Sentiment is locked in excessive concern as Beam crypto (BEAMUSDT) grinds sideways close to key assist, with volatility compressing and sellers trying more and more exhausted.

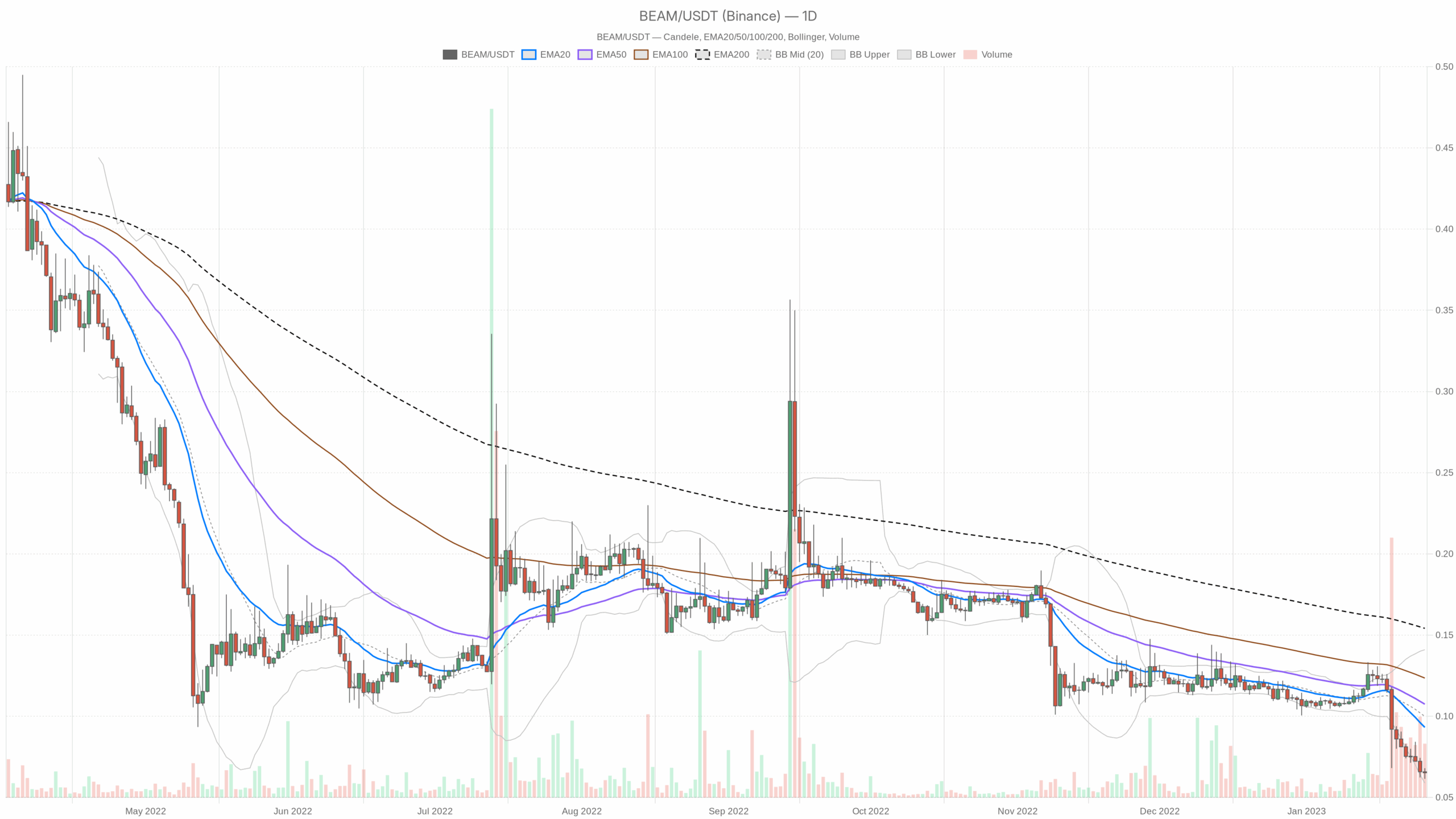

Day by day pattern (D1): clearly bearish, however deeply oversold

On the every day timeframe, BEAMUSDT trades round $0.07, effectively under all key shifting averages and under the mid-line of its Bollinger Bands. Structurally, it is a mature downtrend, not a recent one.

EMAs (20 / 50 / 200): pattern strain nonetheless down

The every day EMAs line up as follows:

- Value (shut): $0.07

- EMA 20: $0.09

- EMA 50: $0.11

- EMA 200: $0.15

Value is under the 20, 50, and 200 EMAs with a transparent bearish stacking (20 < 50 < 200 by way of recency). That alerts a longtime downtrend with sellers in management on all main horizons. The hole to the 200 EMA is broad, which reveals how far Beam has fallen from its longer-term imply.

When worth sits this far below the 200 EMA, you might be both in the course of a structural breakdown or approaching the tail finish of 1. In that part, mean-reversion rallies could be violent however short-lived.

RSI (14): excessive oversold and stretched

The every day RSI is at 19.2, deep into oversold territory.

This studying is uncommon and sometimes not sustainable for lengthy. It tells us the promoting has been one-sided and aggressive, nevertheless it additionally means the draw back gas is beginning to run low. Every further leg down calls for new sellers, and at RSI < 20, these new sellers are usually late arrivals.

In easy phrases, the pattern remains to be down, however the threat of both a pointy short-covering bounce or a remaining capitulation spike is rising.

MACD: momentum bearish, however no recent impulse

On the every day chart:

- MACD line: -0.01

- Sign line: -0.01

- Histogram: ~0

MACD is damaging, confirming the bearish regime, however the line and sign are successfully on prime of one another and the histogram is flat. Meaning draw back momentum has pale. The pattern is down, however it’s dropping vitality slightly than accelerating.

This suits with the RSI story. Sellers have executed a whole lot of work already, and the market is nearer to a pause or reversal try than to the beginning of a brand new leg.

Bollinger Bands: pinned close to the decrease aspect of the vary

Day by day Bollinger Bands:

- Center band (20SMA proxy): $0.10

- Higher band: $0.14

- Decrease band: $0.06

- Value: $0.07

Value is buying and selling between the decrease band and mid-line, leaning to the draw back however not driving the band anymore. Earlier, hugging the decrease band would have indicated energetic promote strain. Now, hovering simply above $0.06–0.07 reveals the market is consolidating close to the lows as an alternative of plunging via them.

That’s usually a staging space. Both the band widens once more on a remaining breakdown, or worth drifts again towards the mid at $0.10 in a mean-reversion bounce.

ATR (14): volatility compression on the lows

The every day ATR is about $0.01 on a $0.07 asset.

Relative to cost, that’s modest however not excessive. What issues is that volatility is now not increasing. After heavy liquidations throughout crypto, the truth that Beam’s every day vary has cooled suggests two issues: individuals are cautious, and liquidity is skinny.

This sort of low-volatility base after a drop can precede both a volatility growth to the draw back (capitulation) or a pointy aid transfer if shorts are crowded.

Day by day pivots: worth hovering close to resistance

Day by day pivot information:

- Pivot level (PP): $0.06

- R1: $0.07

- S1: $0.06

Value at $0.07 sits proper on the primary resistance (R1). In a bearish regime, buying and selling at R1 with out acceptance above it normally marks the higher fringe of a short-term provide zone. It’s a pure space the place late sellers and short-term shorts take a look at the market.

A clear every day shut above $0.07 would sign the primary small crack in that ceiling. Repeated failures right here would reinforce the concept the pattern decrease just isn’t completed.

Placing the every day image collectively, the primary state of affairs remains to be bearish. Development construction is down, shifting averages verify, and the market context is risk-off. Nevertheless, deeply oversold RSI, flat MACD, and compressed volatility all say the market is within the late innings of this transfer, not the opening chapter.

Hourly (H1): short-term stabilization, no actual bullish management

On the 1H chart, BEAMUSDT trades round $0.07 with a extra impartial micro-structure contained in the bigger bearish pattern.

EMAs on H1: flattening out into a variety

- Value (shut): $0.07

- EMA 20: $0.07

- EMA 50: $0.07

- EMA 200: $0.08

The 20 and 50 EMAs are nearly precisely at worth, whereas the 200 EMA hovers above at $0.08. Quick time period, this says the market has stopped trending and is basically shifting sideways round $0.07.

The 200 EMA overhead acts as a dynamic ceiling for any intraday bounce. So whereas the every day is decisively bearish, the hourly has cooled right into a steadiness zone, a spot the place each bulls and bears are probing with out clear dominance.

RSI on H1: subdued, not oversold

The 1H RSI is round 38.7.

That is mildly bearish however not oversold, telling us the rapid promoting strain has lightened. After heavy draw back, intraday individuals are extra hesitant to push the tape decrease, preferring to attend at higher costs. It suits the thought of a digestion part after a powerful transfer down.

MACD on H1: flatline momentum

On the hourly chart, each MACD line and sign hover round 0, and the histogram is flat.

Intraday momentum has primarily gone to sleep. That is typical for a short-term consolidation, the place neither aspect has conviction. For merchants, this atmosphere usually punishes overtrading, as a result of there may be a whole lot of noise and little sustained follow-through.

Bollinger Bands & ATR on H1: very tight, breakout potential constructing

- Bollinger mid: $0.07

- Higher band: $0.07

- Decrease band: $0.06

- ATR 14 (H1): ~0

The bands are squeezed and ATR on the 1H is successfully negligible. That is traditional volatility compression, which means the market is coiling, not trending. On this context, the subsequent directional transfer (up or down) tends to be sharper than ordinary as soon as worth lastly escapes this tight vary.

Hourly pivots: mid-range equilibrium

- Pivot level (PP): $0.07

- R1: $0.07

- S1: $0.06

Buying and selling proper on the pivot signifies the 1H market is in steadiness. Quick-term gamers are marking $0.07 as honest worth, whereas the decrease band and S1 close to $0.06 outline the rapid draw back boundary. This reinforces the image of consolidation inside a much bigger downtrend.

15-minute (M15): execution-only, micro chop close to $0.07

The 15-minute chart just isn’t about course; it’s about execution element. It reveals BEAMUSDT chopping proper round $0.07.

EMAs on M15: totally flattened

- Value (shut): $0.07

- EMA 20: $0.07

- EMA 50: $0.07

- EMA 200: $0.07

All three EMAs are sitting on prime of one another. That’s the textbook image of a short-term equilibrium. From an execution standpoint, entries taken in the course of such a cluster are normally poor.

Higher threat/reward sometimes comes nearer to vary extremes, not within the useless middle.

RSI and MACD on M15: impartial micro-structure

The 15-minute RSI is round 46.5, and the MACD is flat round 0. Quick time period, neither consumers nor sellers are urgent the tape. That is micro-scale consolidation contained in the hourly vary and every day downtrend.

Scalpers will discover small oscillations, however there is no such thing as a clear directional edge right here by itself.

M15 bands, ATR, and pivots: tight and boring

- Bollinger mid: $0.07

- Higher band: $0.07

- Decrease band: $0.06

- ATR 14 (M15): ~0

- Pivot: $0.07, R1 at $0.07, S1 at $0.06

Fifteen-minute volatility is compressed, and pivots are clustered proper at worth. This normally signifies that any breakout try will first present up right here as an growth of the native vary.

For execution, merchants usually look ahead to 15m closes above the short-term vary for breakout affirmation or fade spikes into the extremes in the event that they align with the broader bias.

Market context: macro risk-off weighs on Beam

Proper now the dominant drive is threat aversion throughout the crypto complicated. Bitcoin dominance close to 58% and heavy liquidations sign a defensive backdrop the place capital hides in majors and stablecoins whereas altcoins like Beam are left illiquid and susceptible.

In that atmosphere, Beam is unlikely to stage a sustainable rally by itself; any bounce will likely be extremely depending on a broader shift in threat urge for food.

Past the Beam chart itself, the broader crypto image is clearly risk-off:

- BTC dominance is round 57.6%, which means capital prefers Bitcoin and is much less keen to take a seat in small and mid-cap alts.

- Whole market cap is flat to barely up on the day, however with quantity down over 30%, indicating fading participation.

- The concern & greed index sits at 17 (Excessive Concern), which is supportive of late-stage promoting circumstances however normally not the place new, aggressive shopping for steps in.

Information stream can also be skewed to regulatory, political, and structural issues slightly than progress narratives. That backdrop hardly ever helps an alt like Beam outperform. Any bullish state of affairs on BEAMUSDT is preventing not simply its personal chart, however a nervous macro tape.

Situations for Beam crypto (BEAMUSDT)

Bullish state of affairs: oversold bounce and imply reversion towards $0.10

For the bull case, the story is easy: the downtrend is stretched, sellers are drained, and a foundation for a aid rally is forming.

Key substances for a bullish play:

- Day by day RSI lifts from ~19 towards 30–40, confirming that promoting strain is easing slightly than deepening.

- Value holds above the every day pivot at $0.06 and begins printing larger lows on the every day chart.

- H1 EMAs (20 and 50) flip up and begin to cross above worth, then act as assist slightly than resistance.

- There may be a Bollinger Band growth upward, with worth reclaiming the mid-band close to $0.10.

Below that script, the primary logical upside checkpoint is the Bollinger mid and every day EMA20 space round $0.09–0.10. That’s the place imply reversion meets pattern resistance. If Beam can settle for above $0.10 on robust quantity, the dialog shifts from a useless cat bounce to a possible medium-term base.

What would invalidate the bullish state of affairs?

A decisive every day shut again under $0.06, particularly if accompanied by an RSI droop that stays sub-20 and a renewed growth in ATR, would argue that the draw back leg has not completed. A tough breakdown via the decrease Bollinger Band would additionally point out that sellers have discovered new vitality and the bounce thesis is untimely.

Bearish state of affairs: breakdown of the $0.06–0.07 ground, continuation of the pattern

The bearish case leans on the structural story: Beam is firmly under all main EMAs, the broader market is in excessive concern, and rallies are prone to be bought till confirmed in any other case.

Key components for additional draw back:

- Day by day closes fail above $0.07, confirming R1 as a agency ceiling.

- H1 and M15 break under $0.06 with quantity and increasing ATR, displaying that the tight vary has resolved downward.

- Day by day RSI stays caught within the 15–25 band as an alternative of recovering, signaling persistent, grinding promote strain.

- MACD rolls decrease once more with the histogram turning clearly damaging, indicating a brand new momentum push.

In that atmosphere, Beam may enter a gradual bleed or a capitulation transfer, relying on liquidity. Given the already depressed ranges, draw back targets would should be drawn from historic assist zones or round-number psychology slightly than the present information snapshot.

The important thing takeaway is that the trail of least resistance stays decrease till the every day construction modifications.

What would invalidate the bearish state of affairs?

If Beam begins to shut a number of every day candles above $0.07–0.08 and the 1H 200 EMA at $0.08 flips from resistance to assist, the thought of a simple pattern continuation will get weaker. A sustained push again towards $0.10, with RSI reclaiming impartial territory and MACD crossing optimistic, would sign that the downtrend is transitioning into a variety or early accumulation part.

How to consider positioning, threat, and uncertainty

Beam crypto is in an ungainly however frequent spot in bear phases: the larger pattern is down, however the straightforward a part of the quick commerce might be behind us. Day by day indicators present it’s oversold and drained, whereas decrease timeframes are coiling in a good vary round $0.07.

For directional merchants, the cleaner alternatives are usually:

- Fading emotional spikes into resistance (round $0.09–0.10) so long as the every day construction stays bearish and EMAs act as a ceiling.

- Or ready for real structural change, with larger lows on the every day, reclaimed shifting averages, and RSI again in a wholesome vary, earlier than committing to a medium-term bullish stance.

Volatility is at the moment compressed on intraday charts, which suggests the subsequent growth might be sharp. In excessive concern environments, each upside squeezes and draw back air pockets are frequent.

Place sizing, clear invalidation ranges, and an trustworthy view of time horizon matter greater than ordinary right here. Beam just isn’t buying and selling in isolation; it’s shifting inside a defensive, low-conviction crypto market, and that macro tide will closely affect how any setup performs out.

If you wish to monitor markets with skilled charting instruments and real-time information, you possibly can open an account on Investing utilizing our companion hyperlink:

Open your Investing.com account

This part comprises a sponsored affiliate hyperlink. We could earn a fee at no extra price to you.

Disclaimer: This text is a market evaluation and opinion piece, not funding recommendation. Cryptoassets are extremely risky and can lead to complete lack of capital. All the time do your individual analysis and think about your monetary scenario, expertise, and threat tolerance earlier than making any buying and selling choices.