Bitcoin is making an attempt to rebound however falling shifting averages and powerful resistance nonetheless restrict upside as volatility stays excessive.

Bitcoin (BTC) is buying and selling at $70,936.57, up about 2.6% up to now 24 hours, after an energetic session that noticed the worth swing between a every day low of $69,066.88 and a excessive of $71,852.35. This vary reveals volatility is again, with consumers stepping in aggressively close to $69,100 and sellers defending the higher band close to $71,850.

Market exercise appears supportive reasonably than skinny, with 24-hour quantity round $45.24B and a market cap close to $1.418T. On the chart, Bitcoin climbed steadily from the high-$69,000s into the $70,500–$71,000 zone, then spent a lot of the session chopping round that pivot. Later, a pointy wick towards $72,000 shortly rejected and snapped again to settle just under $71,000.

If bulls can flip $71,000 right into a ground and break the $71,850–$72,000 ceiling, this bounce can develop legs. If not, the rejection zone could invite one other rotation again towards the day’s low.

The place’s Bitcoin Headed?

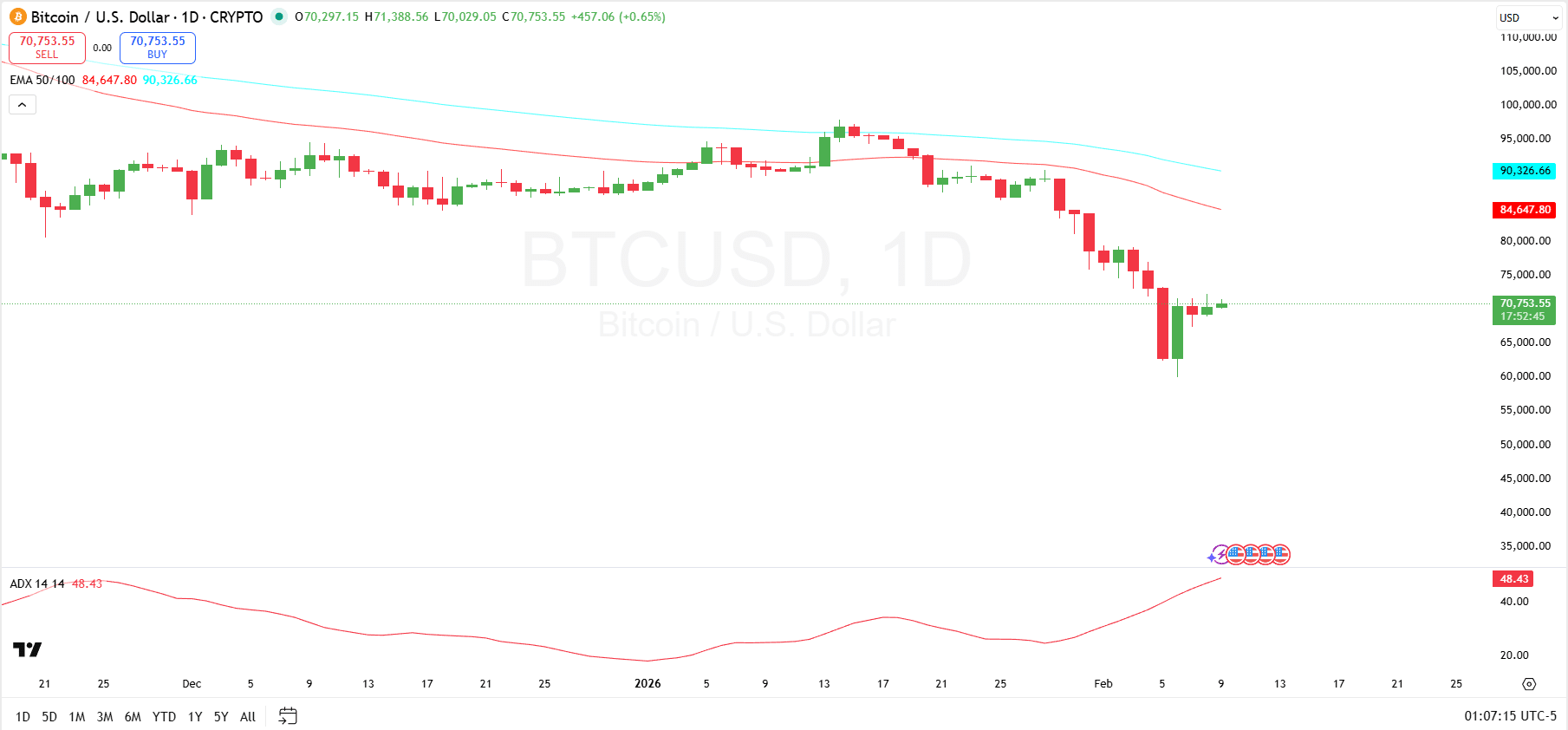

On the TradingView every day chart, the worth is hovering simply above the $70,000 space after a pointy selloff in early February. This was adopted by a robust rebound candle after which tighter sideways candles, indicators of stabilization, however not a confirmed pattern reversal but.

Pattern indicators nonetheless lean bearish as a result of value stays effectively beneath the important thing shifting averages. The EMA 50 sits round $84,647.80 and the EMA 100 round $90,326.66, each sloping downward. This usually marks overhead resistance and suggests rallies could face promoting stress as the worth approaches these zones.

For construction, the speedy assist to look at is the $70,000 area, whereas the following resistance sits close to $71,400. The broader restoration hurdles then start on the mid-$80,000s, the place the EMA band lives.

Momentum power is highlighted by the Common Directional Index at 48.43, which alerts a robust pattern setting. Given value is beneath falling EMAs and the chart simply got here off a steep drop, that strong-trend studying presently helps the concept that the dominant pressure has been bearish, even when a short-term bounce is underway.

Bitcoin’s Rekt Information

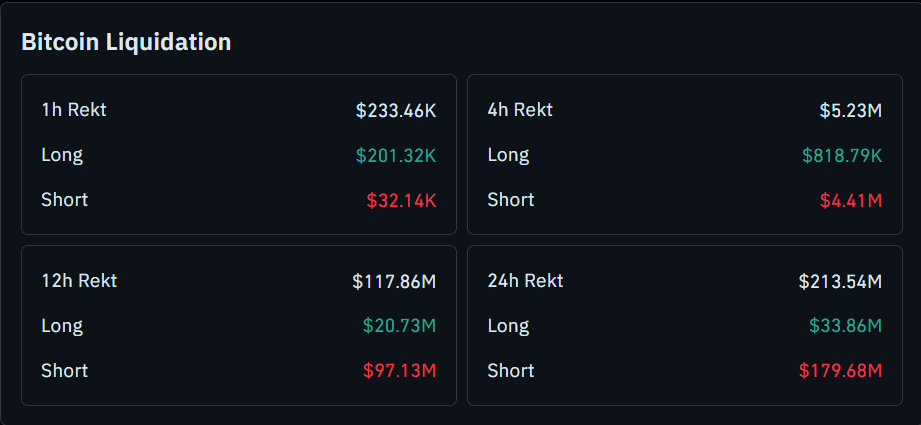

In the meantime, Bitcoin liquidations present a transparent shift towards short-side ache throughout the bigger intraday home windows. Complete liquidations had been $233.46K (1H), $5.23M (4H), $117.86M (12H), and $213.54M (24H).

The 1-hour snapshot is the one window dominated by longs, with $201.32K lengthy liquidations versus $32.14K shorts.

Screenshot 2026 02 09T091656093

Zooming out, shorts take the hit in an enormous means over the past 4 hours, with $4.41M wiped versus $818.79K in longs. Over the past 12 hours, $97.13M in shorts had been liquidated in contrast with $20.73M in longs. Over the past 24 hours, quick liquidations reached $179.68M versus $33.86M in lengthy liquidations.