Ethereum Promote-off Intensifies: Why is $ETH Crashing?

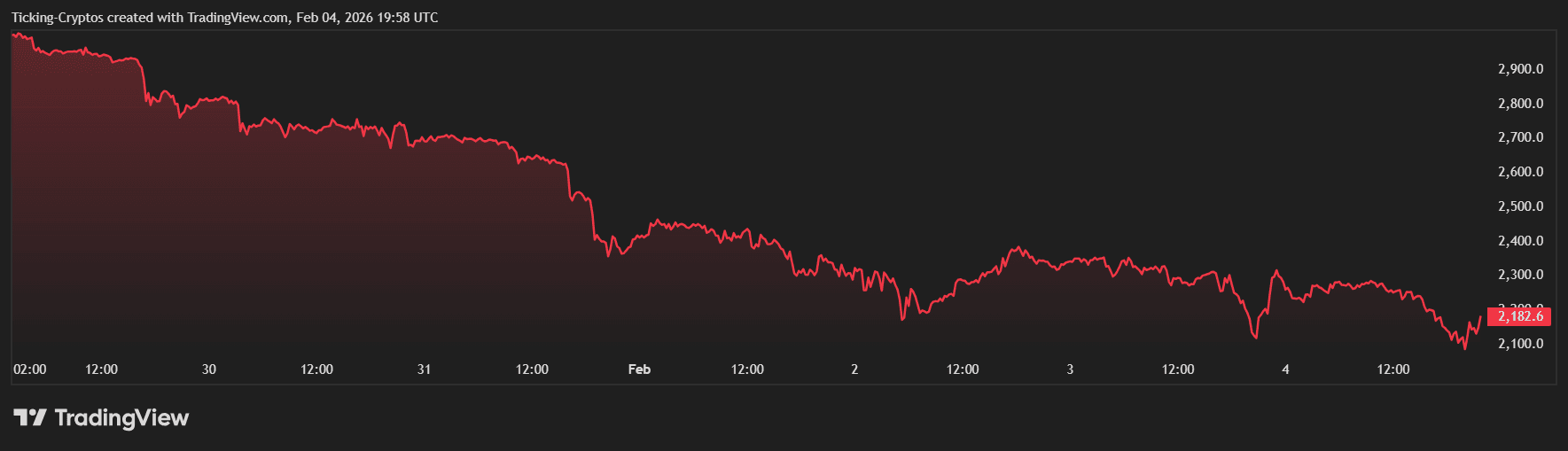

The crypto market is presently witnessing a big “massacre” as we head into February 2026. Ethereum ($ETH) has seen a pointy decline, dropping practically 25% in worth over the past seven days. This downward momentum was accelerated by an enormous liquidation occasion on February 1st, the place over $2.5 billion in positions have been worn out throughout the market.

$ETH/USD over the previous week – TradingView

A number of components are fueling this crypto information cycle. Institutional outflows from Ethereum ETFs have been persistent, with main gamers like BlackRock reportedly transferring giant quantities of $ETH to exchanges. Moreover, a “hawkish” shift in U.S. Federal Reserve expectations following the appointment of Kevin Warsh as Fed Chair has dampened the “risk-on” sentiment that beforehand fueled the 2025 rally.

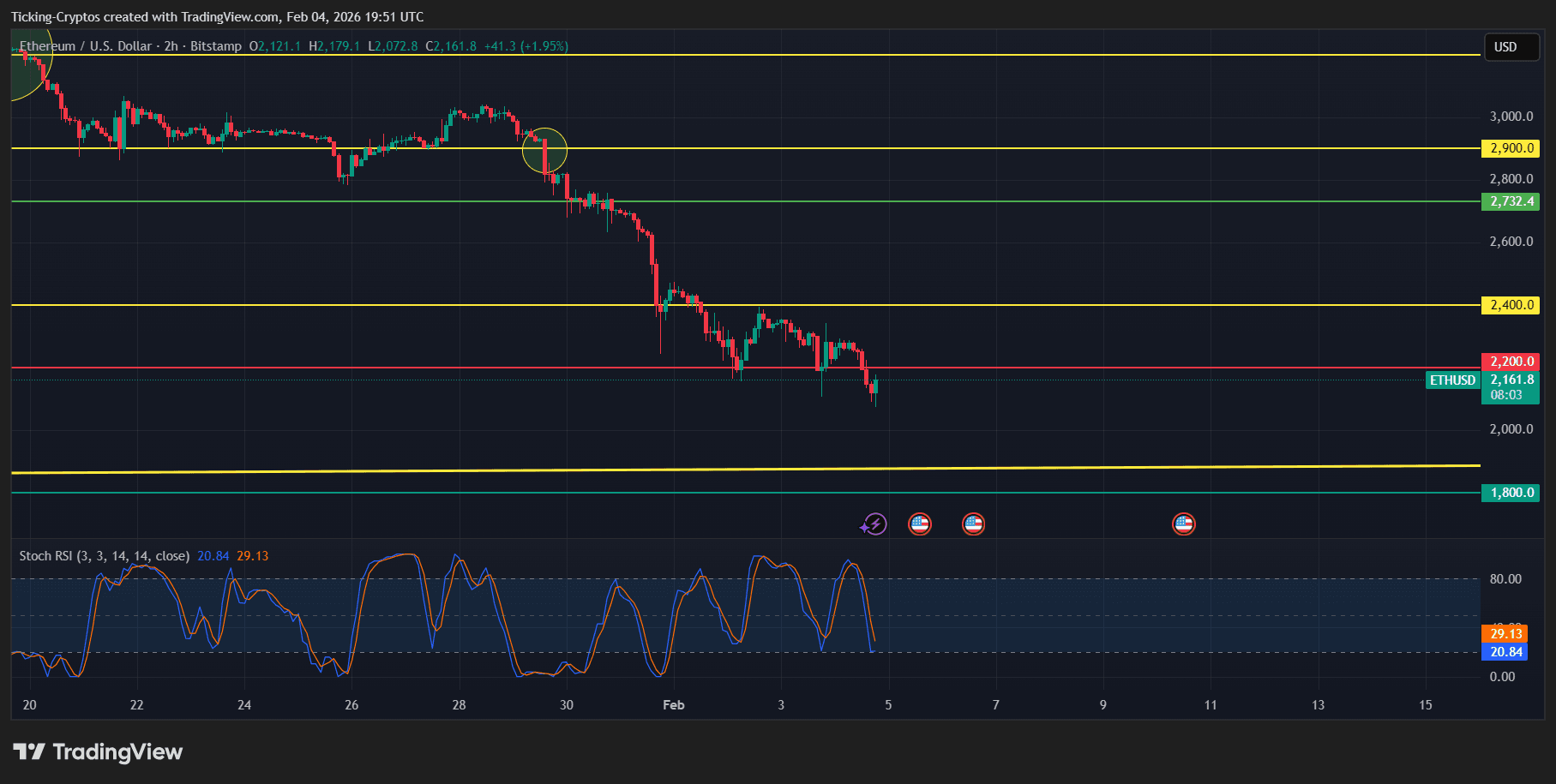

Technical Evaluation: Analyzing the ETHUSD Chart

Trying on the present $ETH value, the construction has turned decidedly bearish. The value just lately failed to take care of the vital $2,500 psychological degree, which has now flipped right into a heavy resistance zone.

As seen within the technical knowledge, $ETH is buying and selling properly beneath its 50-day and 200-day Easy Shifting Averages (SMAs). The Relative Power Index (RSI) is hovering close to 30, indicating oversold circumstances, but the dearth of shopping for quantity suggests {that a} backside has not but been fashioned. The “Layer 2 narrative” additionally appears to be cooling down, including basic stress to the technical breakdown.

Ethereum Worth Prediction?: The $1,800 Robust Help

With the $2,200 help zone presently below excessive stress, merchants are wanting on the subsequent main “demand zone.” If Ethereum fails to reclaim $2,350 within the brief time period, the trail towards $1,800 turns into the most certainly situation.

The $1,800 help degree is traditionally important. It acted as a serious pivot level in the course of the 2025 mid-year correction and aligns with long-term Fibonacci retracement ranges. Many analysts consider this space will function a “liquidity entice” the place institutional consumers would possibly lastly step again in to build up.

- Rapid Resistance: $2,420

- Key Help 1: $2,100

- Final Help: $1,800 – $1,850

For these trying to safe their belongings throughout this volatility, evaluating one of the best {hardware} wallets is a vital step to keep away from exchange-related dangers. If you’re contemplating buying and selling this transfer, make sure you use a good platform by checking our trade comparability web page.

Market Sentiment and Macro Outlook

The “Concern & Greed Index” has plummeted into the “Excessive Concern” zone (presently at 15), a degree not seen for the reason that 2022 bear market lows. Whereas excessive worry is commonly a contrarian purchase sign, the macro setting—marked by geopolitical tensions within the Center East and tightening U.S. liquidity—means that the “digital gold” narrative is being examined. In accordance with knowledge from Bloomberg, the correlation between equities and crypto stays excessive, which means a restoration within the Nasdaq is perhaps required earlier than Ethereum can see a sustained bounce.