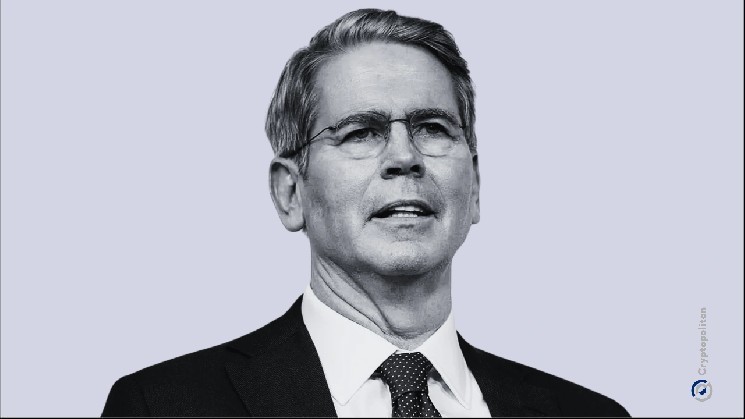

Gold costs crashed final week after a record-setting rally, and Scott Bessent blamed it on reckless buying and selling in China.

Talking stay on Fox Information’ Sunday Morning Futures, Scott mentioned, “The gold transfer factor, issues have gotten a bit unruly in China. They’re having to tighten margin necessities. So gold appears to me form of like a classical, speculative blowoff.”

That was his approach of claiming the spike and sudden fall had little to do with demand and every little thing to do with panic shopping for by leveraged merchants.

The rally in treasured metals had been pushed by fears about international conflicts, free hypothesis, and rising concern about whether or not the Federal Reserve nonetheless operates freely. Then it collapsed.

Chinese language authorities raised margin necessities, and the cash dried up. The worth didn’t fall due to the financial system. It fell as a result of regulators in China yanked the brakes on merchants who had gone approach too far.

Scott pushes Senate to start out hearings regardless of Powell investigation

Whereas merchants had been getting burned within the gold market, Scott was additionally coping with a political standoff in Washington. He mentioned the Senate ought to get transferring with affirmation hearings for Donald Trump’s Federal Reserve decide, Kevin Warsh.

Kevin was nominated on January 30 to switch Jerome Powell, however the course of has been blocked.

Senator Thom Tillis from North Carolina is behind the delay. He mentioned he gained’t let any of Trump’s Fed nominations undergo till the Division of Justice finishes a felony investigation into Powell.

The case is about feedback Powell made to Congress final 12 months concerning the prices of renovations on the Fed’s headquarters. Tillis mentioned he was a witness and known as it a menace to the Fed’s independence.

Even with that, Scott reminded everybody that Tillis had additionally known as Kevin a powerful candidate. “Senator Tillis has come out and mentioned he thinks that Kevin Warsh is a really robust candidate,” Scott mentioned. “So I’d say: Why don’t we get the hearings underneath approach and see the place Jeanine Pirro’s investigation goes.” Pirro is the U.S. legal professional operating the case in D.C.

Scott outlines Fed coverage, Japan ties, and Trump’s financial system

Scott additionally spoke about how the Federal Reserve is dealing with its big stability sheet. He mentioned to not count on any sudden cuts.

“I wouldn’t count on them to do something rapidly,” he mentioned. “They’ve moved to the ample-regime coverage, and that does require a bigger stability sheet, so I’d assume that they’ll in all probability sit again, take at the least a 12 months to determine what they need to do.”

On Kevin Warsh’s independence, Scott mentioned Kevin “goes to be very unbiased, however conscious that the Fed is accountable to the American folks.” He additionally mentioned if Kevin didn’t decrease charges like Trump needs, it might be as much as the president to sue him.

Exterior the Fed mess, Scott congratulated Japanese Prime Minister Takaichi Sanae for her coalition’s election win.

“She is a good ally, nice relationship with the president,” Scott mentioned. He added that Japan’s power helps U.S. technique in Asia, particularly now with Donald Trump again within the White Home.

When requested about how the financial system was doing, Scott mentioned:

“President Trump’s financial system is delivering actual outcomes for the American folks. POTUS’ insurance policies are driving robust progress, bringing down inflation, and taking the inventory market to historic highs, all whereas reaching the bottom crime charge in over 100 years.”

Scott added that in 2025, Trump laid the inspiration for robust job features and earnings progress in 2026.

“The inventory market lives sooner or later,” Scott mentioned, “and its historic efficiency is a sign from Wall Road that Essential Road will quickly harvest the rewards from POTUS’ financial insurance policies.”