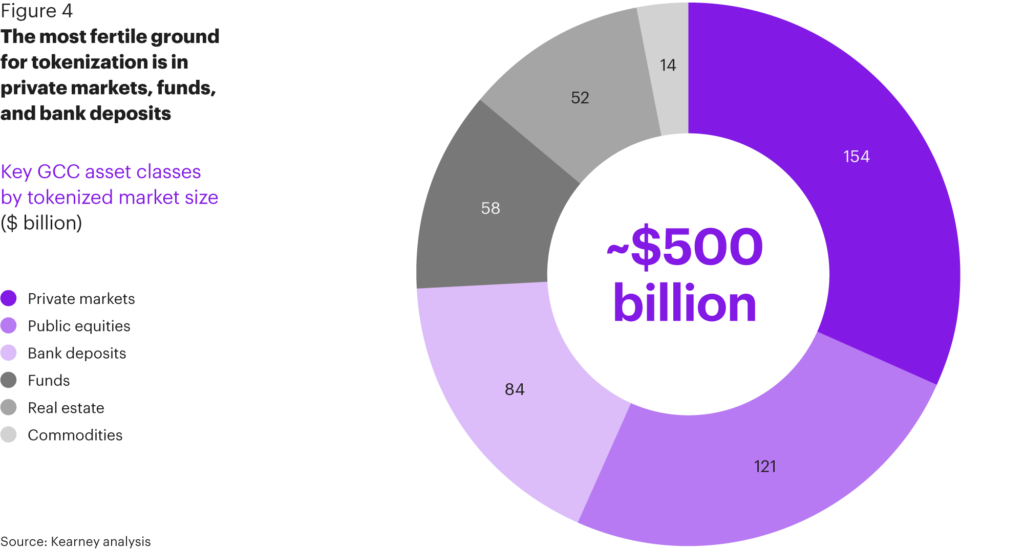

Kearney, a worldwide administration consulting agency, in its latest report, confirms that the projected development for tokenization uptake within the GCC (Gulf Cooperation Council) nations is near $500 billion value of belongings. The fertile sectors for tokenization are non-public markets, funds, and financial institution deposits, whereas the first catalysts are monetary establishments, asset managers, and sovereign wealth funds.

Supply: Kearney Evaluation

As per the report, non-public markets signify the most important tokenization alternative for the GCC. That is because of the excessive and clear demand from traders searching for clear methods to take part. Personal markets are additionally projected to develop from $4.5 trillion in 2024 to $6 trillion in 2030. Personal firms with tokenization can cost-effectively open up methods for traders to construct and handle their non-public market portfolios.

That is particularly vital in Dubai and Riyadh, the place there’s a robust pipeline of high-growth start-ups and unicorns.

On-chain RWAs (excluding stablecoins) have grown from roughly $1.1 billion in early 2023 to almost $20 billion by January 2026.

Moreover, Kearney additionally sees that tokenization will likely be fairly robust in GCC inventory markets, reminiscent of KSA’s Tadawul and Dubai Monetary Market. By tokenizing listed securities, this might simplify cross-border entry and cut back middleman layers whereas opening up fractional possession for simpler participation. Aramco, with a market cap of $1.5 trillion, might make the most of this by permitting traders to participate in smaller ticket sizes.

Kearney additionally discusses how financial institution deposits can undertake tokenization, enabling them to supply real-time institutional settlement, optimized treasury operations, and extra. The report notes that already, banks in KSA, Qatar, and UAE are exploring tokenized financial institution deposits as an alternative choice to stablecoins.

As for Funds, Kearney notes that progress has been stalled within the GCC because of regulatory approvals or a scarcity thereof. If large sovereign wealth funds reminiscent of Saudi Arabia’s Public Funding Fund, which has $913 billion in AUM, do tokenize, it should create a extra environment friendly construction for his or her fund, enhanced liquidity choices, streamline operations, and better visibility.

In terms of actual property, Kearney sees this as a compelling asset class for governments and the general public. There are two benefits: the fractional possession and the improved liquidity with potential for secondary buying and selling. Kearney mentions the Prypco, Ctrl Alt tokenization venture in Dubai, UAE, below the VARA-regulated ecosystem.

It additionally mentions the Saudi Arabian launch of the nationwide actual property tokenization infrastructure venture, which has been enabled by SettleMint because the tokenization platform and implementor.

The Kearney report touches on commodity tokenization, mentioning gold particularly, in addition to gem tokenization, mentioning diamonds, after which oil and gasoline. Apparently, for oil and gasoline, they see traders accessing the market past conventional equities and ETFs, reminiscent of tokenized futures and direct commodity publicity.

In Conclusion, Kearney notes that every one these asset courses, which might be tokenized, signify a near $500 billion alternative by 2030. It explains, ” This implies a elementary shift in market dynamics, and explains why governments, monetary establishments, and asset managers are beefing up their digital asset methods.”

Is GCC prepared for tokenization?

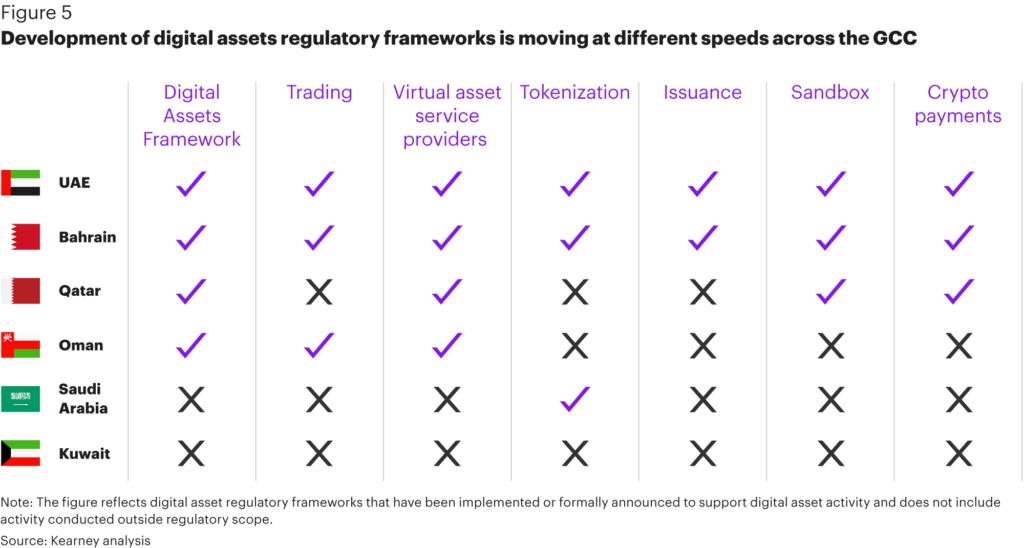

In line with the report, an important query is how prepared the GCC is to assist tokenization, discussing the three main challenges as effectively.

Firstly, when it comes to the regulatory panorama, whereas there are strikes to construct regulatory frameworks that assist tokenization and digital monetary and buying and selling programs, the nations which might be main on this respect are the UAE and Bahrain, with Kuwait presently not doing something on this sector.

Jereon Gillekens, Principal Digital and Analytics Observe, at Kearney Center East and Africa, believes that tokenization will scale the place market infrastructure and laws evolve in step. He explains, “Issuance, custody, settlement, and secondary buying and selling should operate as an built-in system, with digital asset capabilities embedded into core working fashions. That alignment is what allows sturdy, institutional-grade markets.”

One other problem dealing with the GCC is the way to make the most of and combine the know-how, blockchain, DLT, and digital belongings. Kearney analysis notes that for tokenization to be viable at an institutional degree, enterprise-grade infrastructure might want to align with present operational and regulatory processes.

This contains assist for issuance buildings, custody, settlement, funds, regulatory integration, on- and off-ramps, cap desk administration, and valuation processes, alongside analytics and reporting instruments that present visibility and auditability, each very important to take care of stakeholder belief.

Adam Popet, CEO of SettleMint, commenting to Cryptopolitan on the report states, “In terms of tokenization and the adoption of blockchain know-how in manufacturing and at actual scale, you want applied sciences which might be strong, confirmed, and in a position to simply combine with establishments’ present core working programs. Anything will likely be a non-starter.”

Additionally vital is market infrastructure. What is supposed by that’s there needs to be dependable mechanisms for issuance, buying and selling, settlement, and asset servicing, or else tokenized belongings will wrestle to maneuver past remoted pilots. This fragmentation creates friction, limiting liquidity and proscribing cross-border distribution.

Who will lead tokenization within the GCC?

In line with the report, monetary establishments, asset managers, and sovereign traders are prone to be the first catalysts for tokenization initiatives throughout the GCC. They may form each provide and demand for tokenized devices.

Andrew Forson, President of DeFi Applied sciences, commenting on this assertion to Cryptopolitan states, “Completely, Monetary establishments would be the catalyst as a result of they stand on the intersection of availability of capital and the necessity for capital, and their lifeblood is to execute transactions amongst suppliers of capital and shoppers of capital.”

He provides, “Tokenized belongings signify the development of know-how that allows anyone, anyplace, to take part in capital markets any time. This implies an automated enhance of TAM (Complete addressable market) for the revolutionary monetary establishment.”