XRP is buying and selling round $1.74 towards USDT and sitting on short-term assist after a pointy risk-off transfer throughout the crypto market, because the ripple crypto worth reacts to broad deleveraging.

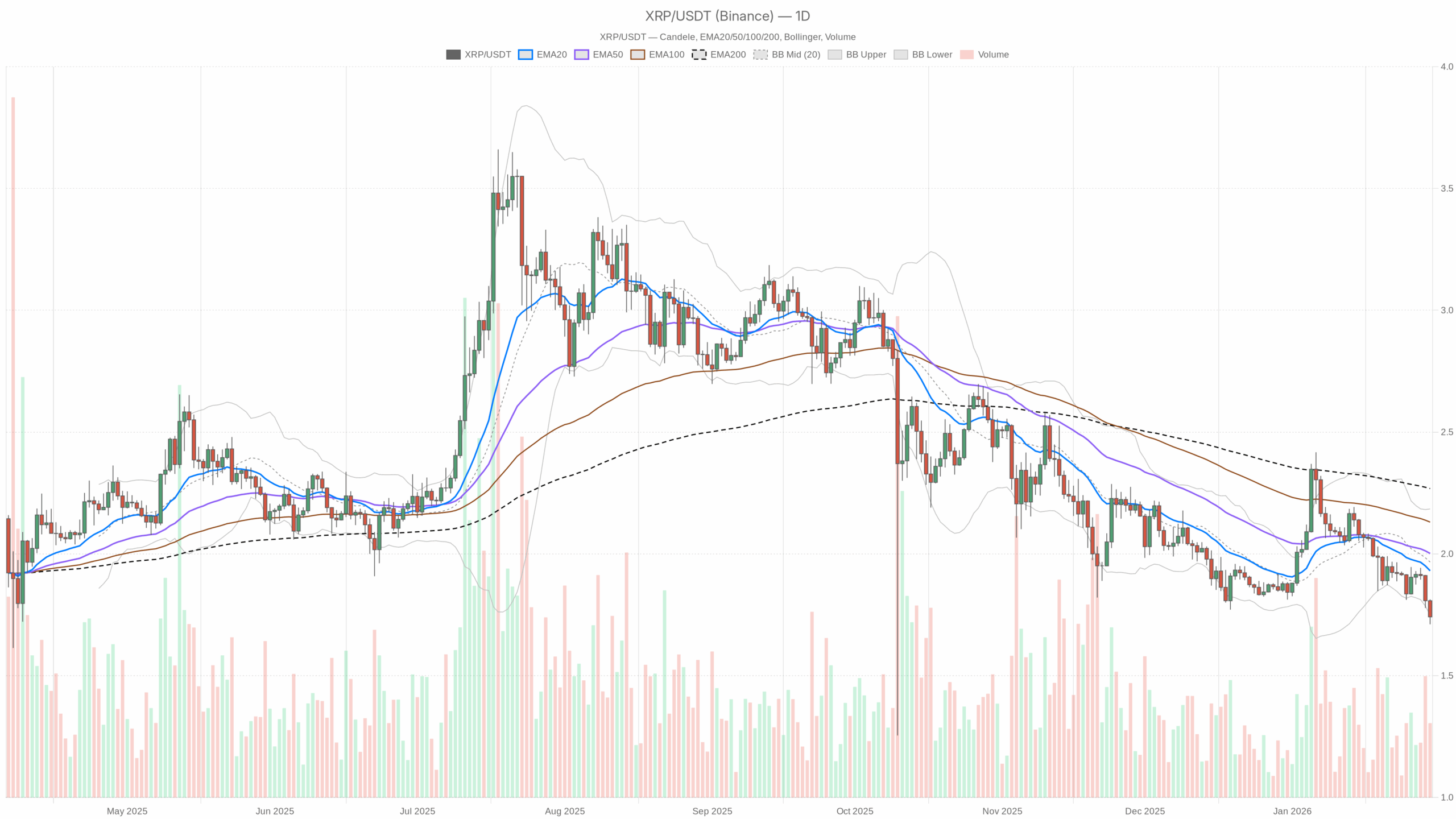

Day by day Chart (D1): Predominant State of affairs and Construction

On the each day timeframe, XRPUSDT is firmly in a bearish regime. Worth is beneath all key EMAs and hugging the decrease Bollinger Band, whereas momentum stays weak.

Pattern: EMAs on D1

– Worth (shut): $1.74

– EMA 20: $1.93

– EMA 50: $2.00

– EMA 200: $2.27

XRP is buying and selling beneath the 20, 50, and 200-day EMAs, with a clear bearish ordering (worth < EMA20 < EMA50 < EMA200). The short-term transferring averages are rolling over and pulling away from worth. That is the textbook signature of a dominant downtrend: rallies usually tend to be bought than prolonged.

In plain phrases, the lengthy aspect is preventing the present right here. Any bullish try has to first reclaim the 20-day EMA close to $1.93 earlier than we are able to even discuss a severe pattern shift.

Momentum: RSI and MACD on D1

– RSI 14: 32.82

– MACD line: -0.06

– MACD sign: -0.03

– MACD histogram: -0.02

The each day RSI at ~33 is sitting simply above oversold territory. That tells us sellers have been in management for days, however we aren’t but in true washout situations. This sort of studying usually permits additional draw back earlier than a powerful bounce. Nevertheless, it additionally means we’re getting nearer to areas the place dip-buyers begin to seem.

The MACD is detrimental and the histogram is barely beneath zero, hinting that bearish momentum continues to be current however not accelerating dramatically. It seems extra like a managed downtrend than vertical panic promoting. Bears stay in cost, however they aren’t hitting the market with most drive.

Volatility and Bands: Bollinger Bands & ATR on D1

– Bollinger Bands (20):

• Midline: $1.97

• Higher band: $2.18

• Decrease band: $1.75

– ATR 14: $0.09

Worth is sitting proper on the decrease Bollinger Band at ~$1.75. This exhibits the Ripple crypto worth is stretched to the draw back within the brief time period. When candles begin driving the decrease band, it usually means we’re in a pattern leg down, not only a random dip. Imply reversion trades work, however provided that the pattern begins to fatigue; in any other case, worth can stroll the band decrease.

The ATR round $0.09 is elevated however not explosive for XRP at these ranges. Volatility is up in comparison with calm durations, but we aren’t seeing the type of wild $0.20–0.30 each day swings that scream capitulation. That matches the image of a gradual bleed in a fearful market somewhat than a one-day crash.

Day by day Pivot Ranges on D1

– Pivot level (PP): $1.76

– Resistance 1 (R1): $1.80

– Assist 1 (S1): $1.70

Immediately’s each day shut at $1.74 is barely beneath the pivot at $1.76 and really near the decrease Bollinger Band. That pins XRP in a fragile space: a decisive push beneath $1.70 (S1) would open the door to a different leg decrease. Conversely, reclaiming the pivot and holding above $1.80 can be the primary small signal that patrons are prepared to step in.

Predominant situation from the each day chart: bearish. We’re in a trend-down surroundings with weak, however not exhausted, momentum and a market-wide concern backdrop. The burden of proof is on the bulls.

Hourly Chart (H1): Intraday Affirmation

The 1-hour chart backs the each day bearish story. There isn’t any clear signal but of a powerful intraday reversal, just some gentle stabilization.

Pattern: EMAs on H1

– Worth (shut): $1.74

– EMA 20: $1.78

– EMA 50: $1.83

– EMA 200: $1.89

On H1, worth sits beneath all intraday EMAs, mirroring the each day construction. The short-term transferring averages are stacked bearish, confirming a downtrend on each macro (D1) and tactical (H1) ranges. That type of alignment normally means any bounce into $1.78–1.83 is prone to meet promoting curiosity from intraday merchants.

Momentum: RSI and MACD on H1

– RSI 14: 31.34

– MACD line: -0.03

– MACD sign: -0.03

– MACD histogram: 0.00

The hourly RSI round 31 is close to oversold ranges, telling us essentially the most quick leg down has been heavy. It leaves room for brief, reactive bounces, however not sufficient to alter the broader image by itself.

The MACD is flat and detrimental, with the histogram at 0. That alerts a lack of intraday momentum. In different phrases, bears should not accelerating the transfer anymore, however bulls should not taking on both. The market is pausing inside a downtrend, which is commonly a prelude to both a small reduction rally or one other grind decrease.

Volatility and Bands: Bollinger Bands & ATR on H1

– Bollinger Bands (20):

• Midline: $1.78

• Higher band: $1.83

• Decrease band: $1.72

– ATR 14: $0.02

Hourly worth is hovering between the mid and decrease band, leaning bearish however not in freefall. The ATR at $0.02 means typical hourly candles are transferring inside a 1–1.5% vary. For intraday merchants, that’s sufficient volatility to commerce, however it isn’t a blowout. The construction nonetheless favors sell-the-bounce techniques whereas worth stays capped beneath the mid-band round $1.78–1.80.

Hourly Pivot Ranges on H1

– Pivot level (PP): $1.74

– R1: $1.74

– S1: $1.74

The automated system provides a good pivot cluster at $1.74, successfully marking the present battle line. Worth sitting instantly on this degree exhibits the market is at a short-term choice level: maintain and bounce, or slip and prolong decrease. Given the broader context, sellers nonetheless have the higher hand whereas we keep beneath the H1 EMAs.

15-Minute Chart (M15): Execution Context

The 15-minute timeframe is just not about long-term path; it’s about timing trades throughout the present each day downtrend. Right here, the image is barely much less heavy however nonetheless not bullish.

Pattern: EMAs on M15

– Worth (shut): $1.74

– EMA 20: $1.75

– EMA 50: $1.77

– EMA 200: $1.83

On M15, worth is sitting proper beneath the 20-period EMA and beneath the 50 and 200. Brief-term, this exhibits makes an attempt to stabilize after the drop, however no convincing restoration but. Scalpers will watch the $1.75–1.77 area because the quick intraday line within the sand for any bounce try.

Momentum: RSI and MACD on M15

– RSI 14: 42.43

– MACD line: -0.01

– MACD sign: -0.01

– MACD histogram: 0.00

The 15-minute RSI close to 42 has recovered from oversold ranges and is now in a neutral-but-weak zone. Promoting stress has cooled down within the very brief time period, however patrons should not dominating. This usually precedes a sideways consolidation or uneven vary.

The MACD is flat and barely detrimental with no clear edge. That aligns with a market catching its breath after a transfer, the place path is unclear on the micro timeframe however nonetheless bears a downward bias from increased timeframes.

Volatility and Bands: Bollinger Bands & ATR on M15

– Bollinger Bands (20):

• Midline: $1.75

• Higher band: $1.77

• Decrease band: $1.73

– ATR 14: $0.01

Worth is oscillating across the midline of the 15-minute bands, between $1.73 and $1.77. With ATR at $0.01, micro-volatility is modest. That is the kind of surroundings the place breakout merchants can get chopped up except they align trades with the dominant each day path, which stays down.

Bullish State of affairs for the Ripple Crypto Worth

For XRP to mount a reputable bullish case from right here, it wants to remodel this oversold, fearful backdrop right into a mean-reversion and trend-repair transfer. The broader crypto market context can be essential.

What bulls want to perform:

1. Maintain and defend $1.70–1.75

This zone combines the decrease each day Bollinger Band (~$1.75) and the primary assist at $1.70. If patrons can hold each day closes above $1.70, the market avoids a recent breakdown and retains the door open for a squeeze increased.

2. Reclaim the each day pivot and 20-day EMA

First step: push again above the each day pivot at $1.76 after which maintain worth above the $1.80 intraday resistance space. The extra essential structural win can be a transfer again above the D1 EMA20 at ~$1.93. That may sign that essentially the most aggressive section of the downtrend is finished.

3. Momentum restore

A bullish restoration can be accompanied by the each day RSI lifting again above 40–45 and the MACD histogram transferring towards or above zero. That may mirror real shopping for somewhat than only a short-covering pop.

If these steps play out, XRP might goal the $2.00–2.18 space, the place the EMA50 and higher Bollinger Band sit. That zone would possible act as a serious choice level: both the bigger uptrend from earlier months resumes, or sellers reload there.

What invalidates the bullish situation?

A clear each day shut beneath $1.70 with increasing quantity and ATR ticking increased would undermine the concept of a easy mean-reversion bounce. In that case, the market is just not stabilizing; it’s breaking down, and the bullish setup is off the desk till a brand new base types decrease.

Bearish State of affairs for the Ripple Crypto Worth

The bearish aspect has the wind at its again proper now: macro concern, BTC dominance up, each day and hourly developments down, and worth caught beneath all main EMAs. Furthermore, altcoins are beneath broad stress as merchants de-risk.

What bears are on the lookout for:

1. Failure at $1.78–1.83 on intraday bounces

So long as the Ripple crypto worth fails to reclaim the H1 mid-Bollinger band and EMAs (roughly $1.78–1.83), rally makes an attempt are prone to be bought. That retains the construction of decrease highs intact.

2. Break of $1.70 assist

A agency transfer beneath the each day S1 at $1.70, backed by rising ATR and a drop of RSI towards or beneath 30, would mark a recent leg decrease within the downtrend. That may verify that the present consolidation was only a pause earlier than continuation.

3. Continuation of risk-off situations

With the concern & greed index deep in Excessive Worry (16) and complete crypto market cap already off virtually 6% in 24 hours, an additional slide within the broader market would put further stress on XRP. If BTC dominance retains grinding increased, altcoins stay on the defensive, making it simpler for the bearish pattern in XRP to increase.

Beneath this situation, draw back targets would rely upon how aggressive the transfer turns into. Structurally, the main focus can be on prior demand zones beneath $1.70 and any round-number helps that begin to entice patrons. With out recent on-chain or elementary catalysts, purely technical promoting can overshoot honest worth in panicky situations.

What invalidates the bearish situation?

If XRP reclaims and holds above $1.93 (the each day EMA20) on a closing foundation, the character of this transfer adjustments from pattern continuation to potential pattern restore. A sustained break above $2.00–2.05 with RSI again above 50 would additional weaken the bearish argument, signaling that sellers have misplaced management of the tape within the short-to-medium time period.

Tips on how to Assume About Positioning Now

Proper now, XRP is in a downtrend on all main timeframes, pressured by a fearful macro surroundings and a defensive shift throughout crypto. Momentum is weak however not but capitulatory, and volatility is elevated however managed.

For merchants, the message is easy: the trail of least resistance continues to be down except bulls can defend $1.70 and begin reclaiming EMAs on H1 and D1. Brief-term bounces are possible in this sort of sentiment. Nevertheless, so long as worth stays beneath $1.93 and particularly beneath $2.00, they’re higher framed as rallies inside a broader downtrend, not a brand new bull leg.

Regardless of the bias, danger administration issues greater than path right here. With the market in Excessive Worry and liquidity scaling down in alts, single candles can transfer a number of p.c towards positions in minutes. Place sizing, clear invalidation ranges (particularly round $1.70 and $1.93), and respect for volatility are important in case you select to interact XRP at these ranges.

If you wish to monitor markets with skilled charting instruments and real-time information, you possibly can open an account on Investing utilizing our companion hyperlink:

Open your Investing.com account

This part incorporates a sponsored affiliate hyperlink. We could earn a fee at no further value to you.

Disclaimer: This text is a market evaluation and displays a technical view of present situations. It isn’t funding recommendation or a suggestion to purchase or promote any asset. Crypto markets are extremely risky, and it is best to do your individual analysis and assess your danger tolerance earlier than making any buying and selling selections.

In abstract, XRP stays beneath stress in a managed downtrend throughout a number of timeframes, with key ranges at $1.70, $1.93, and the $2.00–2.18 zone prone to outline the following directional transfer.