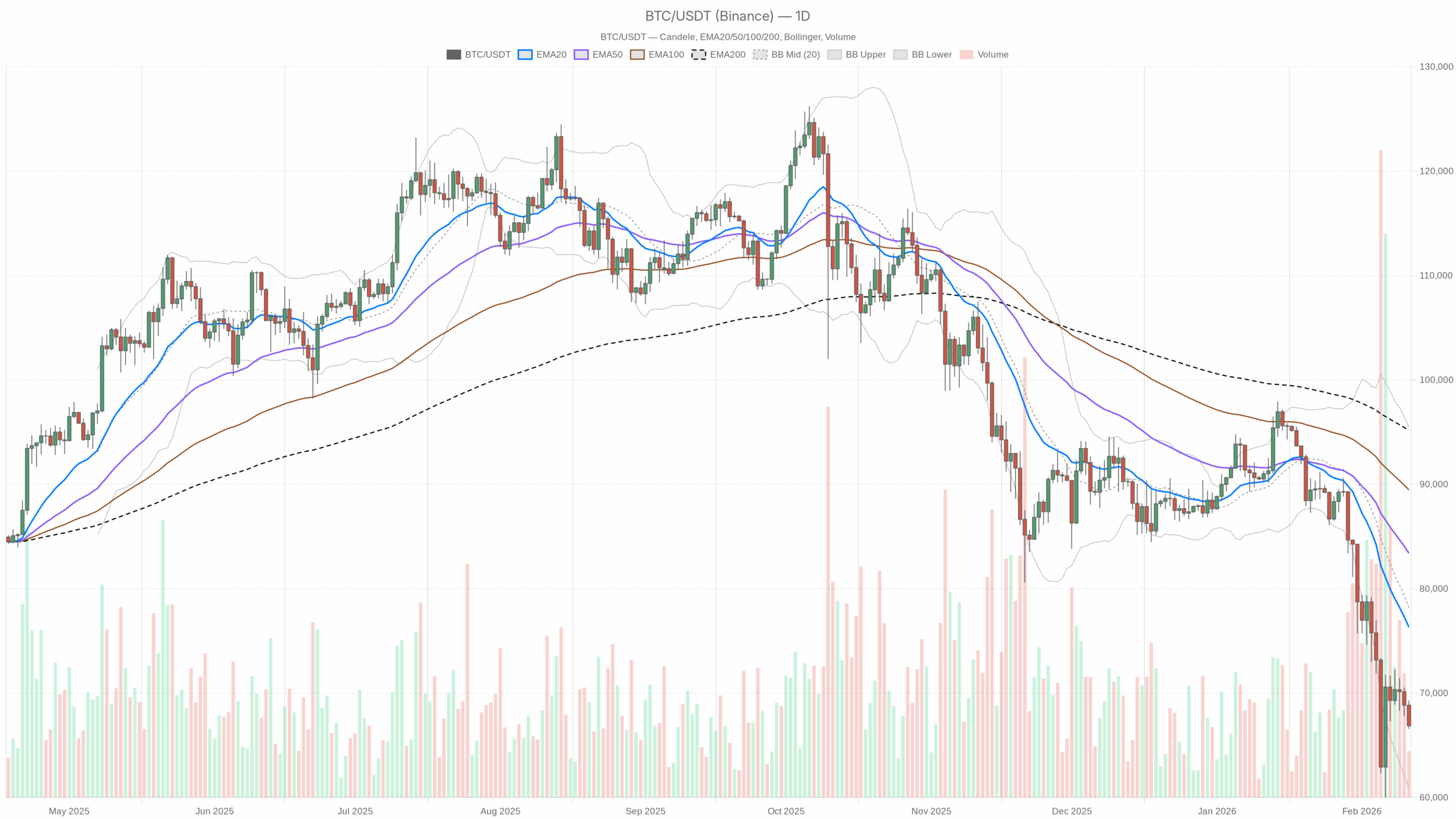

After a violent washout that has shaken confidence, Bitcoin worth as we speak is buying and selling effectively underneath key technical ranges as concern and compelled de-risking dominate the tape.

Day by day bias: clearly bearish, with early oversold circumstances

Bitcoin worth as we speak sits round $66,800–67,000 (BTCUSDT), buying and selling beneath the $70k psychological line and underneath each main shifting common on the every day chart. The dominant power proper now’s compelled de-leveraging and threat aversion: spot and derivatives have each been hit, concern is excessive, and liquidity is scaling down on the draw back moderately than the upside.

This second issues as a result of the market is testing whether or not the latest high-volatility washout was a easy shakeout inside a broader bull cycle, or the beginning of a deeper regime shift again towards a protracted corrective part. The every day construction has flipped decisively bearish, whereas intraday timeframes are edging towards short-term exhaustion however haven’t but constructed a reputable base. Bulls are on the again foot; bears are in management, however they’re additionally beginning to lean right into a crowded commerce.

On the every day (D1), BTCUSDT is firmly in a bearish regime:

- Value: $66,868

- 20-day EMA: $76,314

- 50-day EMA: $83,394

- 200-day EMA: $95,155

- Regime tag: bearish

Value buying and selling nearly $10k beneath the 20-day EMA and much underneath the 50- and 200-day EMAs confirms a robust draw back development, not only a gentle pullback. The complete short- to medium-term moving-average stack is above spot, which is traditional downtrend construction. Furthermore, rallies are, by default, prone to being offered.

Day by day RSI (14): 29.94 – dipping into oversold

RSI 14 (D1): 29.94

Day by day RSI has slipped slightly below 30, which is early oversold territory. That tells us the selloff has been aggressive and emotional, however we aren’t but within the type of extended sub-25 capitulation that usually marks full-blown bottoms. In apply, sellers are clearly in management, however they’re beginning to stretch the rubber band. Shorting contemporary lows down right here carries extra squeeze threat than it did a number of days in the past.

Day by day MACD: destructive and widening – momentum nonetheless factors down

- MACD line: -5,824.35

- Sign line: -4,964.61

- Histogram: -859.73

The MACD line is deeply destructive and beneath the sign, with a sizeable destructive histogram. That may be a clear learn: draw back momentum continues to be dominant and has not but meaningfully reversed. Any bounce for now’s suspect; the trend-following sign stays short-biased on the every day, and it’ll take a number of sturdy inexperienced candles to flip this.

Day by day EMAs: all resistance, no assist

- 20 EMA (D1): $76,313.98

- 50 EMA (D1): $83,393.99

- 200 EMA (D1): $95,155.15

Value is effectively beneath all three EMAs, and every one now acts as a possible overhead provide zone:

The hole between spot and the 20-day EMA is especially necessary. When worth trades this far underneath the short-term EMA, two issues normally observe: both sharp mean-reversion rallies towards the 20 EMA, or a grinding draw back channel the place the EMA itself chases worth decrease. Given the present macro concern backdrop, the trail of least resistance within the very quick time period stays down. Nevertheless, the gap to the 20 EMA additionally tells you that late shorts are getting into at poor ranges.

Day by day Bollinger Bands: using the decrease band, volatility nonetheless elevated

- BB mid (20 SMA): $78,182.26

- Higher band: $95,487.67

- Decrease band: $60,876.85

Bitcoin is buying and selling effectively beneath the center band and nearer to the decrease band. That matches with a draw back enlargement part: worth has damaged out of the prior volatility envelope to the draw back and is making an attempt to stroll the decrease band. The decrease band close to $60.9k is the subsequent apparent volatility-anchored reference; if sellers push worth into that zone, that’s the place you’d anticipate liquidation-driven wicks and potential short-term capitulation.

Day by day ATR (14): 5,504 – vast every day ranges, threat per commerce is excessive

ATR 14 (D1): $5,504.74

Day by day ATR north of $5.5k means one-day swings of seven–8% are completely on the desk. That’s not the quiet grinding uptrend BTC had earlier; it’s a high-volatility corrective surroundings. Place sizing must account for the truth that a standard day can simply run a number of thousand {dollars} towards you even when the broader thought is true.

Day by day pivot ranges: worth hovering across the pivot, draw back assist close by

- Pivot level (PP): $67,573.09

- Resistance 1 (R1): $68,588.20

- Help 1 (S1): $65,853.31

Spot is sitting roughly slightly below the every day pivot. That places the market in a fragile stability zone. A push again above the pivot after which above $68.6k would mark an intraday try to reclaim some upside momentum, whereas a clear break underneath $65.8k opens room for a retest nearer to the decrease Bollinger Band across the $61k space. Merchants will likely be watching how worth reacts on both aspect of this $66–69k band.

Intraday construction: bearish, however short-term momentum is tiring

1-hour (H1): nonetheless in a downtrend, gentle indicators of vendor fatigue

- Value: $66,926

- 20 EMA (H1): $68,254.5

- 50 EMA (H1): $68,968.29

- 200 EMA (H1): $71,416.82

- RSI 14 (H1): 31.72

- MACD hist (H1): -186.67

- Bollinger mid (H1): $68,497.79 (bands: $70,232 up / $66,763 down)

- ATR 14 (H1): $556.23

- Pivot level (H1): $66,956.38 (R1: $67,104.21, S1: $66,778.34)

On the 1H chart, the image is according to the every day: worth trades beneath all key EMAs, confirming a short-term downtrend. RSI round 32 exhibits promoting strain continues to be current, however we’re inching towards intraday oversold territory. The destructive MACD histogram says momentum continues to be down, however the dimension of that histogram will not be excessive, hinting that the tempo of the selloff is cooling a bit.

Bollinger Bands on H1 present worth leaning towards the decrease band close to $66.8k, indicating intraday strain stays to the draw back. H1 ATR round $550 says hour-to-hour swings of just about $1,000 are regular proper now, so tight stops will get hunted simply.

The H1 pivot sits nearly precisely at spot. Holding beneath this pivot retains the intraday bias bearish; a push above the pivot and R1 (roughly $67.1k) can be the primary child step towards a short-covering bounce. Proper now, the 1H chart is saying that the market continues to be down, however not as violently as earlier than.

15-minute (M15): tactical execution zone, early indicators of compression

- Value: $66,886

- 20 EMA (M15): $67,327.93

- 50 EMA (M15): $67,969.77

- 200 EMA (M15): $69,014.25

- RSI 14 (M15): 33.02

- MACD hist (M15): +20.47

- Bollinger mid (M15): $67,271.87 (bands: $68,091 up / $66,453 down)

- ATR 14 (M15): $301.39

- Pivot level (M15): $66,899.08 (R1: $66,912.62, S1: $66,871.99)

On the 15-minute chart, the construction continues to be bearish, with worth beneath all EMAs, however there’s a delicate shift. The MACD histogram has flipped barely constructive despite the fact that the MACD line continues to be destructive general. That’s the type of micro-signal you get when draw back momentum pauses and short-term merchants begin probing for a bounce.

RSI within the low 30s echoes that message: bears are urgent, however not accelerating. The ATR on M15 round $300 confirms that even intra-bar noise is substantial.

Value is buying and selling proper across the 15m pivot. Hanging right here and not using a decisive breakdown or breakout factors to a short-term consolidation inside a broader downtrend. For execution, that normally means you both await a transparent break beneath the native vary, underneath the decrease band and S1, to affix momentum, or a reclaim of the 20 EMA plus native highs to play for a squeeze. Chasing inside this vary is the place merchants get chopped up.

Sentiment and macro context: excessive concern with BTC dominance rising

The broader market information provides necessary context:

- BTC dominance: 56.75%

- Whole crypto market cap: ~$2.35 trillion

- 24h market cap change: -2.89%

- Concern & Greed Index: 11 – Excessive Concern

Bitcoin is gaining dominance whereas the overall market cap is shrinking. That’s traditional flight to relative security inside crypto: capital that stays within the area is consolidating into BTC whereas alts bleed more durable.

The concern studying at 11 is necessary. We’re effectively into the panic zone, the place headlines are uniformly destructive, massive gamers de-risk, and retail tends to capitulate. Traditionally, these circumstances typically coincide with or precede enticing long-term entry zones, however the timing is noisy. Markets can keep in excessive concern and grind decrease longer than most anticipate.

Information circulate reinforces the shift in psychology: items about whales and ETFs bailing out, banks reiterating that crypto will not be an asset, and commentary about Bitcoin being $70,000 too excessive are the everyday narratives that cluster close to sentiment troughs. Nevertheless, from a technical perspective, none of that is but backed by concrete reversal buildings. It’s simply emotional gasoline sloshing round a development that’s nonetheless down.

Bullish state of affairs: oversold bounce and imply reversion towards $75–80k

The bullish case from right here is tactical, not but structural. It depends on oversold circumstances, excessive concern, and short-covering moderately than clear proof of a brand new uptrend.

What bulls need to see

For a sturdy bounce, the sequence would look roughly like this.

First, on the intraday aspect, BTC wants to carry above or at the least rapidly reclaim the $65.8k S1 every day assist. Repeated rejection beneath that degree would injury the bounce setup.

Subsequent, on the H1 chart, bulls need to see worth reclaim and maintain above the 1H pivot and 20 EMA. Meaning sustained buying and selling again over roughly $68.2–68.5k. This transfer would present that the fast promoting strain has cooled and that shorts are beginning to cowl.

On the every day, a great bullish development would come with:

- RSI climbing again above 35–40, indicating that the worst of the oversold strain is unwinding.

- MACD histogram shrinking towards zero, signalling decelerating draw back momentum.

- A every day shut again above the every day pivot (~$67.6k) after which above $70k, which might begin to rebuild a better base.

If that path performs out, a logical upside goal for a mean-reversion swing is the 20-day EMA close to $76.3k, with extension into the $78–80k band across the Bollinger mid and prior congestion. That’s the place you’d anticipate provide to re-emerge except the macro image has genuinely turned.

What invalidates the bullish state of affairs

The bullish bounce thesis breaks down if Bitcoin prints a clear every day shut beneath $65k and begins strolling the decrease Bollinger Band towards $61k with RSI caught underneath 30. A continued enlargement of the destructive every day MACD histogram alongside that transfer would verify that the market will not be executed flushing but.

In that case, makes an attempt to purchase the dip usually tend to be catching a falling knife than front-running a reversal.

Bearish state of affairs: continuation towards $61k and doubtlessly decrease

The bearish case at present has the stronger backing from the charts: development, momentum, and construction all lean in that path.

What bears need to see

For continuation decrease, bears need BTC to stay capped beneath $70k and extra particularly beneath the cluster of intraday resistance shaped by the H1 20 EMA (~$68.3k) and H1/15m Bollinger mids (~$67.3–68.5k).

A break beneath $65.8k (every day S1) that holds on retest can be the subsequent sign that the trail is opening towards the every day decrease band round $60.9k. If worth begins to trip that decrease band with every day RSI hovering within the mid-20s and MACD staying deeply destructive, the market is in a correct development part down, not only a fast spike.

From there, the apparent draw back roadmap is:

- First leg: probe into $61–63k (decrease Bollinger Band and volatility assist).

- Potential extension: if that zone fails to draw actual patrons, a deeper washout into the excessive $50ks turns into believable, particularly if macro or ETF flows stay hostile.

What invalidates the bearish state of affairs

The bearish continuation view weakens materially if Bitcoin can:

- Reclaim and maintain above $70k on a every day closing foundation.

- See every day RSI get better again into the 40s, displaying that sellers have misplaced dominance.

- Print a every day MACD that begins to show upward, with the histogram shrinking towards zero, whereas worth holds larger lows above the latest backside.

A weekly shut again above the $76k 20-day EMA space can be a transparent assertion that the down-leg was corrective inside a bigger bull market and that bears have possible exhausted their benefit, at the least within the quick to medium time period.

Positioning, threat, and the way to consider this tape

Proper now, every day development and sentiment are aligned bearish, however the market can also be short-term oversold with excessive concern. That may be a tough mixture: the larger image favors the shorts, however the timing edge on new shorts is poor, and sharp countertrend rallies can come out of nowhere.

For lively merchants, that is an surroundings the place:

- Timeframe self-discipline issues. Aligning with the every day downtrend however utilizing the 1H and 15m to keep away from promoting proper into intraday helps is vital.

- Threat per commerce ought to replicate the elevated ATR. Stops that might be vast sufficient in calmer markets can simply be noise right here.

- Endurance round key ranges, $65.8k on the draw back and $68–70k overhead, is prone to pay higher than chasing impulsive strikes in the course of the vary.

For longer-term contributors, excessive concern and readings like a sub-30 every day RSI are the indicators you usually see someplace within the bottoming course of, however not all the time on the last low. Staggered entries and a tolerance for additional volatility are sometimes required if one is constructing publicity into circumstances like these.

The one factor that’s clear from the information is that volatility and uncertainty are excessive. The market has left the comfy, trending part and moved right into a shakeout regime the place each bulls and bears might be wrong-footed rapidly. General, respecting the development and the danger, and letting the chart verify a flip, stays essential earlier than treating this as something greater than a high-volatility correction in 2024.