Bitcoin mining shares noticed a major bump on Wednesday after the US winter storm pressured some firms to wind down operations, resulting in decrease block competitors and extra worthwhile mining operations.

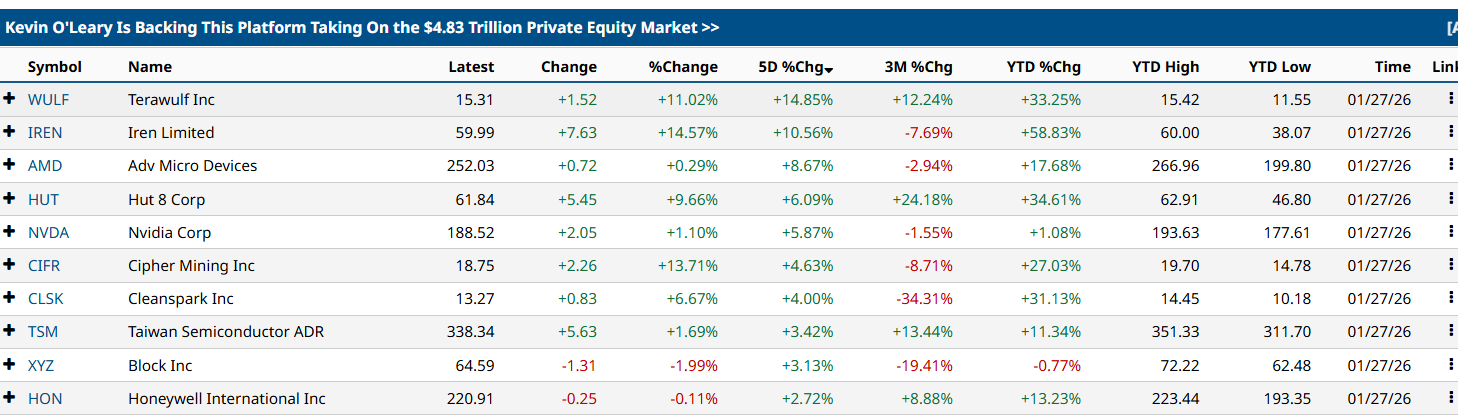

Shares of a number of main mining firms posted double-digit positive factors over the previous 24 hours. TeraWulf rose about 11%, Iren Restricted gained roughly 14%, and Cipher Mining climbed round 13%, in accordance with knowledge from Barchart.

The rally occurred days after the Bitcoin community’s hashrate sank to a seven-month low of 663 exahashes per second (EH/s) on Sunday, a 40% drop in two days because of a extreme winter storm battering the US.

The hashrate recovered to 814 EH/s on Wednesday, however has but to get better to the 1.1 zettahash per second (ZH/s) degree earlier than the weekend decline, knowledge from Coinwarz reveals.

Bitcoin hashrate in EH/S, 1-month chart. Supply: Coinwarz

A decrease hashrate indicators that fewer miners are on-line, lowering the competitors for mining a block on the Bitcoin community, making Bitcoin ($BTC) mining extra worthwhile for miners who keep on-line.

Bitcoin mining inventory efficiency. Supply: Barchart

Associated: Bitcoin rallies, ETF flows rebound as US crypto coverage stalls: Finance Redefined

The Bitcoin hash worth index, a benchmark for measuring miner profitability via the income generated per terahash, additionally factors to extra profitable mining circumstances.

The Bitcoin hashprice index rose to $0.040 per terahash per day on Wednesday, up from $0.038 TH/s per day, in accordance with the HashrateIndex.

Bitcoin hashprice index in usd, 1-week chart. Souce: Hashrateindex

Associated: Crypto loses speculative edge as AI and robotics appeal to capital: Delphi

Bitcoin miners wind down operations amid US winter storm

The advance highlights how giant, well-capitalized mining corporations can profit throughout momentary community disruptions, whereas smaller or much less environment friendly operations could also be pressured offline.

The US winter storm pressured a number of Bitcoin mining firms to cut back operations to assist the facility grid, mentioned Julio Moreno, the top of analysis at knowledge platform CryptoQuant.

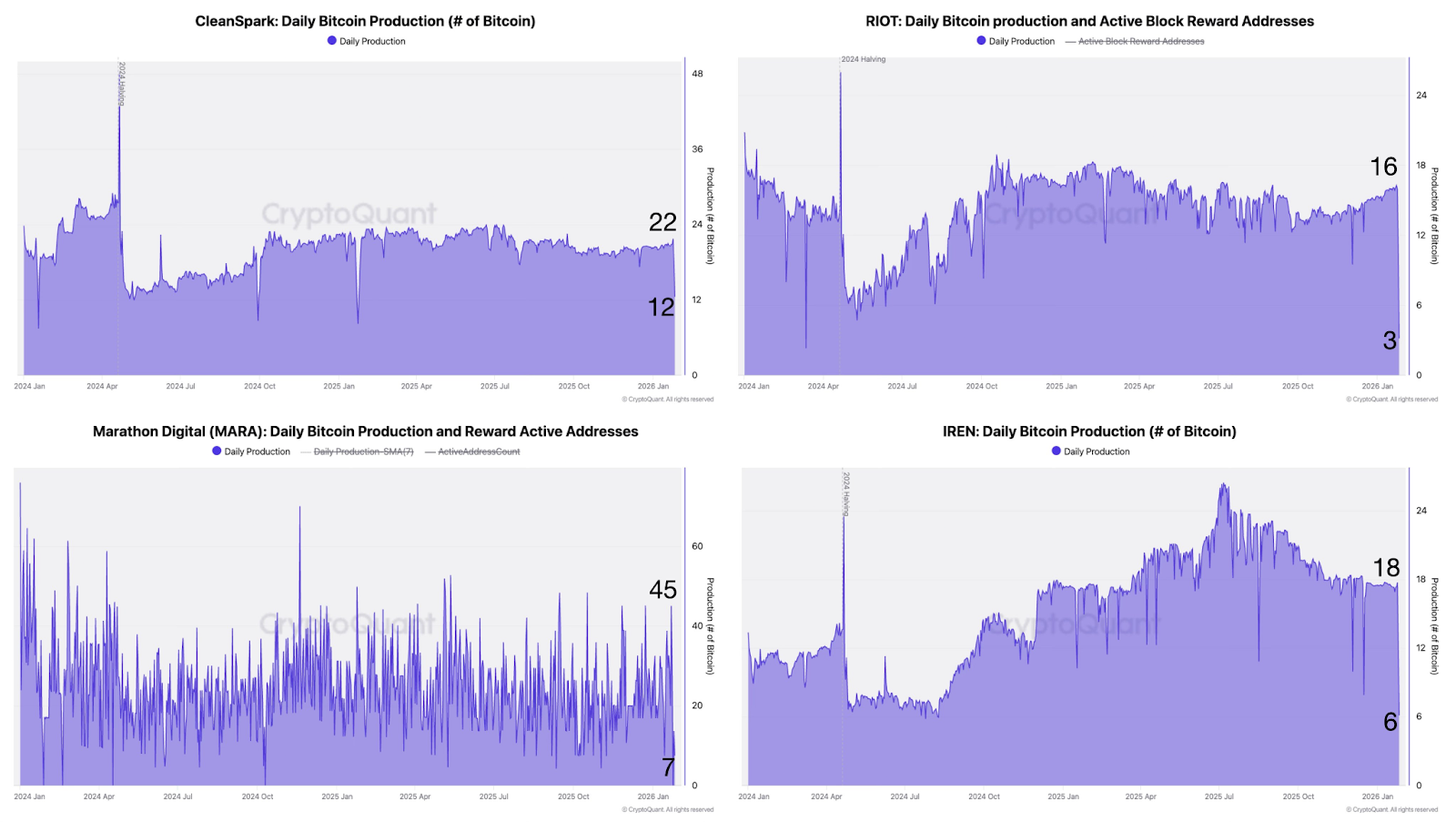

This included a each day Bitcoin manufacturing lower from 22 $BTC to 12 $BTC for CleanSpark, a 16 $BTC to three $BTC discount for Riot Platforms, a decline from 45 $BTC to 7 $BTC for Marathon Digital Holdings, and a drop from 18 $BTC to six $BTC mined each day by Iren, wrote Moreno in a Monday X put up.

Each day Bitcoin manufacturing for CleanSpark, Riot, Marathon Digital, Iren. Supply: Julio Moreno

In the meantime, the acute winter climate within the US “punished weak mining operations,” which is another excuse for the sharp decline in international hash charge, in accordance with Bitcoin mining ecosystem Braiins.

“Winter punishes poor preparation and rushed choices,” wrote Braiins in a Tuesday X put up, warning miners that almost all gear injury occurs when mining machines are restarted in freezing temperatures, or the amenities lack correct airflow and temperature management.

Journal: Bitcoin mining business ‘going to be lifeless in 2 years’ — Bit Digital CEO