Crypto traders are piling into tokenized gold as digital asset markets are treading water, sending inflows to Paxos’ gold token to a document in January.

Paxos Gold ($PAXG), backed by bodily gold held in LBMA vaults in London, raked in additional than $248 million recent capital via January, DefiLlama information reveals. That lifted $PAXG‘s market capitalization over $2.2 billion, trailing solely XAUT$5,318.82.

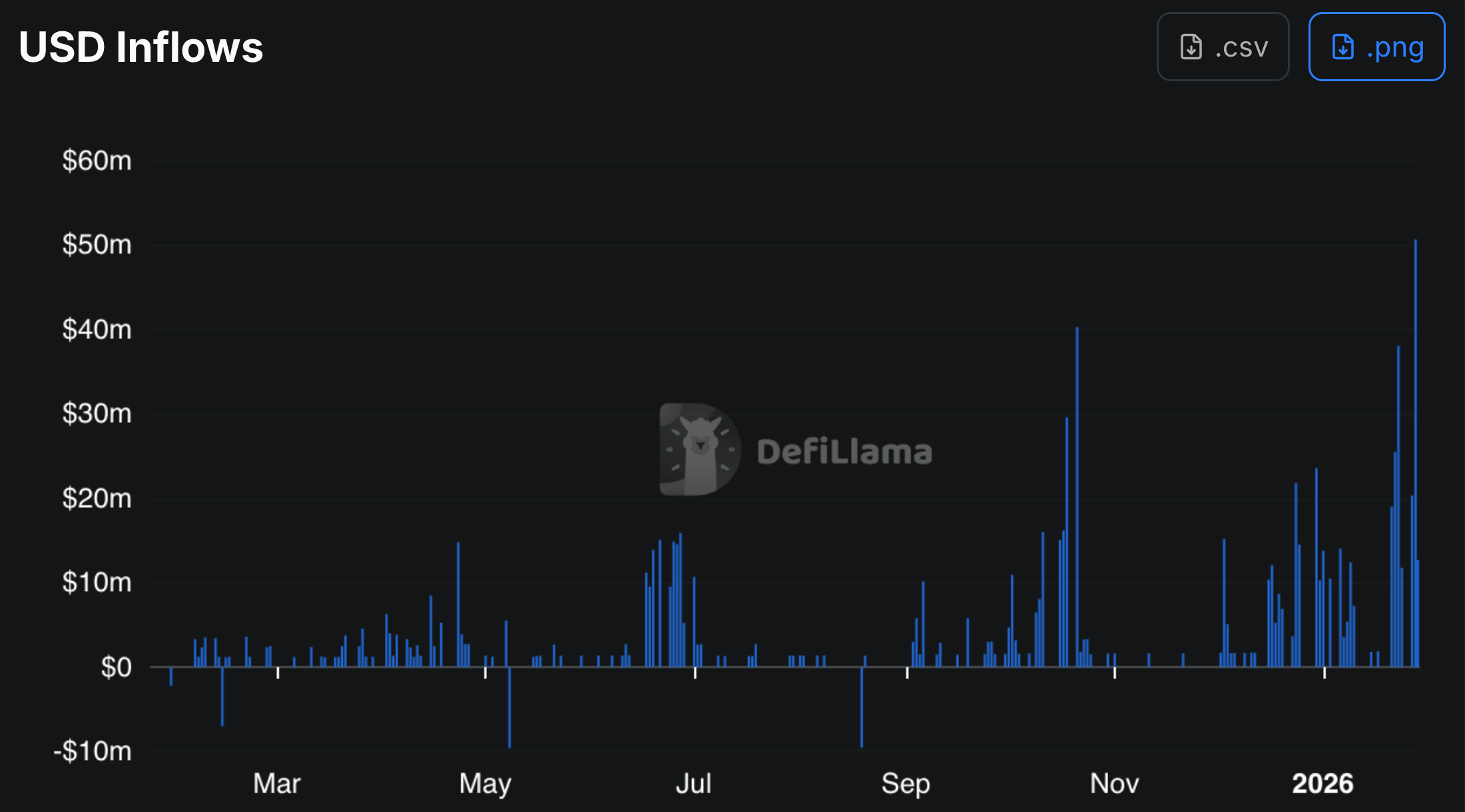

Paxos Gold inflows (DefiLlama)

The wave of inflows coincide with gold having fun with a blistering rally. The dear metallic crossed $5,300 per ounce on Wednesday, hovering 22% via January and gaining greater than 90% up to now yr. In the meantime, bitcoin BTC$89,363.92 has slid over 10% in a yr and the broader crypto market sunk

This dynamic has shifted some crypto traders’ consideration towards blockchain-based gold, searching for safety in an unsure macro atmosphere, stated James Harris, CEO of crypto yield platform Tesseract Group.

“The rising traction of tokenized gold has improved gold’s utility, notably round transferability and divisibility,” he stated, “whereas bitcoin continues to commerce extra like a danger asset in durations of macro uncertainty.”

Tokens like $PAXG and XAUT provide fractional possession of bodily gold, with blockchain-based transfers and crypto pockets compatibility. For traders, it’s a solution to maintain a centuries-old retailer of worth without having a vault.

The overall marketplace for tokenized gold has now topped $5.5 billion, in keeping with CoinGecko, marking an all-time excessive as each inflows and gold costs push the sector to new heights.