Within the newest Solana crypto information panorama, SOL’s pairing in opposition to USDT is navigating a fragile section the place sentiment, liquidity and pattern construction are clearly beneath pressure. But, the identical stress that’s pushing costs decrease may be getting ready the bottom for the following decisive transfer, as merchants reassess threat beneath a heavy macro and on-chain backdrop.

Abstract

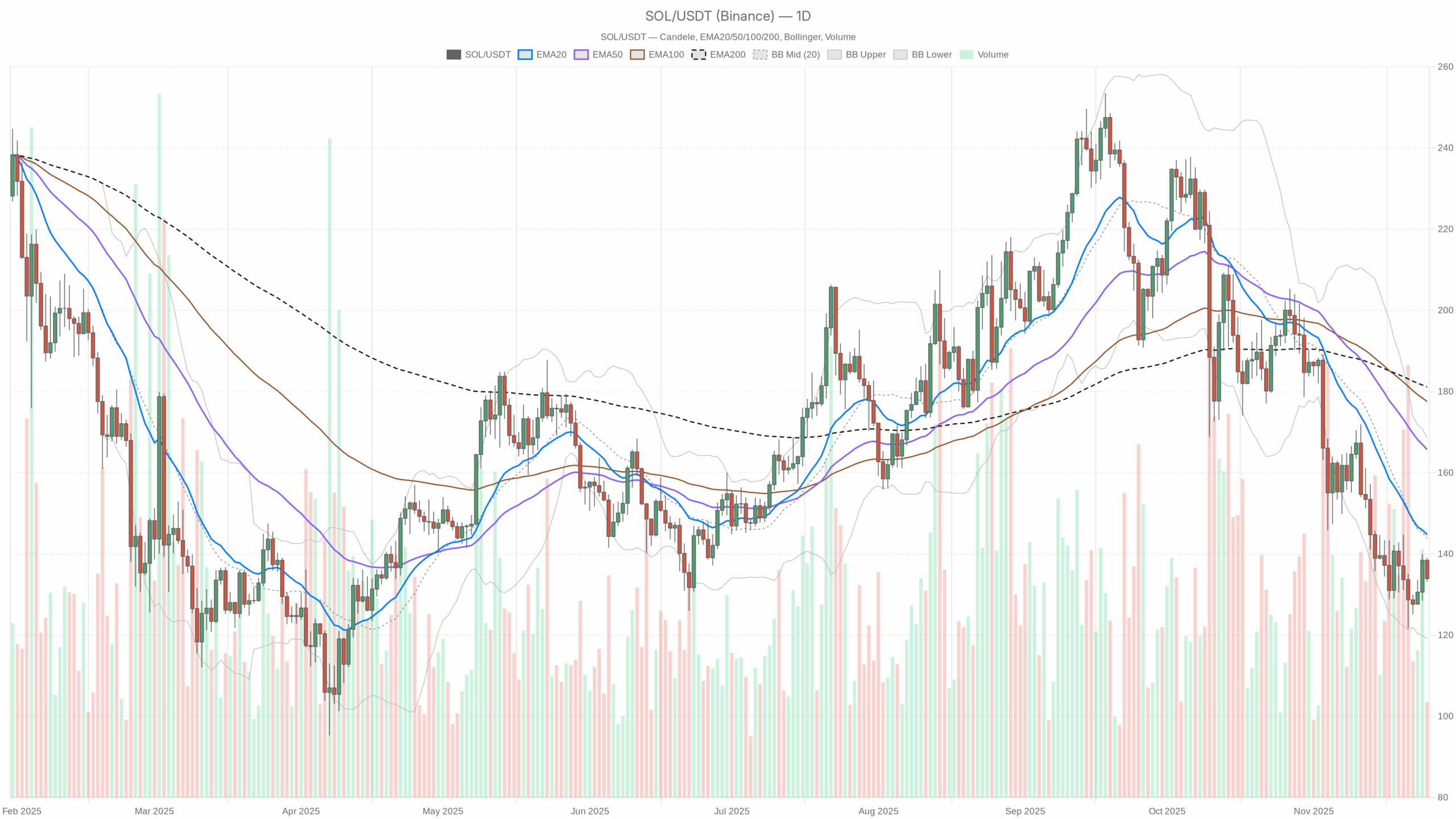

The day by day chart exhibits SOL buying and selling close to 133.9 USDT, firmly under its medium- and long-term transferring averages, confirming a broadly bearish market regime. Momentum indicators lean detrimental however not capitulative, pointing extra to grinding draw back and consolidation than to a full flush. Furthermore, volatility on the day by day timeframe is average, with the Common True Vary close to 10.44 USDT, leaving room for significant swings round present costs. Intraday, the image is barely much less heavy, with hourly and 15-minute regimes labeled as impartial fairly than outright bearish. Nevertheless, Bitcoin dominance above 56% and a crypto Worry & Greed Index caught in Excessive Worry counsel that capital is cautious and prefers majors over higher-beta tokens. Total, short-term merchants are probing for a tactical bounce, whereas longer-term contributors nonetheless face a broken however doubtlessly stabilizing pattern.

Solana crypto information: Market Context and Course

The broader market backdrop continues to be comparatively constructive in combination, with whole crypto capitalization round 3.05 trillion {dollars} and a gentle 24-hour improve. Nevertheless, that constructive floor hides a pointy choice for security: Bitcoin instructions greater than 56% market share, which traditionally leaves much less room for aggressive altcoin rotations. In distinction, SOL represents solely a small slice of the worldwide pie, underlining the present hierarchy the place liquidity favors the biggest names.

The sentiment aspect of the equation is much more telling. The Worry & Greed Index sits at 20, firmly in Excessive Worry territory, reinforcing that traders stay extremely defensive. This backdrop tends to suppress pattern energy on the upside for altcoins, whereas additionally rising the likelihood of sharp however short-lived aid rallies. Furthermore, DeFi exercise on Solana’s ecosystem, as seen by Raydium, Orca and different DEX charges, exhibits blended indicators: long-term price accumulation stays massive, however current proportion drops in month-to-month averages level to a cooling speculative cycle. That stated, the continuing acquisition narrative round Solana infrastructure, corresponding to Coinbase’s transfer for a local buying and selling platform, reminds markets that structural curiosity within the ecosystem persists past day-to-day worth noise.

Technical Outlook: studying the general setup

On the day by day chart, SOL trades at 133.9 USDT, clearly beneath the 20-day exponential transferring common at 144.74, the 50-day at 165.68, and the 200-day at 181.13. This stacked configuration of EMAs, all nicely above spot, confirms a mature downtrend with no speedy pattern reversal. Every of those transferring averages now acts as dynamic overhead strain, suggesting that any bounce towards them might meet promoting curiosity from trapped longs or systematic methods.

The Relative Power Index at 37.72 helps that image. It sits under the impartial 50 mark however nonetheless above classical oversold territory, signaling bearish momentum with out full exhaustion. In follow, this implies sellers are in management, but there’s nonetheless room for extra draw back earlier than a robust mean-reversion impulse turns into statistically extra probably.

The MACD on the day by day body tells a barely extra nuanced story. The road at -12.31 stays under zero, confirming detrimental momentum, however it has edged simply above its sign at -13.25, with a modestly constructive histogram of 0.95. This refined crossover hints at a possible momentum deceleration inside the broader downtrend, usually a precursor to sideways consolidation or a counter-trend rally fairly than an instantaneous sustained reversal.

Bollinger Bands add additional context: the midline sits at 143.85, with the higher band at 168.55 and the decrease at 119.15. Worth close to 133.9 is hovering within the decrease half of this volatility envelope, which aligns with draw back bias however not an excessive volatility growth. The asset is just not hugging the decrease band aggressively, suggesting strain is current however not but in a panic section.

Lastly, the Common True Vary at 10.44 factors to average day by day volatility. For merchants, because of this intraday strikes of a number of {dollars} are fully believable, however the market is just not in a blow-off or capitulation regime. Consequently, threat administration should nonetheless respect potential sharp counter-moves in opposition to the prevailing pattern.

Intraday Perspective and SOLUSDT token Momentum

In the meantime, the intraday construction is softer than the day by day downtrend would possibly suggest. On the hourly chart, SOL trades round 133.97 USDT, very near its pivot at 134.08, with a regime labeled impartial. The 20-period EMA at 135.92 lies barely above present worth, whereas the 50 and 200 EMAs cluster between 134.44 and 135.03, forming a good vary. This clustering hints at an ongoing consolidation section, the place neither bulls nor bears maintain decisive intraday management.

The hourly RSI round 40.68 is subdued but not excessive, signalling gentle draw back strain. Nevertheless, the MACD line at 0.23 has slipped under its sign at 0.84, with a detrimental histogram of -0.61, implying that current makes an attempt to rebound are fading. Consequently, intraday merchants might even see uneven motion with a slight bearish tilt, particularly as worth oscillates across the hourly pivot.

On the 15-minute chart, the image turns into extra tactical. Worth at 133.97 is under the 20- and 50-period EMAs (135.62 and 136.25) however close to the 200 EMA at 134.21. The short-term RSI at 30.9 is near oversold, indicating momentum pressure on very brief horizons. The MACD line at -0.61 stays beneath its sign at -0.4 with a detrimental histogram, confirming that microstructure nonetheless favors sellers, but the proximity to oversold territory raises the likelihood of fast, technical bounces.

Key Ranges and Market Reactions

Every day pivot evaluation locations the central reference level close to 135.34 USDT, simply above spot. Holding under this space retains the short-term bias detrimental. Fast resistance emerges within the zone round 137.5 USDT, which coincides with the primary pivot resistance on each day by day and intraday frames. A push into that band, if rejected, would probably verify ongoing distribution on rallies and will ship worth again towards the decrease Bollinger area.

On the draw back, help seems first within the 131.7 USDT space, consistent with the day by day first help degree, after which nearer to the decrease day by day Bollinger Band round 119.1. A clear break under 131.7, adopted by acceptance towards 120, would reinforce the present bearish continuation setup. Conversely, a reclaim of 137–145, notably if day by day closes begin to kind again above the 20-day EMA at 144.74, could be an early sign that sellers are dropping management.

Future Situations and Funding Outlook

Total, the charts describe a market by which the dominant pattern nonetheless factors decrease, however with early hints of stabilization in momentum. Swing merchants could favor to attend for affirmation, both by a decisive breakdown under key helps that validates one other leg down, or by a collection of upper lows supported by RSI restoration above 50. In the meantime, intraday contributors can exploit the present range-bound habits, however solely with tight threat parameters given the backdrop of Excessive Worry.

Longer-term traders could view the current construction as a creating base fairly than a confirmed backside, as EMAs stay stacked bearishly and volatility can nonetheless broaden. A affected person technique, scaling in provided that worth begins to reclaim main transferring averages and if market-wide threat urge for food improves from at present’s depressed ranges, seems extra prudent than aggressive dip-buying. On this sense, the most recent Solana crypto information headlines matter lower than whether or not worth can remodel the present strain right into a sturdy shift in market regime.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding choices.