The Ethereum community is experiencing its most energetic part up to now. Nonetheless, this doesn’t essentially point out a bullish outlook. Current on-chain information reveals Ethereum reaching a serious milestone as switch counts hit a document excessive. Traditionally, comparable alerts haven’t all the time led to constructive value efficiency.

As well as, a pointy spike in trade inflows raises considerations that promoting stress has not but subsided.

How Does Ethereum’s Present State of affairs Evaluate to 2018 And 2021?

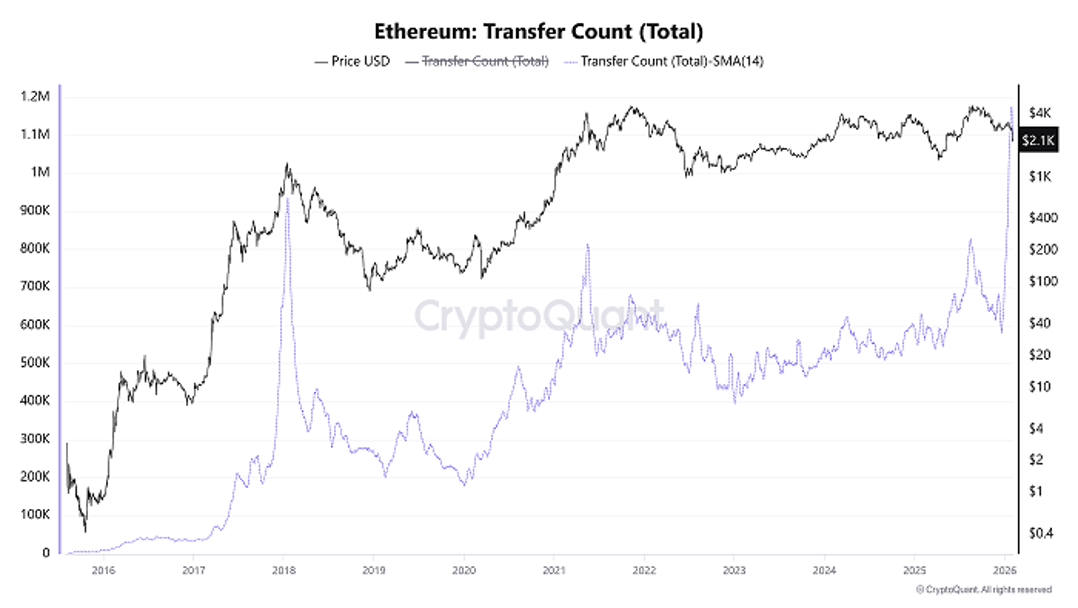

Getting into February, CryptoQuant information reveals that Ethereum Switch Depend—the full variety of token transfers—measured by a 14-day transferring common, reached a document stage of 1.1 million.

At first look, this determine seems promising. It suggests robust community progress and broader adoption of Ethereum.

Ethereum Switch Depend. Supply: CryptoQuant.

Nonetheless, deeper evaluation signifies this might not be the bullish sign many count on. As an alternative, it might level to a correction part or perhaps a cyclical value peak, primarily based on historic precedents.

CryptoQuant analyst CryptoOnchain highlights two intervals when heightened Ethereum community exercise signaled market tops.

- On January 18, 2018, on the peak of the ICO growth, Ethereum transaction counts surged. Shortly afterward, $ETH collapsed from round $1,400 to under $100 by the top of the 12 months. This decline dragged your complete crypto market right into a two-year “crypto winter.”

- On Could 19, 2021, amid the explosive progress of DeFi and NFTs, the metric reached one other document excessive. The market then reversed sharply, with $ETH falling from above $4,000 to under $2,000.

The reasoning is simple. Elevated $ETH motion typically signifies that extra buyers are withdrawing funds from wallets, typically in massive transactions. This conduct could mirror makes an attempt to promote amid deteriorating future expectations.

“The present state of affairs bears a placing resemblance to the setups seen in 2018 and 2021. Whereas the macro atmosphere modifications, the on-chain conduct of community members suggests we’re in a zone of excessive danger,” CryptoOnchain said.

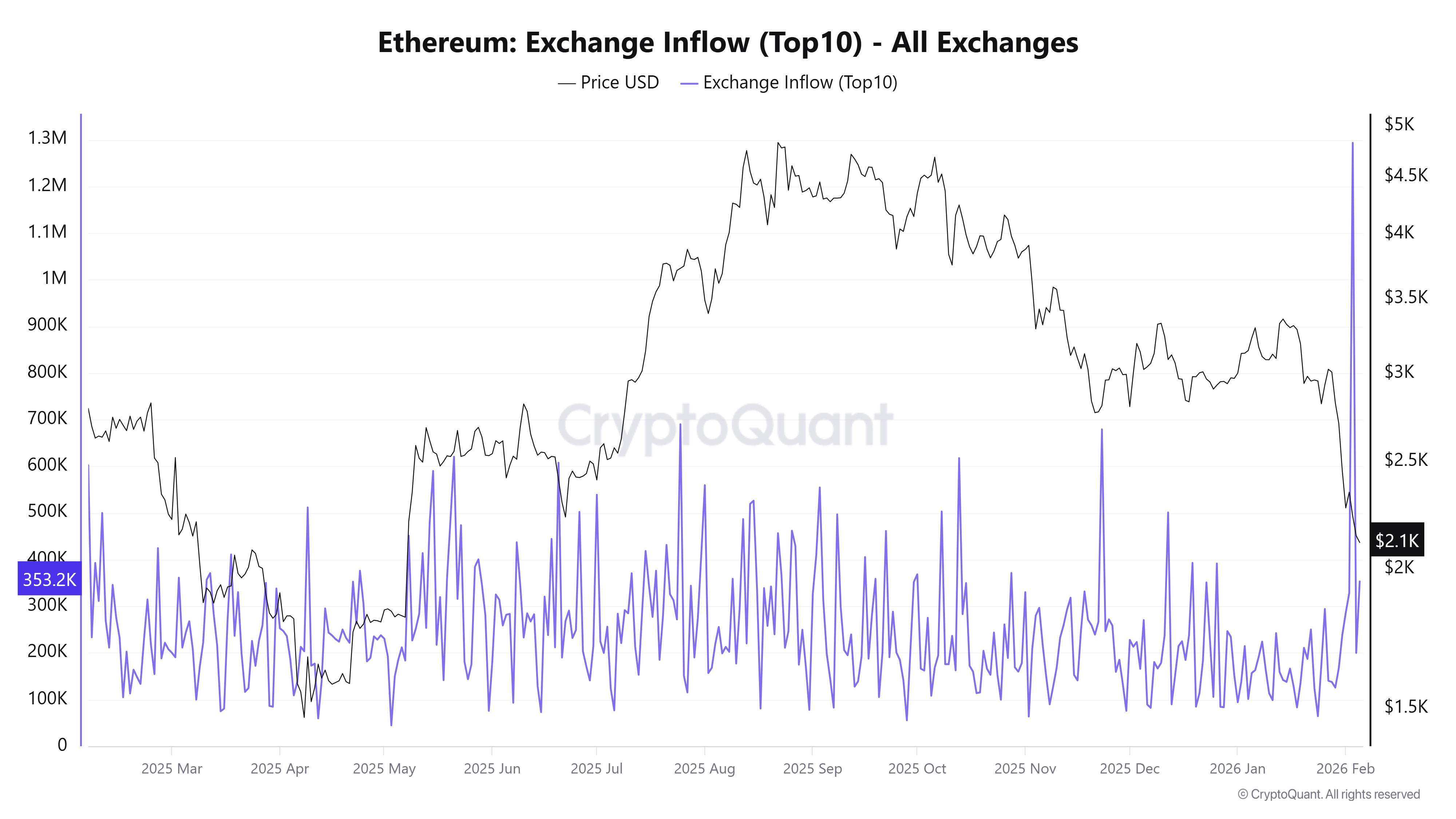

This view is additional supported by a spike in Ethereum Trade Influx (Prime 10) as $ETH dropped under $2,300 in early February.

Ethereum Trade Influx (Prime 10) measures the full quantity of cash from the ten largest influx transactions to exchanges. Excessive values point out a rise in buyers depositing massive quantities without delay. This typically alerts rising promoting stress and the danger of additional value declines.

Ethereum Trade Influx (Prime 10). Supply: CryptoQuant.

On February 3, this metric surged to 1.3 million, the best stage in a 12 months. Two days later, $ETH fell from $2,230 to under $2,100.

In keeping with evaluation from BeInCrypto, a confirmed pattern reversal would require Ethereum to get better to not less than $3,000. Within the quick time period, $ETH could proceed to say no towards the $2,000 help stage, as promoting stress stays unresolved.

The submit Ethereum Community Exercise Hits Peak, however Why This Is Not Essentially a Bullish Sign appeared first on BeInCrypto.