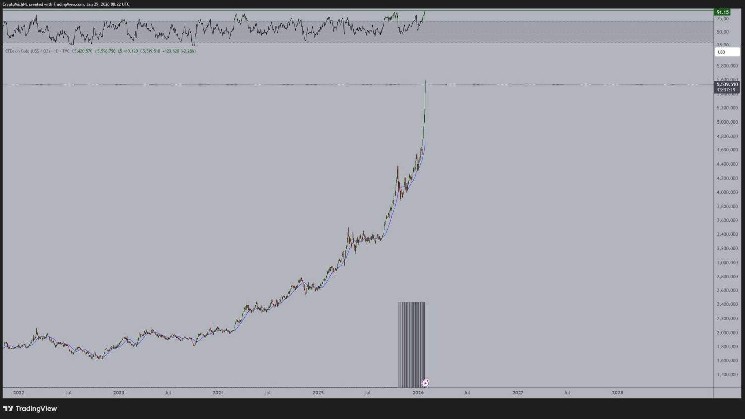

Gold’s momentum is reaching unprecedented ranges, elevating questions on what may come subsequent not just for the dear steel however the crypto market as nicely, particularly Bitcoin (BTC).

Specifically, the gold worth has now pushed its Relative Energy Index (RSI) above 91, a degree that has been recorded solely as soon as earlier than in historical past, December 1979, simply earlier than a protracted consolidation part.

One thing comparable additionally occurred in August 2020, when gold once more surged to document highs, simply earlier than consolidating and letting Bitcoin go on an almost sixfold run over the next cycle.

Understandably, the historic parallel has left traders questioning whether or not gold could as soon as once more be nearing a consolidation part and doubtlessly set the stage for renewed upside in its digital counterpart.

In accordance with Michaël van de Poppe, macro market knowledgeable and crypto buying and selling analyst, the present gold setup is traditionally excessive and will have implications for Bitcoin.

“Gold’s RSI above 91 has solely occurred as soon as earlier than — in 1979. It’s now greater than August 2020, which was adopted by gold consolidating and Bitcoin rallying 5–6x,” mentioned van de Poppe.

Gold rallies to document highs

The continuing gold rally is basically the results of escalating geopolitical tensions and weakening of the U.S. greenback, with markets reacting to renewed threats of army motion by United States President Donald Trump towards Iran.

Certainly, bullion climbed above $5,500/oz on Thursday, up greater than 20% because the begin of the 12 months. Final 12 months, for comparability, the dear steel jumped 64% in complete due to the brand new administration’s overhaul of worldwide commerce relationships and worldwide establishments.

Gold’s robust efficiency has additionally been supported by waning confidence in different conventional secure havens, significantly authorities bonds, as traders develop more and more uneasy concerning the scale of public debt throughout main developed economies, together with america.

In the meantime, the Federal Reserve left rates of interest unchanged on Wednesday, January 28, retaining the benchmark coverage fee in a 3.5% to three.75% vary. Talking at a press convention following the choice, Fed Chair Jerome Powell mentioned the central financial institution would think about chopping charges as soon as inflation exhibits clearer indicators of easing.

Bitcoin’s trajectory unsure

As for crypto, Bitcoin’s trajectory stays unknown. The market is at the moment weighing weakening technical indicators towards the potential for renewed institutional demand.

Regulatory catalysts are thus in focus, as upcoming discussions round U.S. crypto laws and the attainable define of U.S. Strategic Bitcoin Reserve may each unlock recent institutional capital or end in extra uncertainty.

Whale accumulation, nevertheless, supplies help. Massive holders have been shopping for en masse and tightening the liquid provide within the course of. Traditionally, such exercise has tended to precede durations of heightened volatility.

All in all, the market seems to be in a ready part, with traders carefully watching for brand new coverage developments that would tip the steadiness towards the subsequent main transfer in a setup characterised by excessive gold momentum and altering macroeconomic situations.

Featured picture by way of Shutterstock