BitMine Immersion Applied sciences, a publicly traded cryptocurrency treasury firm linked to investor Tom Lee, is carrying vital unrealized losses on its Ether holdings following the newest wave of market liquidations, underscoring the dangers going through crypto balance-sheet methods throughout sharp downturns.

After buying an extra 40,302 Ether ($ETH) final week and rising its whole holdings to greater than 4.24 million $ETH, BitMine’s unrealized losses have grown to over $6 billion, in accordance with knowledge from Dropstab, a platform that tracks digital asset costs and portfolio valuations.

Primarily based on present market costs, BitMine’s Ether holdings are valued at roughly $9.6 billion, down from a peak of about $13.9 billion in October, reflecting the affect of the broader crypto sell-off.

Supply: Dropstab

The paper losses mounted as Ether’s worth slid towards $2,300 on Saturday, a transfer that The Kobeissi Letter attributed to fragile liquidity situations.

“In a market the place liquidity has been uneven at finest, sustained ranges of maximum leverage are leading to “air pockets” in worth,” the market commentator stated, including that “herd-like” positioning amplified the sell-off.

Associated: Bitmine’s staked Ether holdings level to $164M in annual staking income

A tough reset for crypto markets

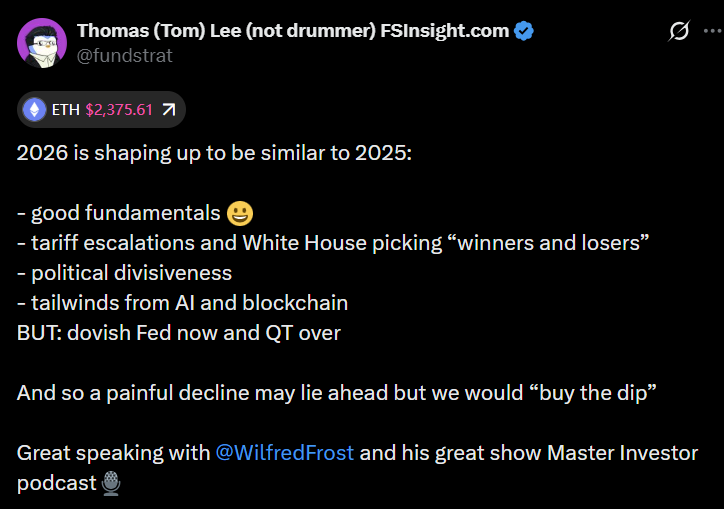

Regardless of earlier optimism for the tip of 2025, Tom Lee has warned that situations have shifted, with 2026 probably beginning on a “painful” word earlier than any potential rebound later within the yr.

In a latest interview, Lee stated the crypto market remains to be feeling the consequences of deleveraging, at the same time as longer-term fundamentals stay intact. He pointed to the Oct. 10 market crash, which worn out roughly $19 billion in worth, as a key turning level that reset threat urge for food throughout digital belongings.

Supply: Tom Lee

A latest evaluation by market maker Wintermute echoed that view, arguing {that a} sustained restoration in 2026 would require structural enhancements. These embody renewed momentum in Bitcoin (BTC) and Ether, broader exchange-traded fund participation, expanded digital asset treasury mandates and a return of retail inflows.

Wintermute stated these components are wanted to revive a wider wealth impact throughout the market. Retail participation, nonetheless, stays restricted as buyers proceed to gravitate towards faster-growing themes reminiscent of synthetic intelligence and quantum computing.

Associated: Liquidations knock Bitcoin out of world’s high 10 belongings