MSTR inventory value continued its current downtrend on Monday as volatility within the crypto market remained.

Abstract

- MSTR inventory value continued its robust downward development this week.

- MicroStrategy continued its Bitcoin accumulation technique.

- Technical evaluation means that MSTR might crash to $100 quickly.

MicroStrategy dropped to $136, down by 75% from its all-time excessive. It then stabilized at $145 as Bitcoin ($BTC) pared again a few of its earlier losses and moved above $78,000.

Technique additionally stabilized after the corporate revealed that it acquired 8555 cash price over $75 million final week. It was its smallest buy in three weeks.

Technique has acquired 855 $BTC for ~$75.3 million at ~$87,974 per bitcoin. As of two/1/2026, we hodl 713,502 $BTC acquired for ~$54.26 billion at ~$76,052 per bitcoin. $MSTR $STRC https://t.co/tYTGMwPPUF

— Michael Saylor (@saylor) February 2, 2026

The corporate now holds 713,502 cash, which it purchased for the typical value of $76,052. At its lowest stage on Monday, Technique’s unrealized losses jumped to over $900 milllion.

You may additionally like: Bitcoin insiders face Epstein-era electronic mail fallout over Ripple, Stellar feud

Technique has entry to more money to proceed it Bitcoin shopping for spree. Its shopping for report confirmed that it has entry to over $8 billon price of the MSTR inventory to promote to lift capital. It additionally has $20 billion price of STRK most popular shares, $4 billion of STRD, $3.6 billion of STRC, and $1.6 billion of STRD inventory.

Due to this fact, there’s a chance that Saylor will use the decrease Bitcoin value to proceed the buildup. His view is that Bitcoin will finally bounce again and transfer to a brand new file excessive.

Historical past exhibits that Bitcoin at all times rebounds at any time when it crashes right into a bear market. For instance, $BTC crashed by over 35% between its highest level in January final 12 months and its lowest level in April. It then rebounded to a file excessive in Could.

Bitcoin additionally slipped by over 70% between its highest stage in 2021 and lowest stage in 2022. It then surged from under $16,000 in 2022 to $126,200 in 2025. Due to this fact, the more than likely state of affairs is the place Bitcoin rebounds later this 12 months.

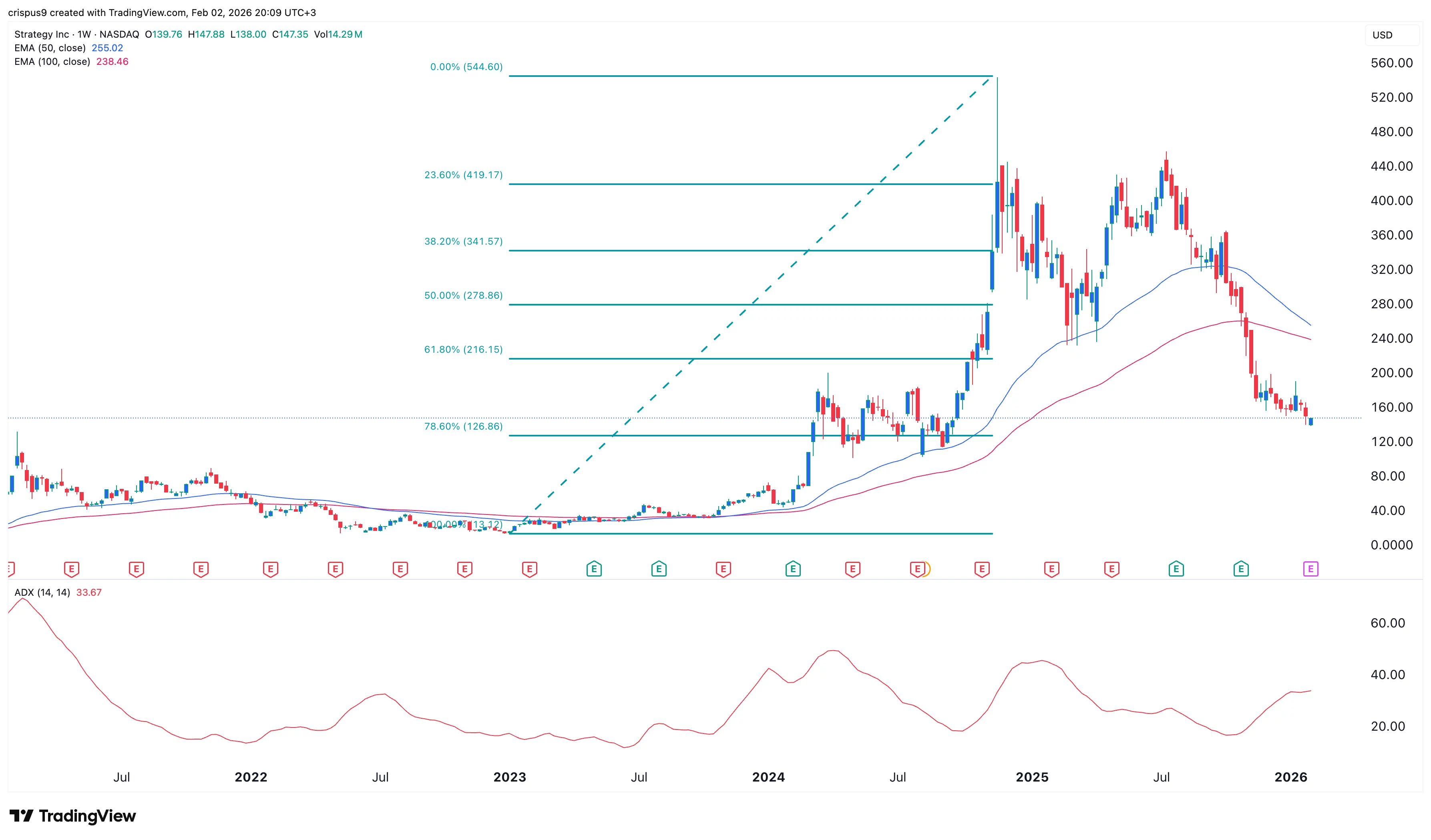

MSTR inventory value technical evaluation

Technique inventory chart | Supply: TradingView

The weekly chart exhibits that the MicroStrategy share value has been in a powerful downward development. It has now crashed under the 61.8% Fibonacci Retracement stage, confirming the downward development.

The Common Directional Index has jumped to 33, its highest stage since March final 12 months. A hovering ADX indicator is an indication that the downward development is gaining momentum.

The inventory moved under all transferring averages and the Supertrend indicator. Due to this fact, the more than likely state of affairs is the place it drops by 35% to $100 after which resumes the downward development.

Learn extra: Palantir inventory kinds an alarming sample, regardless of robust This fall forecast