Whereas the Tron crypto nonetheless trades close to the decrease finish of its latest vary, some short-term metrics trace at an try to stabilize, whilst longer-term indicators stay fragile.

Abstract about crypto Tron

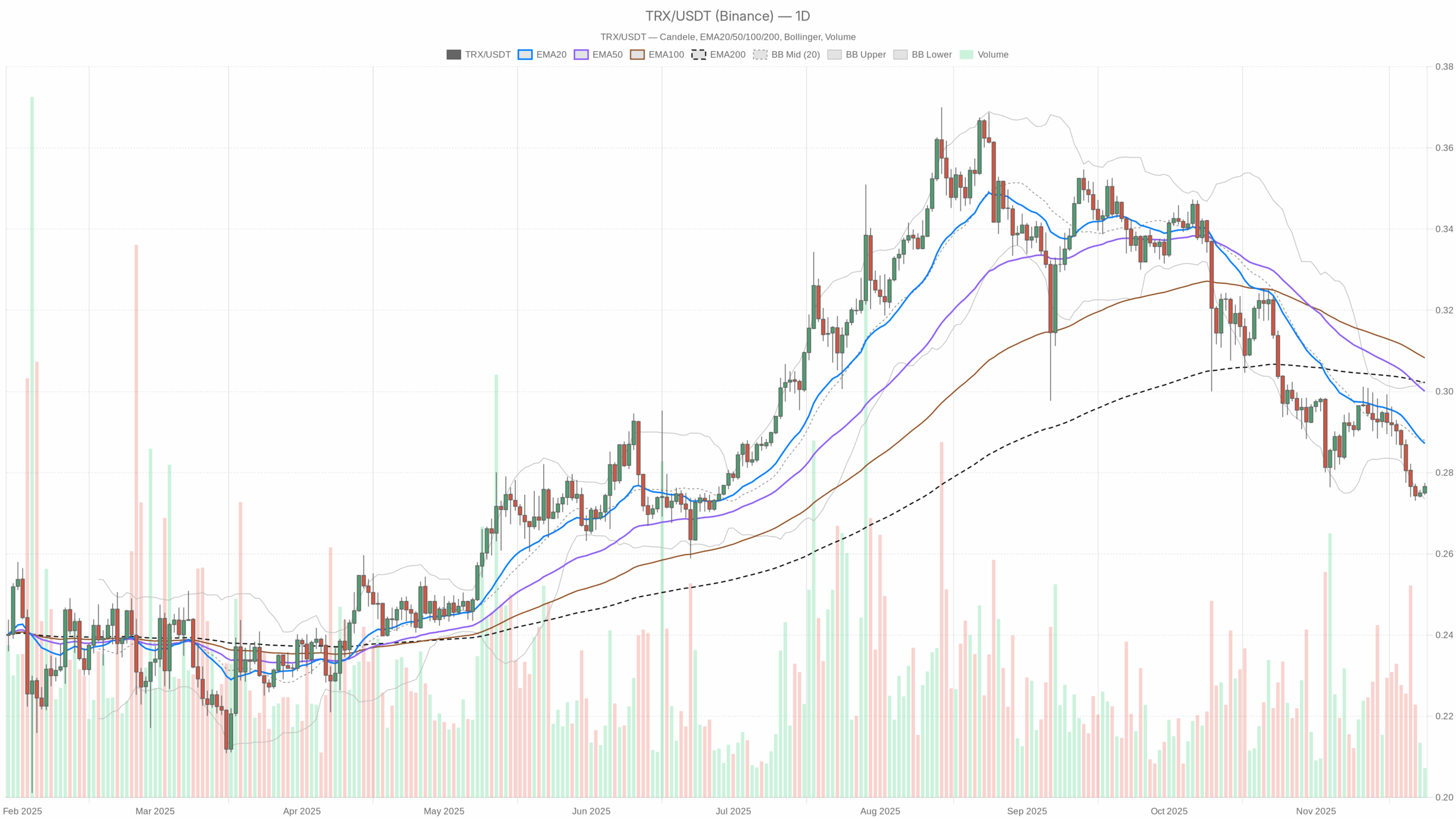

The each day chart factors to a bearish market regime, with value closing at 0.28 under the 20, 50 and 200-day EMAs round 0.29–0.30. Momentum on the upper timeframe stays weak, because the each day RSI hovers close to 32, near oversold territory. MACD on the identical timeframe sits barely unfavourable with a flat histogram, signaling downtrend fatigue however not but a reversal.

Furthermore, Bollinger Bands are comparatively tight between 0.27 and 0.30, indicating subdued volatility reasonably than a full capitulation spike. On the macro facet, a complete crypto market cap above 3 trillion {dollars} and Bitcoin dominance close to 57% present a risk-on bias centered on majors. Nevertheless, a Worry & Greed Index at 19 (Excessive Worry) reveals that sentiment continues to be fragile, particularly for altcoins.

Tron crypto: Market Context and Path

The present backdrop for this community token can’t be learn in isolation from the broader market. With world capitalization round 3.04 trillion {dollars} and Bitcoin capturing roughly 56.9% dominance, capital stays concentrated within the prime property. Furthermore, the 24-hour market cap change is modestly constructive, simply above 0.5%, suggesting a cautious however constructive world setting reasonably than a panic part.

That mentioned, sentiment metrics inform a extra nuanced story. The Worry & Greed Index at 19, firmly in Excessive Worry, highlights that many buyers nonetheless mistrust any rally, significantly exterior Bitcoin and the most important smart-contract platforms. In distinction, this identical setting may be fertile floor for accumulation by long-term members who’re prepared to look past short-term noise. For this token, the mixture of a fearful temper and a still-elevated dominance of Bitcoin often interprets into subdued relative power towards the broader market, except a robust catalyst seems.

Technical Outlook: studying the general setup about crypto Tron

On the each day timeframe, the value closing at 0.28 under the 20, 50 and 200-session exponential shifting averages round 0.29–0.30 confirms a dominant bearish development construction. The truth that all three EMAs are clustered barely above present value suggests a well-defined provide zone overhead, the place sellers have repeatedly defended rallies. For swing merchants, this alignment usually indicators that any bounce towards that area could first be handled as a corrective transfer, not but a brand new uptrend.

The each day RSI at 32.17 provides an necessary nuance. It’s near, however not inside, traditional oversold territory, indicating weak momentum with room for additional draw back but additionally the potential for sharp reduction rebounds. If RSI stabilizes and begins to show up from this space whereas value holds above the latest lows close to the decrease Bollinger Band at 0.27, it might be an early clue that promoting strain is dropping power.

MACD on the each day chart reveals the road and sign each close to -0.01 with a flat histogram round zero. This configuration is typical of a market the place the earlier down-leg is slowing, but consumers haven’t gained management. It displays a part of momentum exhaustion reasonably than clear development reversal. Merchants typically wait in such contexts for a decisive cross with increasing histogram to substantiate {that a} new directional leg is underway.

Bollinger Bands reinforce this image. With the mid-band at 0.29 and the envelope spanning roughly 0.27 to 0.30, volatility stays contained. There isn’t a signal of a violent squeeze-and-breakout but, however the proximity of value to the decrease band hints at draw back saturation. ATR on the each day, at round 0.01, confirms a comparatively quiet setting, with common each day swings restricted to some cents. This compressed volatility can precede a bigger transfer as soon as a catalyst or breakout degree is triggered.

Intraday Perspective and Tron crypto Momentum

In the meantime, shorter timeframes inform a considerably completely different story. On the hourly chart, value sits proper on its key EMAs, with the 20, 50 and 200-hour averages all clustered round 0.28. This alignment across the identical degree signifies a impartial intraday regime, the place neither bulls nor bears have a transparent benefit.

Consequently, many short-term merchants will deal with breaks above or under this stability zone to gauge the subsequent micro-trend.

The hourly RSI at about 57 suggests barely constructive momentum, in distinction to the weak each day studying. It hints that intraday dip-buyers are lively round present ranges, making an attempt to defend the vary.

MACD on the hourly and 15-minute charts is sort of flat, mirroring the sideways value motion and supporting the view of short-term consolidation inside a broader downtrend. This divergence between each day weak point and intraday neutrality typically precedes a decisive transfer as one timeframe finally adapts to the opposite.

Key Ranges and Market Reactions

From a ranges perspective, the each day pivot level sits exactly at 0.28, matching the present value and performing as a reference for each consumers and sellers. The primary help space emerges round 0.27, close to the decrease Bollinger Band, the place latest reactions recommend that value-oriented members are stepping in. If this ground have been to interrupt on sturdy quantity, it might validate the prevailing bearish continuation setup and open the door to a deeper correction.

On the upside, probably the most quick problem lies simply above the pivot, between 0.28 and 0.30, the place the each day EMAs and higher Bollinger Band converge. A sustained shut again above 0.29–0.30 would sign that the market is beginning to soak up overhead provide. In that case, a shift towards development stabilization reasonably than persistent decline would turn into extra believable, particularly if accompanied by rising quantity and an enhancing RSI.

Future Situations and Funding Outlook

General, the primary situation for this asset stays cautiously bearish on the each day timeframe, tempered by indicators of exhaustion and low volatility. Quick-term merchants could search for vary methods round 0.27–0.30 whereas ready for a breakout to redefine course. Longer-term buyers, nevertheless, may interpret the mixture of Excessive Worry, compressed volatility, and proximity to help as a possibility to scale in step by step, offered they settle for the chance of additional drawdowns. In such an setting, a disciplined strategy that respects key ranges and reacts to confirmed breakout or breakdown indicators is more likely to outperform aggressive bets on quick development reversal in Tron crypto.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding selections.