Bitcoin entered the ultimate month of 2025 below overwhelming worry. Many traders gave up as a result of they might not afford to deal with the rising losses. Information, nonetheless, signifies {that a} main alternative is opening.

The Bitcoin Capitulation Metric simply reached an all-time excessive. This improvement holds vital significance within the present market context.

How the Bitcoin Capitulation Metric Suggests a Main Shopping for Alternative in December

The Bitcoin Capitulation Metric displays the extent of “ache” traders are experiencing.

Builders constructed this indicator utilizing the Price Foundation Distribution (CBD). CBD exhibits the whole token provide primarily based on the typical buy worth of every handle. It additionally allows analysts to trace shifts in provide and investor sentiment over time.

When traders undergo vital losses, they usually capitulate and promote their holdings aggressively. These intervals normally align with the formation of native bottoms. They assist determine potential reversal factors the place provide strikes from “weak fingers” to “robust fingers.”

Historic information exhibits that peaks on this metric (marked in purple on the chart) sometimes coincide with worth bottoms (marked in black). This sample appeared in Q3 2024 and once more in Q2 2025.

Not too long ago, the Capitulation Metric surged to its highest degree ever. Many analysts at the moment are paying shut consideration. They count on a robust reversal in Bitcoin’s worth towards the tip of the 12 months.

“Bitcoin capitulation metric simply hit an all-time excessive! Final time this occurred, the value skyrocketed 50%. Are you prepared for the subsequent ATH?” analyst Vivek Sen stated.

As well as, stablecoin market capitalization has begun to rise once more after 4 consecutive weeks of decline. This renewed development strengthens bullish expectations. Since stablecoins present the market’s main liquidity, this rebound could sign that traders are getting ready to purchase the dip.

A Cautious View from Peter Brandt

One problem with this metric is the lack to pinpoint the precise second a reversal will happen.

The Capitulation Metric spiked twice in Q3 2024 earlier than Bitcoin discovered a backside. It additionally wanted three spikes in Q2 2025 earlier than the market reversed. If the metric cools now and surges once more, Bitcoin’s worth could drop even additional.

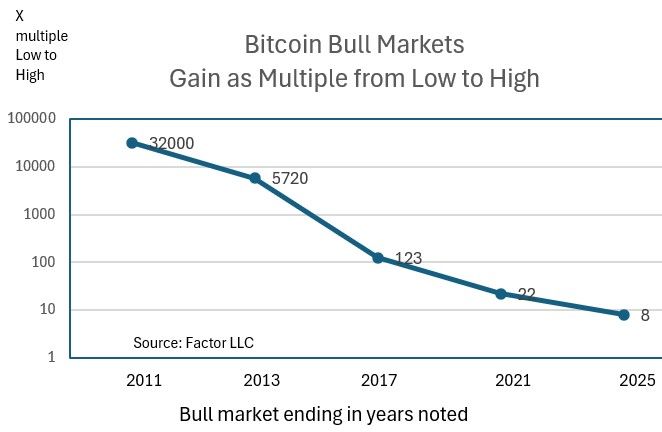

In his newest evaluation, legendary dealer Peter Brandt advised a worth run from the $50,000 backside to above $200,000.

Bitcoin’s development charge over cycles. Supply: Issue LLC/Peter Brandt

“The historical past of Bitcoin bull market cycles has been a historical past of exponential decay. Agree with it or not, you’ll have to take care of it. Ought to the present decline carry to $50k, the subsequent bull market cycle ought to carry to $200k to $250K.” – Brandt stated.

Brandt emphasised the idea of “exponential decay,” the place development charges decline exponentially over time. This development displays Bitcoin’s maturation as an asset.

In easier phrases, if Bitcoin reverses and enters a brand new bull run, the upside could solely attain 4 to 5 occasions the underside. The market could not expertise explosive good points much like these of earlier cycles.

The put up Bitcoin Capitulation Metric Hits All-Time Excessive – What Does It Imply? appeared first on BeInCrypto.