Bitcoin $BTC$71,091.27 is now roughly 20% under its estimated common manufacturing value, growing monetary strain throughout the $BTC mining sector.

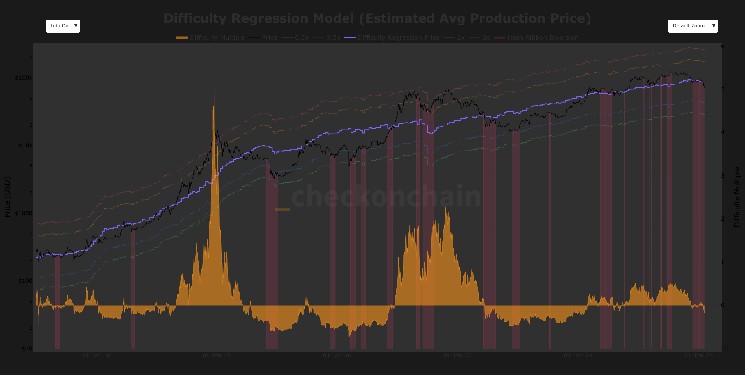

The common value to mine one bitcoin is round $87,000, in accordance with information from Checkonchain, whereas the spot value has fallen in the direction of $70,000. Traditionally, buying and selling under manufacturing value has been a function of a bear market.

The manufacturing estimate makes use of community problem as a proxy for the business’s all-in value construction. By linking problem to bitcoin’s market capitalization, the mannequin gives an estimate of common mining prices.

In earlier bear markets, together with 2019 and 2022, bitcoin traded under manufacturing value earlier than step by step converging again towards it.

Hashrate, which measures the full computational energy securing the bitcoin community, peaked close to 1.1 zettahash (ZH/s) in October, subsequently declining by roughly 20% as much less environment friendly miners have been pressured offline. Extra just lately, hash price has rebounded to 913 EH/s, suggesting some stabilization.

Nevertheless, many miners stay unprofitable at present costs. With revenues under working prices, miners are persevering with to promote bitcoin holdings to fund day-to-day operations, cowl power bills, and repair debt. This ongoing miner capitulation highlights persistent stress within the sector.