In keeping with VanEck analysts, Bitcoin’s hashrate fell 4% over the month to Dec. 15. That transfer has caught the eye of market watchers as a result of previous situations of hashrate declines have typically come earlier than worth positive aspects.

VanEck’s Matt Sigel and Patrick Bush level to historic patterns: when hashrate fell over the prior 30 days, Bitcoin’s 90-day ahead returns had been optimistic 65% of the time, in contrast with 54% when hashrate rose. Numbers matter right here, and merchants are treating them as a part of the proof combine.

Hashrate Compression Can Sign Recoveries

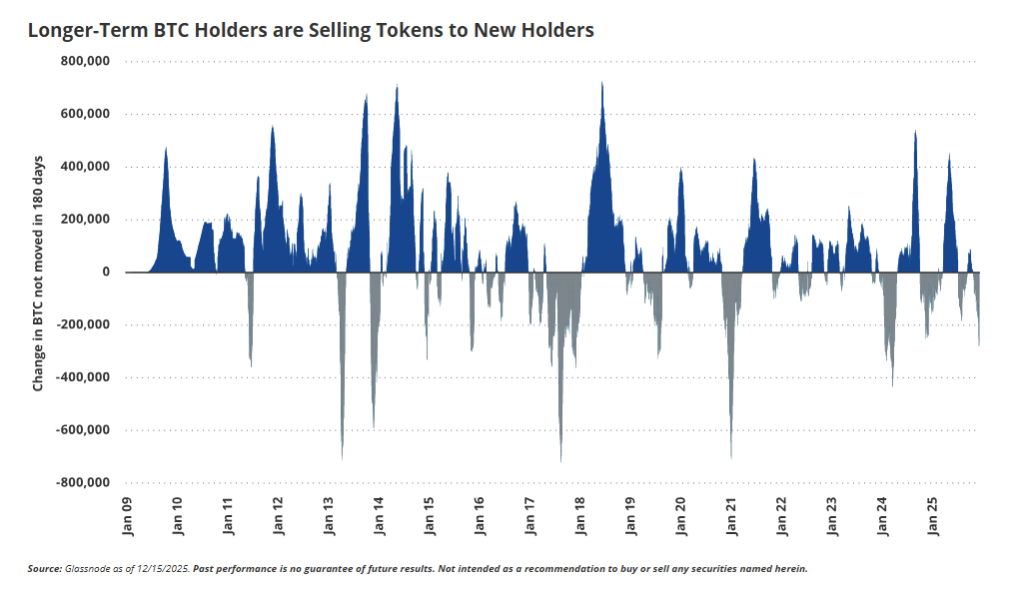

Stories have disclosed that longer home windows look higher for bulls. When hashrate contracted and stayed low, the chances of a restoration improved over wider horizons. Unfavourable 90-day hashrate progress was adopted by optimistic 180-day Bitcoin returns 77% of the time, with a mean achieve of 72%.

Supply: VanEck

The mathematics is obvious and the sample is constant sufficient to make traders take discover. Miner economics add to the story: the break-even electrical energy worth on a 2022-era Bitmain S19 XP dropped practically 36% from $0.12 per kilowatt-hour in Dec. 2024 to $0.077/kWh by mid-December. That shift squeezes margins and forces marginal operators to rethink their rigs.

Miners Exit, Markets Watch

Some capability has left the community. VanEck tied the latest 4% decline to a shutdown of roughly 1.3 gigawatts of mining energy in China. Analysts additionally warn that rising demand for AI compute may pull capability away from Bitcoin, a development they estimate would possibly erase 10% of the community’s hashrate.

That might redistribute mining exercise and will focus operations the place energy and coverage align. On the identical time, assist for mining has not disappeared worldwide. Based mostly on experiences, as much as 13 international locations are backing mining actions, together with Russia, Japan, France, El Salvador, Bhutan, Iran, UAE, Oman, Ethiopia, Argentina, and Kenya.

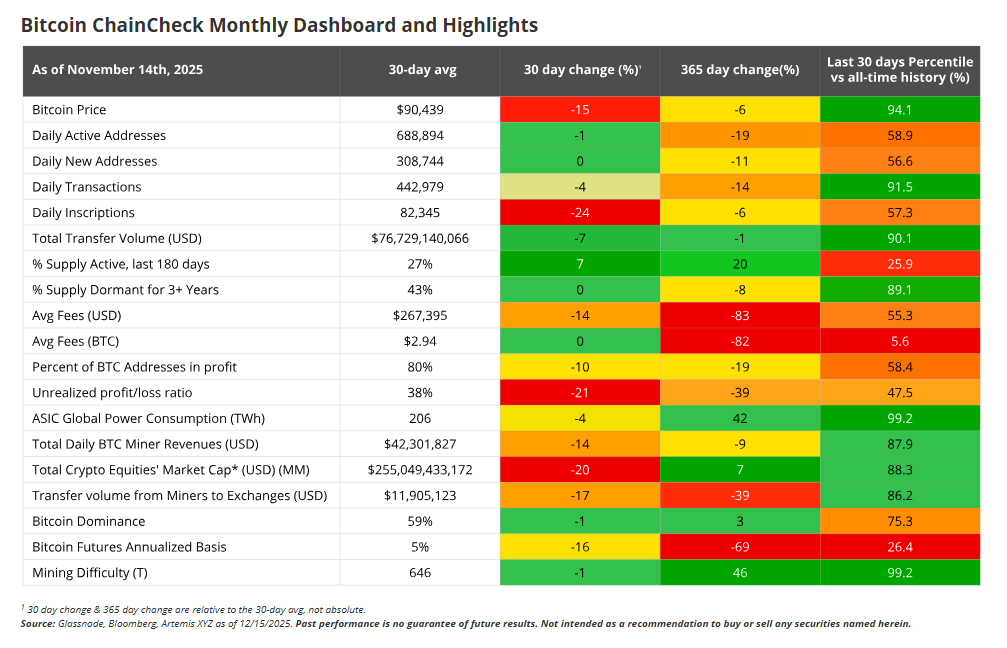

Worth And Market Context

Bitcoin is buying and selling close to $88,600, down practically 30% from its Oct. 6 all-time excessive of $126,080. Markets have been quiet round year-end and skinny liquidity can disguise actual momentum.

Supply: VanEck

BTC was monitored as regular close to $89K in latest protection and remained range-bound as merchants weighed provide and demand alerts. Different cross-asset strikes matter too. Gold climbed above $4,400/oz whereas silver reached $69.44/oz, strikes that some traders see as a part of a broader safe-haven bid.

The info factors recommend a cautious optimism. Miner capitulation has labored as a contrarian sign traditionally — weaker miners exit, problem adjusts, and surviving operators face much less near-term promoting strain. That sequence can set the stage for worth stabilization and positive aspects over months.

Featured picture from Pixabay, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.