MicroStrategy is below renewed market strain after Bitcoin slid to $60,000, pushing the corporate’s huge crypto treasury deeper beneath its common acquisition value and reigniting considerations about balance-sheet threat.

Shares of the corporate fell sharply as Bitcoin prolonged its sell-off, reflecting Technique’s function as a leveraged proxy for the cryptocurrency. The inventory’s decline additionally pushed its market valuation beneath the worth of its underlying Bitcoin holdings. It is a key stress sign for the agency’s treasury mannequin.

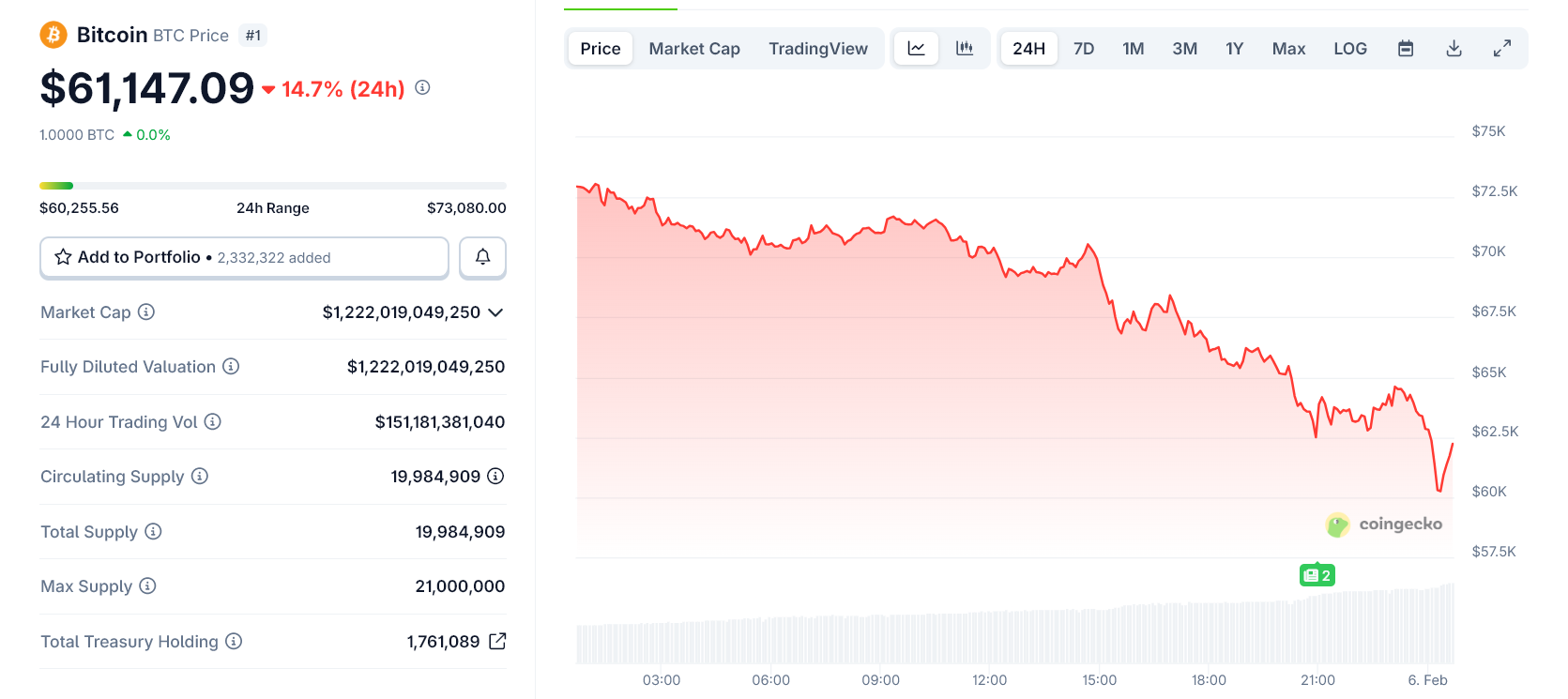

Bitcoin Value Chart. Supply: CoinGecko

Bitcoin Value Crashes to a Yearly Low of $60,000

MicroStrategy holds roughly 713,500 Bitcoin, acquired at a median value of about $76,000 per coin.

With Bitcoin now buying and selling close to $60,000, the corporate’s holdings are roughly 21% beneath value foundation, translating into billions of {dollars} in unrealized losses.

Whereas these losses are unrealized and don’t pressure rapid asset gross sales, they materially weaken MicroStrategy’s fairness story.

The drawdown additionally shifts investor focus from long-term accumulation to short-term monetary resilience.

Bitcoin is Now $16,000 Beneath MicroStrategy’s Common Buy Value. Supply: Technique

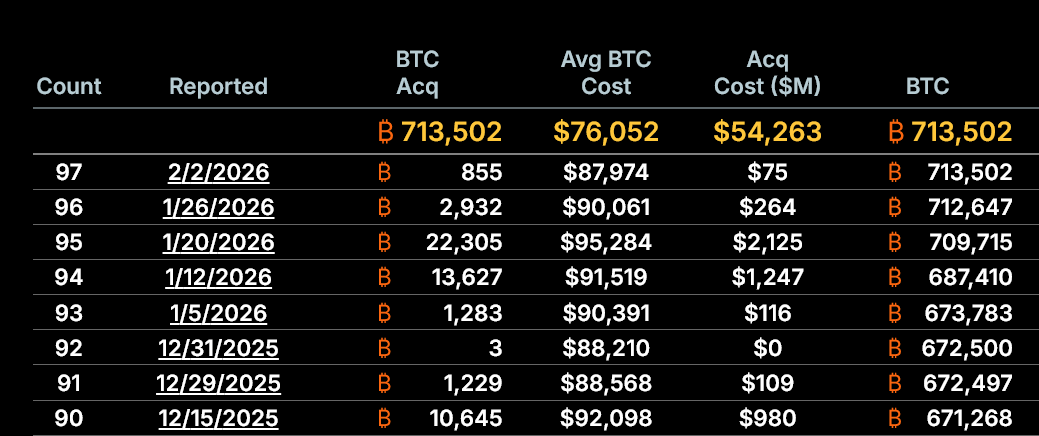

Market Premium Collapses Beneath Asset Worth

A extra rapid concern is MicroStrategy’s market internet asset worth (mNAV), which has fallen to roughly 0.87x. This implies the inventory now trades at a reduction to the worth of the Bitcoin on its steadiness sheet.

That low cost issues as a result of MicroStrategy’s technique depends closely on issuing fairness at a premium to fund further Bitcoin purchases.

With the premium gone, issuing new shares can be dilutive slightly than accretive, successfully freezing the corporate’s major progress mechanism.

Technique’s Bitcoin Premium Collapses. Supply: Saylor Tracker

Technique and Michael Saylor Nonetheless Have Some Quick-Time period Safety

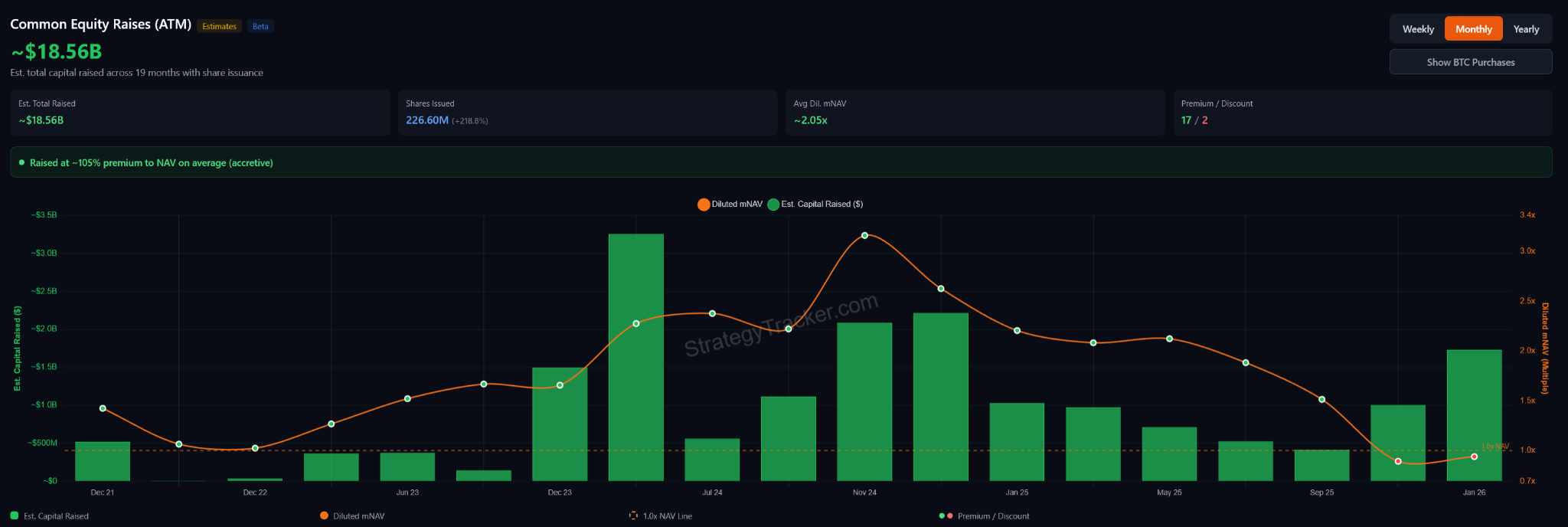

Regardless of the strain, the scenario is just not but a solvency disaster. MicroStrategy beforehand raised round $18.6 billion by way of fairness issuance over the previous two years, largely at premiums to its internet asset worth.

These capital raises occurred throughout favorable market circumstances and helped the corporate construct its present Bitcoin place with out extreme dilution.

Importantly, the agency’s debt maturities are long-dated, and there aren’t any margin-call mechanisms tied on to Bitcoin’s spot worth at present ranges.

Technique’s Whole Capital Raised. Supply: Saylor Tracker

The Actual Danger Lies Forward

MicroStrategy has moved from an enlargement section into defensive mode.

Catastrophic threat would rise if Bitcoin stays properly beneath value for an prolonged interval, mNAV stays compressed, and capital markets stay closed.

In that state of affairs, refinancing would change into tougher, dilution threat would improve, and investor confidence may erode additional.

MSTR Share Crashed 23% This Week. Supply: Google Finance

For now, MicroStrategy stays solvent. Nonetheless, the margin for error has narrowed sharply, leaving the corporate extremely uncovered to the following section of Bitcoin’s market cycle.