Ethereum value right now trades close to $2,930 as patrons wrestle to regain management following weeks of sustained institutional promoting. The market is consolidating after a pointy November breakdown, however value stays pinned under key transferring averages whereas ETF outflows proceed to empty demand.

ETF Outflows Proceed To Weigh On Sentiment

Institutional flows stay the dominant headwind. Since December 11, Ethereum spot ETFs have recorded $853.9 million in web outflows, in response to Farside Traders. Just one session broke the development. On December 22, funds posted a quick $84.6 million influx earlier than promoting resumed.

The newest information from December 27 exhibits one other $16.6 million exiting Grayscale’s ETHE, whereas BlackRock’s ETHA unexpectedly led latest redemptions. That shift issues. When the biggest allocator reduces publicity throughout consolidation, it alerts threat discount relatively than rotation.

This persistent withdrawal of capital explains why ETH has did not construct momentum regardless of a number of makes an attempt to stabilize. With out institutional participation, upside strikes stay fragile.

Trendline And EMA Cluster Cap Each Rally

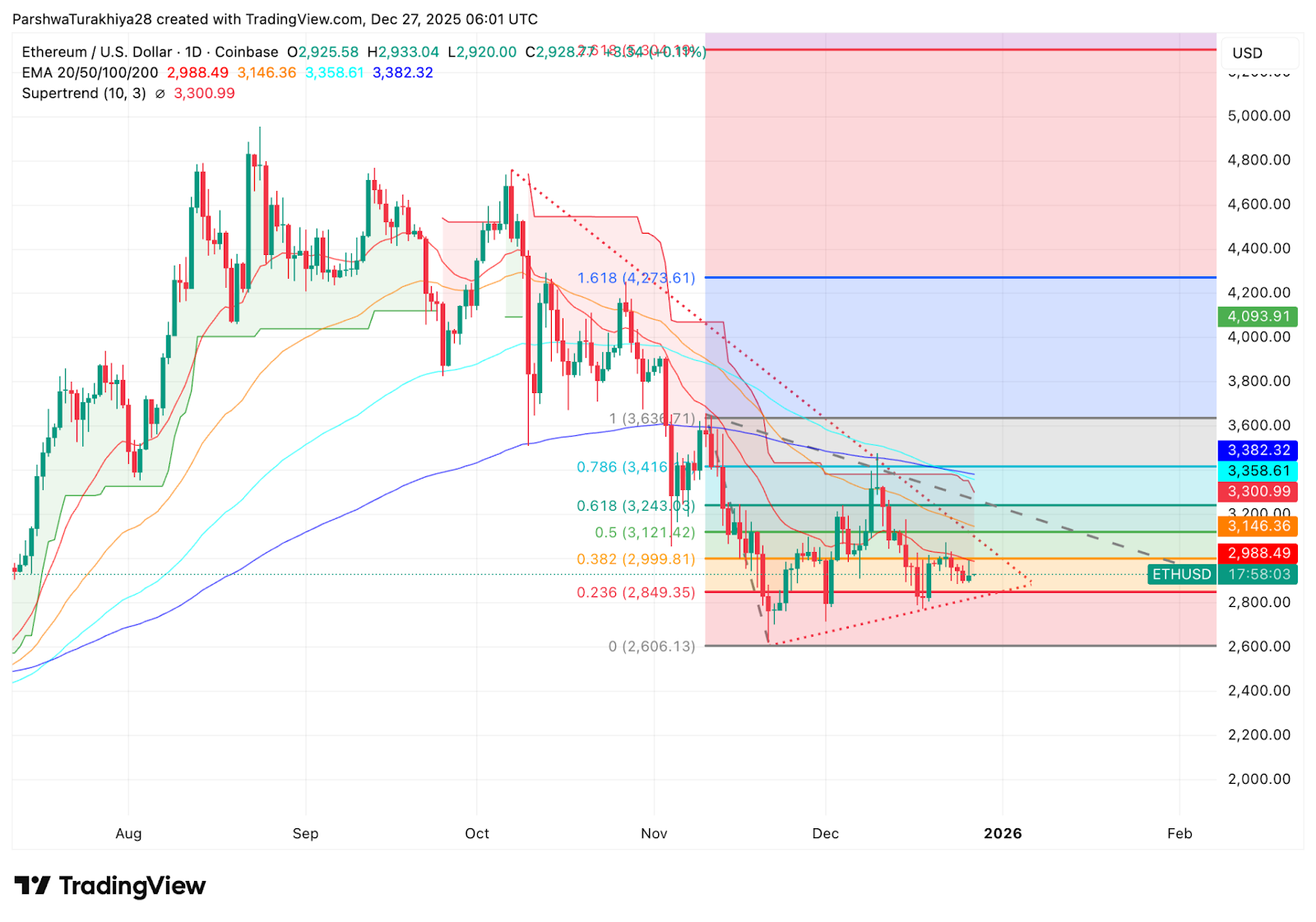

ETH Worth Motion (Supply: TradingView)

On the every day chart, Ethereum continues to commerce under a descending trendline that has outlined decrease highs since early November. Worth can be compressed beneath a dense EMA cluster that reinforces resistance.

The 20-day EMA sits close to $2,988, adopted by the 50-day EMA round $3,146. Above that, the 100-day and 200-day EMAs close to $3,358 and $3,382 kind a broader ceiling. ETH has repeatedly examined the decrease fringe of this zone and failed, confirming that sellers stay energetic on rallies.

The Supertrend indicator flipped bearish close to $3,301 and has not reversed. So long as ETH stays under that degree, the broader construction favors continuation relatively than restoration.

Fibonacci Ranges Spotlight A Stalled Retracement

Fibonacci retracement ranges drawn from the October excessive to the November low present ETH struggling under the 0.382 retracement close to $3,000. That degree has acted as a pivot all through December, repeatedly rejecting value again into the $2,900s.

Under present ranges, the 0.236 retracement close to $2,850 marks the important thing help to defend. A clear break under this zone would expose the November low close to $2,600, the place patrons final stepped in aggressively.

On the upside, reclaiming the 0.5 and 0.618 retracement ranges close to $3,120 and $3,240 would sign a significant shift in momentum. Till then, the retracement stays incomplete.

Derivatives Present Deleveraging, Not Accumulation

ETH Spinoff Evaluation (Supply: Coinglass)

Derivatives information helps the cautious tone. Ethereum futures open curiosity stands close to $37.3 billion, down roughly 1.4% on the day. That decline displays place trimming relatively than new leverage getting into the market.

Quantity has dropped practically 15 %, whereas choices exercise has spiked. Choices quantity is up greater than 55 %, at the same time as choices open curiosity has fallen sharply. This mix suggests merchants are repositioning and hedging publicity relatively than expressing directional conviction.

Liquidation information exhibits restricted stress. Over the previous 24 hours, roughly $21 million in liquidations hit the market, with longs accounting for almost all. The absence of a giant liquidation cascade signifies that leverage is already lowered.

Intraday Construction Reveals Compression Close to Help

ETH Worth Evaluation (Supply: TradingView)

On the one-hour chart, ETH is compressing inside a narrowing vary between $2,900 and $2,980. Parabolic SAR dots stay above value, maintaining short-term strain intact, whereas RSI hovers within the mid-40s, reflecting impartial momentum.

This construction usually precedes enlargement, however path stays unsure. Consumers are defending dips, but they don’t seem to be pushing value above resistance with sufficient power to set off follow-through.

Outlook. Will Ethereum Go Up?

Ethereum stays in a corrective section, not a confirmed downtrend reversal.

- Bullish case: A every day shut above $3,150 that reclaims the 50-day EMA and breaks the descending trendline would sign that patrons are regaining management. That transfer would open the door towards $3,350 and the higher EMA band.

- Bearish case: Shedding $2,850 would affirm one other leg decrease and expose $2,600 as the following main help. A failure there would deepen the correction into early 2026.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be chargeable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.