triangle, the place costs preserve making greater lows alongside an upward-sloping help line. This construction normally displays purchaser resilience even throughout pullbacks. The Fibonacci ranges mark key resistance and help zones inside this triangle.

Between October 30 and November 3, the ETH worth fashioned a better low, whereas the Relative Power Index (RSI) — which measures the stability between shopping for and promoting energy on a scale of 0 to 100 — made a decrease low. This sample is a hidden bullish divergence, suggesting that the underlying momentum stays optimistic regardless of the value dip.

Ethereum Worth Evaluation: TradingView

If the Ethereum worth manages to carry above the $3,679 help zone, a rebound towards $3,899 (0.382 Fibonacci) might start. Additional energy above $4,035 and $4,132 would verify the restoration and invalidate the short-term bearish bias. Do observe that this key help zone has earlier been validated by the price foundation heatmap.

A day by day worth shut under $3,679, nevertheless, would break the ascending trendline and open the trail to a deeper correction. That might even push the ETH costs to $3,512, invalidating the rebound outlook.

The publish Ethereum Worth Takes a Hit as Holders Dump — However Is the Weak point Momentary? appeared first on BeInCrypto.