President Donald Trump’s announcement that he wouldn’t impose tariffs scheduled for Feb. 1 triggered a pointy reversal in threat belongings, with Bitcoin rebounding above $90,000 after testing $87,300 earlier within the session.

The transfer erased most of a two-day selloff pushed by trade-war fears tied to Trump’s Greenland push, confirming Bitcoin’s standing as a high-beta macro asset that amplifies directional swings when geopolitical headlines shift shortly.

Gold and silver tumbled following the announcement, suggesting the return of risk-on sentiment. Gold fell from round $4,850 to $4,777 per ounce, whereas silver dropped from roughly $93 to $90.60 per ounce. Each metals, nevertheless, recovered round 1% in a single day, whereas Bitcoin remained flat close to $90,000.

The flight-to-safety bid that had supported treasured metals throughout the tariff scare unwound as merchants rotated again into threat belongings.

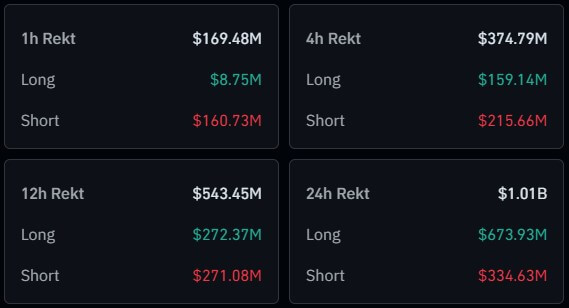

As of press time, Bitcoin traded at $90,213.45, up 2.1% in a single hour and a couple of% on the day. CoinGlass knowledge reveals that the rebound compelled $160 million in brief liquidations in only one hour, pushing complete liquidations on Jan. 21 above $1 billion throughout lengthy and brief positions.

How Greenland grew to become a tariff menace

Over the weekend and into early week, Trump’s marketing campaign to amass Greenland morphed right into a trade-war-style menace. He introduced additional tariffs on items from a number of European nations beginning Feb. 1, with escalation language tied to securing a Greenland deal.

That framing turned a geopolitical oddity right into a tangible risk-off set off. Equities bought off, the greenback strengthened, and Bitcoin slid beneath $92,000 as merchants repriced tail threat round a renewed commerce battle.

Between Jan. 19 and 20, the tariff fears had unfold past crypto. A broad selloff throughout threat belongings despatched Bitcoin down as a lot as 7% amid the shock. Crypto-specific strain intensified as a result of leveraged positioning amplified the transfer.

CoinGlass liquidation knowledge confirmed ongoing lengthy liquidations following a bigger burst earlier within the week, suggesting the tape was fragile heading into the announcement.

$87,000 to $90,000 in hours

Bitcoin’s intraday vary in the present day stretched from a low of $87,304 to a excessive of $90,379, a 3.5% swing that illustrates how shortly sentiment can flip when macro headlines reverse.

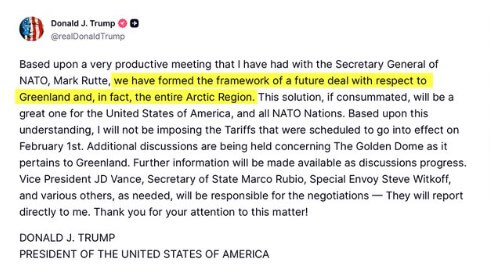

The low got here as European markets opened, amid elevated tariff fears. The rebound started after Trump posted on Fact Social that he had fashioned “the framework of a future deal” with NATO Secretary Basic Mark Rutte concerning Greenland and the Arctic area, and that he wouldn’t impose the tariffs scheduled for Feb. 1.

The bounce timing was clear. Inside an hour of the publish, Bitcoin had reclaimed $90,000, and brief positions started getting liquidated. The transfer wasn’t remoted to crypto, fairness futures rallied, Treasury yields stabilized, and gold and silver reversed their safe-haven bid.

The previous few days learn much less like a Bitcoin-only story and extra like Bitcoin buying and selling as a high-beta threat asset throughout a macro shock. Tariffs and geopolitical uncertainty hit equities, currencies, and charges, and Bitcoin adopted.

Derivatives positioning amplified the draw back when technical ranges broke, making a suggestions loop between spot value strikes and compelled liquidations.

The sharp bounce after the “no tariffs” publish matches the identical sample in reverse. The macro headline eliminated tail threat, threat belongings snapped again, and Bitcoin led the rebound.

That dynamic confirms what institutional observers have famous for months: Bitcoin more and more behaves like a levered play on threat sentiment, notably in periods when macro uncertainty dominates.

The dimensions of liquidations stresses the extent of leverage embedded within the system. Over $1 billion in complete liquidations on Jan. 21 alone, cut up between longs caught within the morning selloff and shorts compelled to cowl throughout the afternoon rally, suggests merchants have been positioned for continuation in each instructions and obtained whipsawed when the narrative flipped.

Danger-off unwind

Gold’s drop from $4,850 to $4,777 per ounce and silver’s fall from $93 to $90.60 per ounce marked a transparent rotation out of safe-haven belongings.

Through the preliminary tariff scare, each metals had rallied as traders hedged geopolitical threat and potential greenback weak point. When Trump introduced the tariffs have been on maintain, that bid evaporated.

The velocity of the reversal highlights how delicate treasured metals markets are to geopolitical headlines, but in addition how shortly sentiment can shift when tail dangers get eliminated.

The divergence between Bitcoin’s rebound and gold’s selloff reinforces the narrative that Bitcoin trades extra like a threat asset than a digital secure haven throughout macro shocks.

When uncertainty spiked, Bitcoin bought off alongside equities. When the uncertainty was resolved, Bitcoin rallied with equities whereas gold bought off. That correlation construction issues for portfolio building and for understanding how Bitcoin matches into broader macro flows.

What comes subsequent

The decision of the Feb. 1 tariff menace removes one near-term overhang, however the underlying Greenland negotiations stay unresolved.

Trump’s publish indicated that discussions are ongoing, suggesting the tariff menace may resurface if these talks stall. That leaves a level of headline threat, notably if the administration makes use of commerce coverage as leverage in future negotiations.

For Bitcoin, the important thing takeaway is that macro headlines drive volatility greater than crypto-specific fundamentals in periods of geopolitical uncertainty.

The Jan. 21 whipsaw demonstrates how shortly sentiment can reverse. Nonetheless, it additionally reveals how a lot leverage stays embedded in derivatives markets and the way keen merchants are to place aggressively in each instructions regardless of that threat.