The crypto market is presently witnessing a big “massacre” as we navigate by means of February 2026. Ethereum ($ETH) has seen a pointy decline, fueled by $Bitcoin shedding its important $70,000 foothold. This downward momentum has left the second-largest cryptocurrency by market cap combating for survival on the $2,000 psychological stage.

Vitalik Buterin Promoting Spree Provides to Worry

Including gasoline to the bearish fireplace, on-chain stories from Coinpaper and different analytics platforms have confirmed that Ethereum co-founder Vitalik Buterin offered 2,972 $ETH (value roughly $6.69 million) over the past three days. Whereas these gross sales are sometimes related to philanthropy by way of the Kanro entity, the timing has intensified the “panic promoting” sentiment amongst retail merchants.

When probably the most outstanding determine within the ecosystem strikes such a quantity to exchanges throughout a market-wide correction, it typically indicators an absence of speedy upward catalysts, inflicting buyers to hunt security in {hardware} wallets to guard their remaining capital.

Technical Evaluation: The Path to $1,550

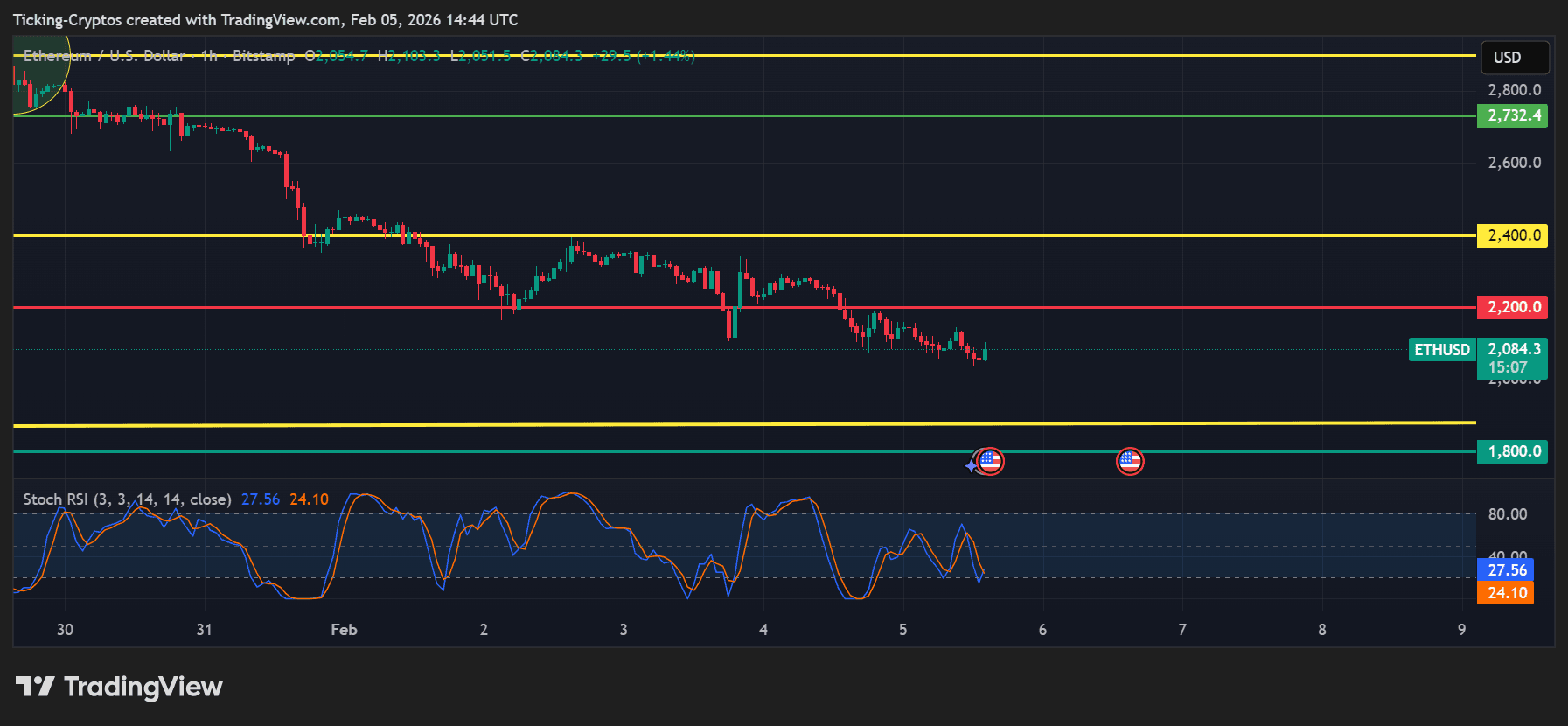

The beneath $ETH/USD 1-hour chart reveals a textbook descending channel that has dominated the value motion since early February.

- The $2,000 Brink: As of at this time, $ETH is buying and selling close to $2,084. The Stochastic RSI is hovering at 27.56, which is nearing the oversold zone, however the sheer quantity of the sell-off means that the underside will not be but in.

- Resistance Flips: The earlier assist at $2,200 has formally flipped right into a “ceiling,” making any aid bounce tough to maintain.

- Bearish Targets: If the every day candle closes beneath the $2,000 mark, the subsequent historic “demand zone” sits at $1,800. A failure there would open the door for a deeper crash towards $1,550, a stage not seen for the reason that consolidation phases of late 2025.

$ETH/USD 1H – TradingView

Market Contagion and Trade Flows

The crash is not taking place in isolation. With Bitcoin struggling to reclaim $70,000, high-leverage positions on main crypto exchanges are being flushed out. In accordance with Reuters, institutional curiosity in $ETH ETFs has additionally cooled, with internet outflows recording tens of millions in losses this week.

Merchants ought to train excessive warning. Till Ethereum can reclaim the $2,200 stage and stabilize, the development stays firmly to the draw back. The breach of $2,000 may act as a “tripwire” for a large liquidation occasion.