If there was any doubt concerning the arrival of the bear market, the newest drop within the Bitcoin value to round $81,000 considerably made it extra plausible. Whereas totally different triggers, together with geopolitical tensions, Microsoft’s earnings miss, and liquidation cascades, have been credited for this drop, the premier cryptocurrency appears to be struggling catch any break in the meanwhile.

Curiously, the newest decline not solely shattered the stays of the Bitcoin value bullish construction but in addition tilted the on-chain framework in the direction of an much more bearish outlook. With each technical and on-chain information wanting much less optimistic, the bears seem like profitable the battle for dominance within the BTC market.

This Metric Modifications First, BTC Worth Reacts Later: Crypto Founder

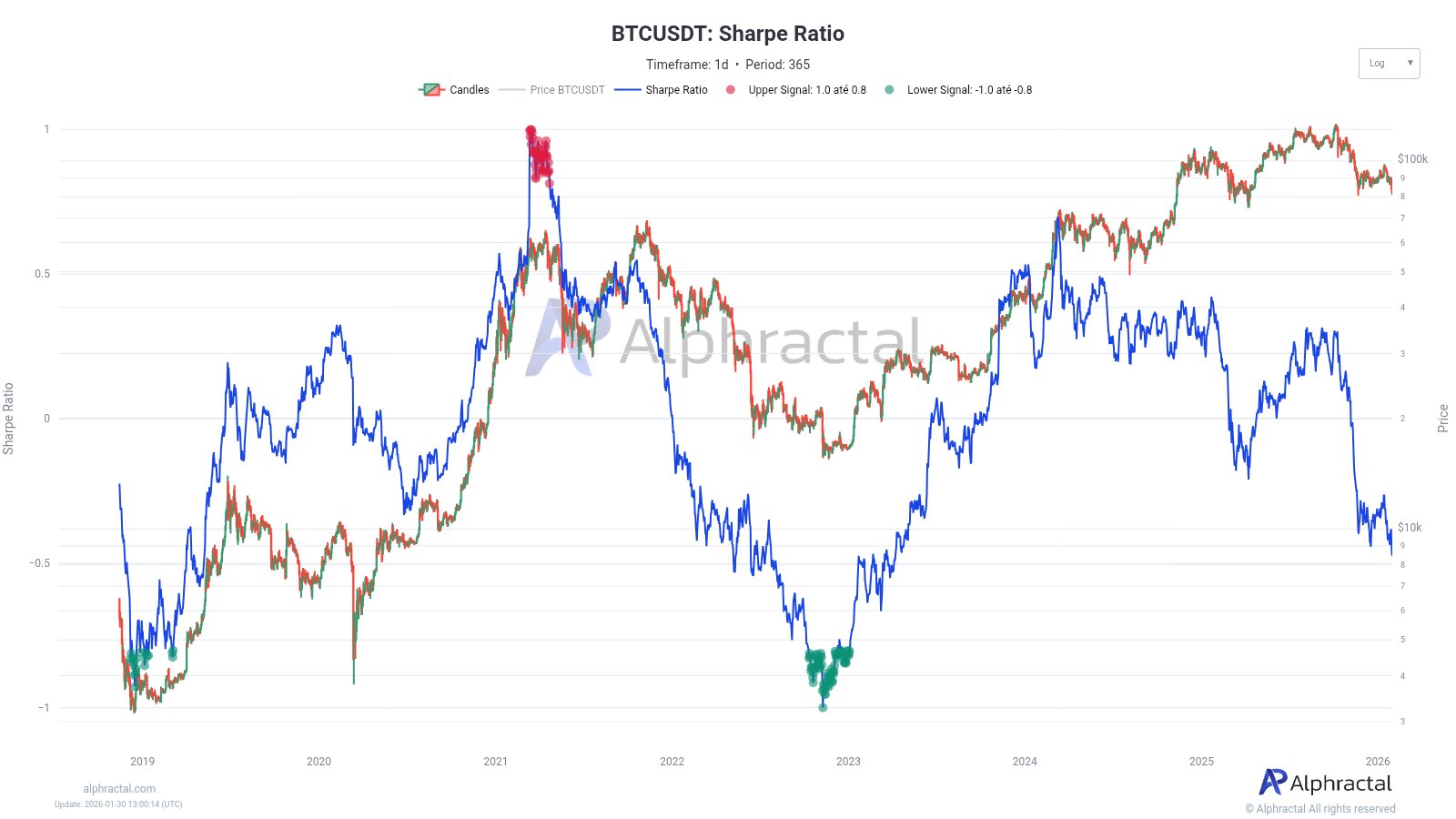

In a January 30 submit on the X platform, Alphractal’s founder and CEO, Joao Wedson, revealed that the Bitcoin Sharpe Ratio is declining at a price sooner than the BTC value. The related indicator right here is the Sharpe Ratio, which assesses the risk-adjusted returns of a specific cryptocurrency (Bitcoin, on this case).

This on-chain metric principally tracks the quantity of revenue an funding gives per unit of danger (contemplating danger is measured by volatility), with a excessive worth signaling a better risk-adjusted efficiency. In the meantime, a unfavourable Sharpe Ratio signifies that the returns being realized on an funding will not be commensurate with the chance being taken.

Wedson wrote in his submit on X:

Merely put: the market is taking extra danger for much less return.

Supply: @joao_wedson on X

Certainly, the Bitcoin Sharpe Ratio slipped into the unfavourable territory a number of days into the brand new yr. Nonetheless, BTC’s value motion nonetheless loved an unimaginable run of kind — operating to as excessive as $97,000 — after this shift, putting much less significance on the on-chain remark.

What’s extra attention-grabbing is that the Sharpe Ratio is falling and weakening at a tempo sooner than the Bitcoin value. Traditionally, this price of decline has usually coincided with prolonged durations of momentum loss and sideways value motion. In truth, Wedson concluded that the risk-adjusted metrics want to alter earlier than value can react positively.

Bitcoin Worth May Fall To $65,500 If This Occurs

In a case the place the premier cryptocurrency continues its downward spiral, Wedson has projected a goal for the BTC value. In an older submit on X, the Alphractal founder had revealed that the Bitcoin value can’t lose the $81,000 stage below any circumstances.

The on-chain skilled acknowledged {that a} capitulation section much like the one seen in 2022 might unfold if the market chief breaks beneath the $81,000 stage. Based mostly on the Fibonacci-Adjusted Market Imply Worth, Wedson recognized $65,500 as the following main assist stage.

The $81,000 got here below focus because the Bitcoin value approached this stage throughout its decline on Thursday, January 29. As of this writing, although, BTC has recovered above the $83,000 mark, with the worth nonetheless down by practically 8% on the weekly timeframe.

The worth of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.