UNI is buying and selling round $3.92 towards USDT, sitting deep in a medium-term downtrend however beginning to base out on intraday timeframes because the Uniswap value reveals conflicting alerts throughout charts.

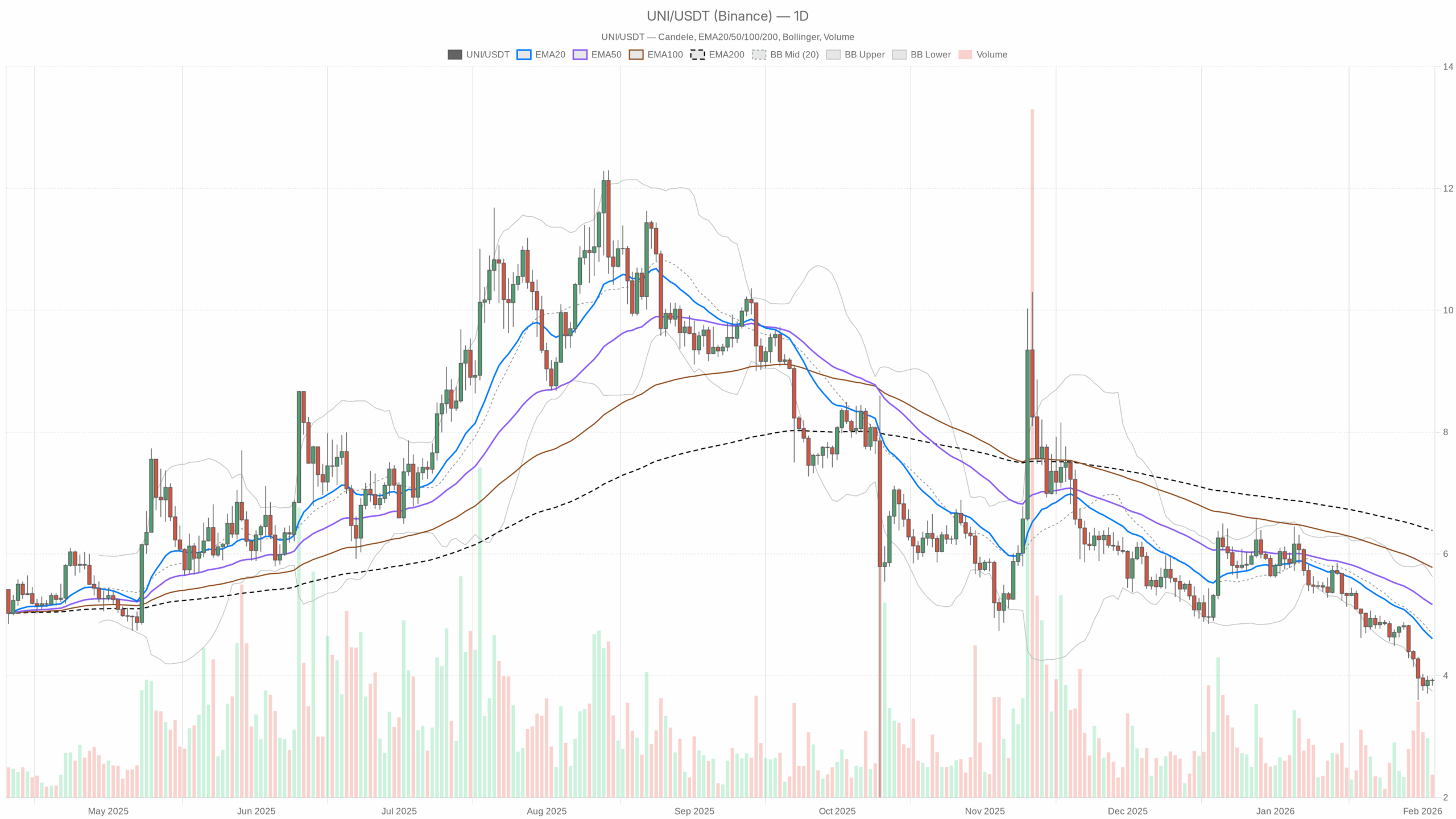

UNI/USDT every day chart with EMA20, EMA50 and quantity”

UNI/USDT every day chart with EMA20, EMA50 and quantity”loading=”lazy” />

Every day timeframe (D1): Principal situation is bearish, however stretched

The every day pattern is unambiguously bearish. Worth at $3.92 is nicely beneath all key shifting averages and hugging the decrease Bollinger Band. It is a basic late-trend space the place draw back momentum nonetheless dominates, however incremental new promoting has to work tougher to push value a lot decrease.

Pattern construction: EMA20, EMA50, EMA200

– EMA20: $4.61

– EMA50: $5.17

– EMA200: $6.38

UNI is buying and selling far beneath the 20, 50 and 200-day EMAs, with a clear bearish stack (value < EMA20 < EMA50 < EMA200). That’s textbook downtrend construction: sellers have been in management for weeks, and each bounce to this point has been offered into. The space to the short-term EMA20 is notable; being about $0.70 below the 20-day common alerts a market that’s not simply in a downtrend, however presently pulled away from its imply. In apply, that retains the primary situation bearish, but additionally opens the door to a pointy snapback rally if sellers lose steam.

Momentum: RSI

– RSI (14): 26.45

Every day RSI is nicely beneath 30, firmly in oversold territory. That tells you the selloff has been intense and protracted. Traditionally, ranges like this usually precede both a volatility flush, with a closing fast leg down, or a aid bounce. It doesn’t robotically imply a backside is in, nevertheless it does imply recent shorts are late to the social gathering on the every day.

Momentum & pattern high quality: MACD

– MACD line: -0.41

– Sign: -0.33

– Histogram: -0.08

The MACD line is beneath the sign and each are in destructive territory, which is in step with the established downtrend. The histogram is destructive however not massive, hinting that bearish momentum is current however not accelerating aggressively. So the pattern remains to be down, however the worst-of-the-worst momentum part would possibly already be behind us, aligning with that oversold RSI backdrop.

Volatility & value location: Bollinger Bands

– Center band: $4.69

– Higher band: $5.63

– Decrease band: $3.75

– Shut: $3.92

UNI is buying and selling simply above the decrease Bollinger Band. That tells you value is parked on the decrease fringe of its current volatility vary. That is the sort of zone the place you usually see both continued strolling down the band in a robust pattern, or a mean-reversion push again towards the center band close to $4.69. Given the oversold RSI, there’s a rising danger of a short-covering bounce again towards the mid-band, however to this point there isn’t a clear every day reversal sign.

Volatility & danger: ATR

– ATR(14): $0.28

A every day ATR round $0.28 on a $3.92 asset means typical every day swings are roughly 7% of value. That’s not excessive by crypto requirements however it’s significant: a single every day candle can simply wipe out tight stops. For merchants, place sizing has to respect {that a} regular day can transfer UNI about $0.25–0.30 both approach.

Brief-term reference ranges: Every day pivots

– Pivot level (PP): $3.90

– R1: $3.97

– S1: $3.85

Worth is hovering basically on high of the every day pivot at $3.90–3.92. That reveals a short-term equilibrium stage inside a bigger downtrend. R1 at $3.97 is the primary fast upside friction zone; a sustained transfer above that might be an early signal of intraday consumers making an attempt to problem the every day bearish bias. S1 at $3.85 is the close by assist that, if misplaced cleanly, would verify that the downtrend remains to be grinding decrease.

Every day takeaway: The principle situation stays bearish: the pattern is down, construction is bearish, and value is beneath all main averages. Nevertheless, with RSI oversold and value hugging the decrease band, UNI is coming into a fragile zone the place draw back continuation provides diminishing reward relative to the chance of a pointy, sentiment-driven bounce.

1H timeframe (H1): Neutralizing after the dump

The 1-hour chart is the place the story will get extra nuanced. Whereas the every day chart screams downtrend, the 1H regime is marked as impartial, and the indications again that up. Worth is coiling round key intraday averages and the Bollinger mid-band, hinting that the fast promote strain has light, at the least for now.

EMAs on H1

– EMA20: $3.91

– EMA50: $3.93

– EMA200: $4.24

– Shut: $3.92

On the hourly, UNI is buying and selling proper across the 20 and 50 EMAs, with each clustered in a good vary. That displays a market that has stopped trending intraday and is as an alternative consolidating. The EMA200 up at $4.24 remains to be far overhead, reminding you that that is consolidation inside a broader downtrend. In plain phrases, the intraday slide has paused, however the larger image remains to be heavy.

RSI on H1

– RSI (14): 52.72

Hourly RSI close to 53 is principally center of the street. Promoting strain has been absorbed, and consumers have simply sufficient power to carry value steady with out but turning it into a transparent uptrend. That helps the thought of a short-term stability zone relatively than a right away breakdown or breakout.

MACD on H1

– MACD line: 0.00

– Sign: 0.00

– Histogram: 0.00

MACD being basically flat at zero confirms the shortage of a robust intraday pattern. Momentum has reset on the 1H. The market is neither in a robust bounce nor in an lively flush decrease. That matches with the impartial regime tag for this timeframe.

Bollinger Bands on H1

– Center band: $3.91

– Higher band: $3.96

– Decrease band: $3.87

– Shut: $3.92

Worth is buying and selling basically on the Bollinger mid-band and nicely contained in the bands. After urgent the decrease edges on the way in which down, UNI is now in a calmer, range-like conduct on the hourly. This usually precedes an even bigger transfer; the query is whether or not this consolidation breaks up as a aid rally or rolls over to increase the every day downtrend.

ATR & intraday pivots on H1

– ATR(14): $0.04

– Pivot level: $3.93

– R1: $3.93

– S1: $3.92

An hourly ATR of about $0.04 means typical 1H candles cowl about 1% of value. That’s average intraday volatility, sufficient to shake out tight stops however not a wild tape. The pivot ranges are extraordinarily compressed, with PP and R1 each at $3.93 and S1 at $3.92, which underlines how flat the intraday construction presently is. The market is catching its breath right here.

15-minute timeframe (M15): Execution context, slight intraday bullish tilt

The 15-minute chart is there primarily for execution, and it leans mildly constructive in comparison with the upper timeframes. The regime is impartial, however the indicators present a small intraday bullish bias.

EMAs on M15

– EMA20: $3.91

– EMA50: $3.91

– EMA200: $3.92

– Shut: $3.92

All of the short-term EMAs are virtually on high of one another with value simply above them. That could be a basic micro-consolidation construction the place the market is balanced however tilting barely in favor of the consumers so long as value holds above that $3.91–3.92 cluster.

RSI on M15

– RSI (14): 57.43

Brief-term RSI round 57 reveals a gentle bullish bias intraday. It isn’t overheated, nevertheless it does say consumers have the higher hand on this small window of time, serving to assist value at present ranges.

MACD on M15

– MACD line: 0.00

– Sign: 0.00

– Histogram: 0.01

The marginally constructive histogram on the 15m chart displays a light upward thrust within the very close to time period, which is in step with the marginally bullish RSI. Momentum is constructive however nonetheless fragile; that is early-stage stabilization, not a robust intraday uptrend.

Bollinger Bands & ATR on M15

– Center band: $3.90

– Higher band: $3.94

– Decrease band: $3.86

– ATR(14): $0.02

UNI is hovering close to the middle-to-upper half of its 15m band construction, with a slim band width and a small ATR of $0.02. That tells you the market is in a low-volatility pause. These intervals not often final; they normally resolve with a volatility enlargement in a single path or the opposite.

How the timeframes match collectively

There’s a clear rigidity between timeframes:

– The every day chart is firmly bearish however visibly oversold.

– The 1H is impartial, signaling that the most recent wave of promoting is pausing.

– The 15m is exhibiting a small bullish lean, with value barely above key quick EMAs and RSI biased larger.

That is what a possible inflection zone appears to be like like. It doesn’t assure a pattern reversal, nevertheless it does say that risk-reward for brand new shorts is deteriorating whereas aggressive countertrend longs are nonetheless betting towards the dominant every day path. On this context, merchants watching the Uniswap value are successfully weighing continuation towards a short-covering bounce.

Bullish situation for UNI

For bulls, the setup is actually a mean-reversion or aid rally guess inside a bigger downtrend.

What the bullish path appears to be like like:

1. Brief-term maintain above $3.85–3.90: That is the fast assist space, coinciding with every day S1 at $3.85 and the present pivot zone. Holding this band turns it right into a short-term base relatively than a staging level for one more leg down.

2. Break and acceptance above $3.97–4.00: That’s roughly every day R1 and a psychological stage. A sustained push above there, ideally backed by rising 1H RSI and a constructive 1H MACD cross, would verify that intraday consumers are keen to chase relatively than simply defend.

3. First goal: reversion towards the every day mid-Bollinger and EMA20 zone: An inexpensive upside zone for a aid transfer sits round $4.60–4.70, with the every day center band at $4.69 and EMA20 at $4.61. That’s the place the downtrend’s gravity ought to sit back in if the broader bear construction remains to be intact.

What would invalidate the bullish situation:

– A clear breakdown beneath $3.85 on sturdy momentum, particularly if every day RSI fails to bounce from oversold and begins to float even decrease. That will sign the market is just not performed liquidating and that oversold circumstances are being resolved through time and value decrease, not through a bounce.

– Failure to carry intraday EMAs on 1H and 15m, across the $3.90 space, with repeated rejections from $3.95–4.00 would additionally warn that bulls are too weak to even management the native vary.

Bearish situation for UNI

The bears nonetheless management the upper timeframe, and their thesis is straightforward: the pattern is your good friend till there’s an precise reversal, not simply oversold readings.

What continuation on the draw back may appear like:

1. Failure of the present base: Worth slips again below the $3.90 pivot and loses $3.85 assist. On the intraday charts, this could present up as 1H and 15m RSI rolling over from mid or excessive ranges again towards 40 and beneath, with Bollinger Bands on these timeframes beginning to increase downward.

2. Every day band stroll decrease: UNI begins closing at or beneath the every day decrease Bollinger Band at $3.75 with no significant intraday bounces. That’s the trend-grind conduct the place oversold stays oversold and shorts preserve urgent the transfer.

3. Additional draw back extension: With out actual structural ranges beneath on this information, the broader concept is continuation of the medium-term downtrend so long as value stays nicely beneath the EMA20 and EMA50 area between $4.60 and $5.20. Every failed bounce into that band turns into one other alternative for sellers to reload.

What would invalidate the bearish situation:

– A decisive reclaim and maintain above the $4.60–4.70 zone, the place the every day EMA20 and mid-Bollinger sit, turning that space into assist on retests. At that time, the downtrend’s quick lane could be damaged, and the market would start transitioning towards a extra balanced and even constructive construction.

– On the every day, MACD curling up towards a bullish cross and RSI climbing again above 40–45 with larger lows would point out that promoting strain is now not dominant.

Positioning, danger and uncertainty

UNI’s value motion is a basic instance of a trending market coming into exhaustion territory. The every day chart says the trail of least resistance remains to be down, however more and more crowded. Intraday charts say the promoting wave is pausing, not but reversing. Furthermore, the broader backdrop in late 2024, with Bitcoin dominance elevated and the concern and greed index at Excessive Worry (17), reinforces how delicate altcoins are to swings in sentiment.

For anybody buying and selling this, the core choices revolve round time horizon and danger urge for food:

– Pattern followers will respect the bearish every day regime and sure look to fade rallies into resistance areas like $4.00–4.70, at all times with the notice that oversold circumstances can gas violent squeezes.

– Imply-reversion merchants will give attention to the oversold every day RSI and early intraday stabilization, however they’re successfully swimming towards the present. Tight danger administration and clearly outlined invalidation beneath the $3.85 space are essential for that model.

Volatility, with a every day ATR close to 7% of value, is excessive sufficient that being improper and not using a plan can turn out to be costly rapidly. The chart proper now doesn’t provide certainty; it provides a cleanly outlined battleground between continuation and aid. How UNI behaves round $3.85–4.00 within the subsequent periods will let you know which aspect is definitely getting the higher hand.

If you wish to monitor markets with skilled charting instruments and real-time information, you possibly can open an account on Investing utilizing our associate hyperlink:

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We might earn a fee at no extra value to you.

Disclaimer: This evaluation is for informational and academic functions solely and is predicated solely on the supplied market information. It isn’t funding, buying and selling, or monetary recommendation, and it doesn’t contemplate your particular person circumstances. Cryptoassets are extremely unstable and can lead to whole lack of capital. All the time conduct your personal analysis and use applicable danger administration.