Underneath loosened rules from the Trump administration in the US, each decentralized finance (DeFi) and centralized platforms are speeding to deliver real-world property (RWAs) onchain, with tokenized shares being one in every of this yr’s breakout merchandise.

In line with TokenTerminal, the market capitalization of tokenized shares stands at $831 million as of this week, in comparison with simply $32 million originally of 2025, a 2496% improve.

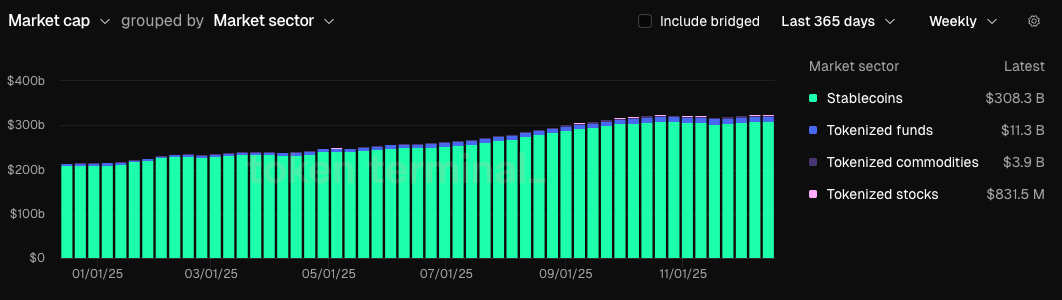

Tokenized Asset Progress – TokenTerminal

Main conventional finance (TradFi) and DeFi corporations are piling in to win the tokenized fairness race, with standard retail platforms reminiscent of Robinhood diving headfirst into tokenized fairness buying and selling. Crypto exchanges Coinbase and Kraken are additionally competing for their very own slice of the pie, whereas decentralized venues like TradeXYZ and Ostium are engaged on crypto-native adoption.

Robinhood provides the biggest variety of tokenized shares, with almost 2000 tokenized property in accordance with Dune Analytics, whereas TradeXYZ boasts the best publicly accessible buying and selling volumes, averaging $4 billion per week over the past month.

Tokenized commodities and funds have additionally grown, albeit to a lesser extent than tokenized shares. During the last yr, the tokenized commodity area is up 220% to $3.8 billion, and the tokenized fund sector is up 145% to $11.3 billion. Nonetheless, it’s value noting that tokenized commodities and funds each started the yr with considerably bigger valuations of $1.2 billion and $4.3 billion, respectively, in comparison with the tokenized inventory sector’s $32 million.