Ethereum regained the $3,100 worth degree after briefly dipping under for over 4 hours on Monday morning. The rebound got here throughout heightened exercise from a decade-old pockets and main liquidations by notable market figures.

The latest volatility underscores two contrasting market forces: long-term holders reemerging and influential gamers trimming publicity.

ETH Worth Motion and Market Sentiment

Ether dropped under $3,100 for the primary time since November 4, 2025, buying and selling at $3,066 at 9:36 PM UTC on November 16, down 3.4% over 24 hours. This decline mirrored broader weak spot in digital belongings and a view that ETH carries the next threat than Bitcoin.

One dealer on X stated, “Getting increasingly more troublesome to see a special consequence for $ETH presently. Needed to lower the lengthy (on ETH) this afternoon. Gained’t be making an attempt anymore.”

90 days ETH Worth. Supply: BeInCrypto

Regardless of the temporary dip, Ethereum recovered to above $3,100 inside hours, demonstrating notable resilience. Market members are intently monitoring ETF flows for indicators of continued promoting or a reversal, as they might set the tone for ETH’s route round this key help.

Based on Coinalyze information, the Lengthy-Quick Ratio for ETH data over 3.0, signaling sturdy dealer engagement. Current excessive factors point out intervals of elevated exercise, whereas rising Open Curiosity displays rising participation and potential for bullish continuation. Nonetheless, ratio spikes additionally trace at short-term volatility dangers.

Arthur Hayes Liquidates Crypto Holdings

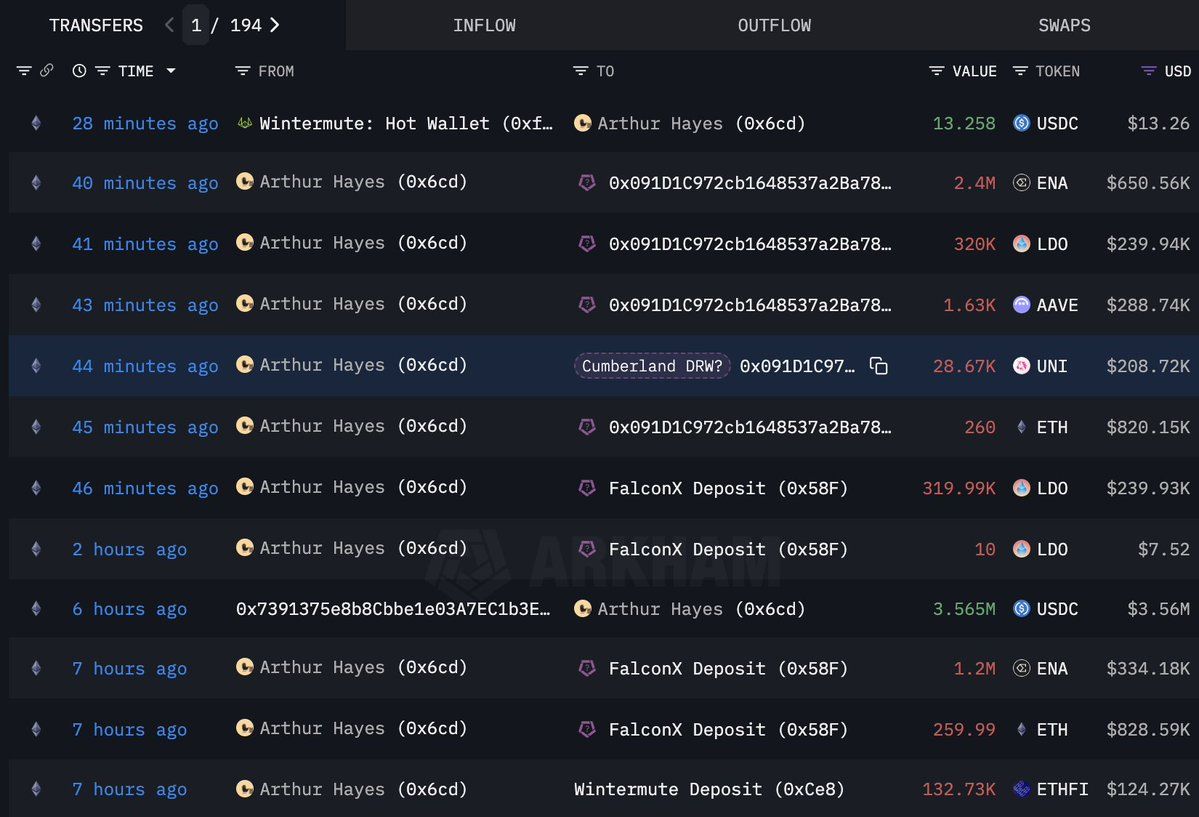

BitMEX co-founder Arthur Hayes started a sequence of large-scale crypto gross sales totaling roughly $4.1 million. On-chain analytics platform Lookonchain reported that Hayes offered 520 ETH, valued at $1.66 million, 2.62 million ENA, valued at $733,000, and 132,730 ETHFI, valued at $124,000, on Sunday.

Arthur Hayes’ on-chain transaction exercise – Lookonchain

Hours later, Hayes expanded the liquidation: he offered one other 260 ETH value $820,000, 2.4 million ENA valued at $651,000, 640,000 LDO value $480,000, 1,630 AAVE valued at $289,000, and 28,670 UNI value $209,000, based on one other Lookonchain publish. These belongings had been despatched to institutional desks—together with Flowdesk, FalconX, and Cumberland—that generally deal with high-volume liquidations.

Arthur Hayes’ continued asset gross sales – Lookonchain

These gross sales occurred as Ethereum retreated to $3,100 and Bitcoin slid to $94,000. Hayes’ actions could replicate a defensive rebalancing or profit-taking method throughout uncertainty, presumably including promoting strain on ETH and associated belongings.

Dormant Ethereum Pockets Reawakens After a Decade

In a uncommon transfer, a dormant Ethereum ICO pockets transferred 200 ETH value $626,000 after over 10 years, based on Lookonchain. The pockets had acquired 1,000 ETH throughout Ethereum’s genesis for a $310 funding—now a ten,097x return at present costs.

Ethereum ICO pockets awakens after 10 years – Lookonchain

Such exercise is important as a result of it exhibits early adopters’ ongoing religion in Ethereum’s long-term worth and potential. These actions may improve market provide. The wallets tied to Ethereum’s genesis and pre-mining levels are uncommon and intently adopted by the crypto neighborhood as indicators of whale exercise and shifts in sentiment.

The reactivation of a decade-old pockets illustrates the maturation of the Ethereum ecosystem. Early buyers who held by means of a number of bear markets and unstable cycles at the moment are shifting belongings, presumably for profit-taking, diversification, or new funding methods.

Diverging Knowledgeable Opinions on Ethereum’s Future

Distinguished analysts stay divided about Ethereum’s future. Tom Lee, Chairman of BitMine, communicated sturdy bullish sentiment, evaluating Ethereum to Bitcoin’s earlier supercycles. In a latest assertion, Lee identified that Bitcoin endured six declines of over 50% and three of over 75% prior to now 8.5 years, but rose 100-fold by 2025.

Lee emphasised that navigating volatility and uncertainty is required to revenue from supercycles. He argued that Ethereum is now following the same trajectory, urging buyers to carry by means of turbulence for the potential of exponential features.

$1,800 appears like a terrific spot to purchase Ethereum $ETH! pic.twitter.com/sDZiga5XQy

— Ali (@ali_charts) November 16, 2025

Conversely, analyst Ali Martinez provided a cautious view, suggesting ETH might drop to $1,800. His outlook displays issues about ETF outflows, threat relative to Bitcoin, and broader market challenges. The disagreement amongst consultants highlights ongoing uncertainty about Ethereum’s near-term strikes.

The strain between long-term optimism and short-term warning displays present sentiment towards Ethereum. Institutional buyers present hesitation, however on-chain actions by early members and energetic buying and selling counsel a fancy surroundings. The following few weeks could decide if ETH can preserve its help above $3,100 or if additional declines will check decrease ranges.