Ethereum traded above the $2,000 per coin vary on Friday afternoon, as derivatives markets flashed a mixture of warning and crowding throughout futures and choices. Futures open curiosity edged decrease intraday whereas choices information confirmed merchants clustering round key strikes, setting the stage for potential worth compression.

Ethereum Choices Positioning Factors to Compression Close to Max Ache Zones

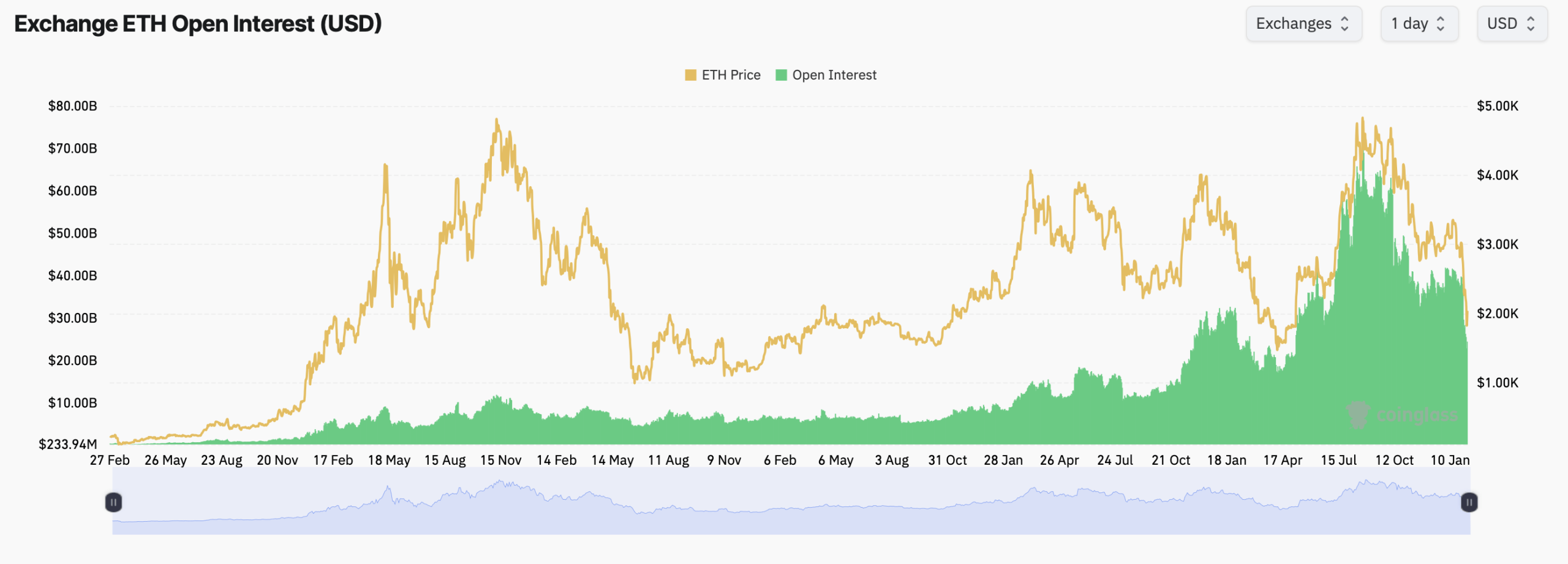

Ethereum had a wild experience yesterday, and on Friday, issues are method calmer. In keeping with coinglass.com stats, ethereum futures open curiosity stays substantial throughout main venues, with CME main in greenback phrases at roughly $3.45 billion, representing about 14.1% of complete tracked publicity.

Binance adopted intently with roughly $5.53 billion in open curiosity, giving it the most important share by notional measurement, whereas Gate, Bybit, OKX, and Bitget rounded out a tightly packed second tier.

Ethereum futures open curiosity on Feb. 6, 2026.

Brief-term market motion, nevertheless, leaned defensive. Most main exchanges recorded one-hour declines in open curiosity, together with Binance, CME, OKX, Bybit, and Bitget, suggesting merchants have been trimming danger relatively than urgent directional bets. The four-hour and 24-hour figures instructed a extra nuanced story, with CME, Binance, and Gate nonetheless displaying internet will increase over the day.

Quantity-adjusted metrics strengthened that divergence. CME’s open interest-to- quantity ratio hovered close to 0.93, pointing to deep, institutional-style positioning, whereas Binance’s decrease ratio mirrored sooner turnover and extra lively buying and selling. BingX and Bitget posted a number of the highest ratios, signaling tighter positioning regardless of lighter total flows.

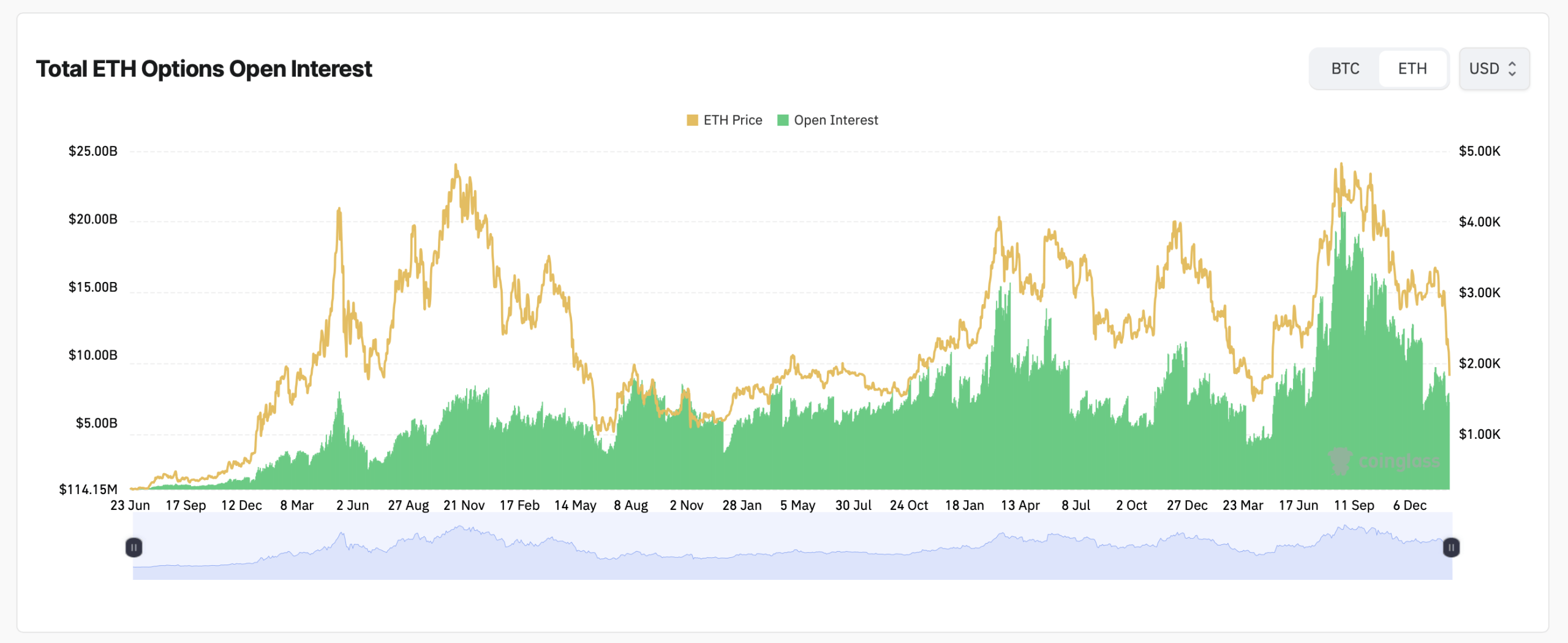

On the choices facet, ether open curiosity remained targeting Deribit, the place long-dated name contracts dominated the leaderboard. The only largest contract by open curiosity was the Deribit ETH-27MAR26 $6,500 name, adopted intently by $5,500 and $6,500 calls expiring later in 2026, underscoring persistent long-term upside positioning.

That optimism, nevertheless, got here with a hedge. Put contracts at $1,800, $1,500, and $2,200 additionally ranked among the many largest open curiosity positions, revealing a market that desires upside publicity however refuses to depart the draw back unattended. Choices merchants, in brief, are sporting each seatbelts and helmets.

Ethereum choices open curiosity on Feb. 6, 2026.

Mixture choices information confirmed calls accounting for roughly 58.2% of complete ether choices open curiosity, in contrast with 41.8% for places. But the 24-hour buying and selling break up was almost lifeless even, with calls and places every capturing about half of each day quantity, an indication that conviction stays fragile.

Max ache ranges added one other layer of stress. On Deribit, the max ache worth clustered close to $2,100 to $2,200 per ethereum throughout upcoming expiries, with notable notional worth stacked round late February and late March. Binance’s max ache estimates skewed barely increased close to $2,800 earlier than dropping sharply towards $2,200 for later expiries.

OKX introduced a unique image, with max ache gravitating nearer to the low-$2,400 vary earlier than collapsing close to the $2,100 zone on later contracts. Throughout all three venues, the recurring theme was gravity towards the low-$2,000 area, uncomfortably near ethereum’s present spot worth of $2,041 per coin.

Additionally learn: US Shares Rally as Inflation Expectations Ease and Tech Stabilizes

Longer-term charts strengthened the message. Whereas complete ether futures and choices open curiosity has grown considerably over the previous 12 months, current pullbacks in each worth and open curiosity recommend merchants are lowering leverage relatively than doubling down. The derivatives market seems to be catching its breath.

Mainly, ethereum’s derivatives markets are signaling restraint, not panic. With futures positioning easing, choices crowding close to max ache, and worth hovering simply above $2,000, merchants seem content material to attend, watch, and let the numbers do the speaking.

FAQ ❓

- What’s ethereum’s present worth?Ethereum traded at $2,041 per coin as of 1:30 p.m. EST on Feb. 6, 2026.

- Which alternate holds probably the most ethereum futures open curiosity?Binance leads by notional measurement, whereas CME dominates in institutional-style positioning.

- Are ethereum choices merchants bullish or bearish?Calls outweigh places in complete open curiosity, however each day buying and selling is sort of evenly break up.

- The place is ethereum’s max ache stage?Throughout Binance, OKX, and Deribit, max ache clusters close to the low-$2,000 vary.