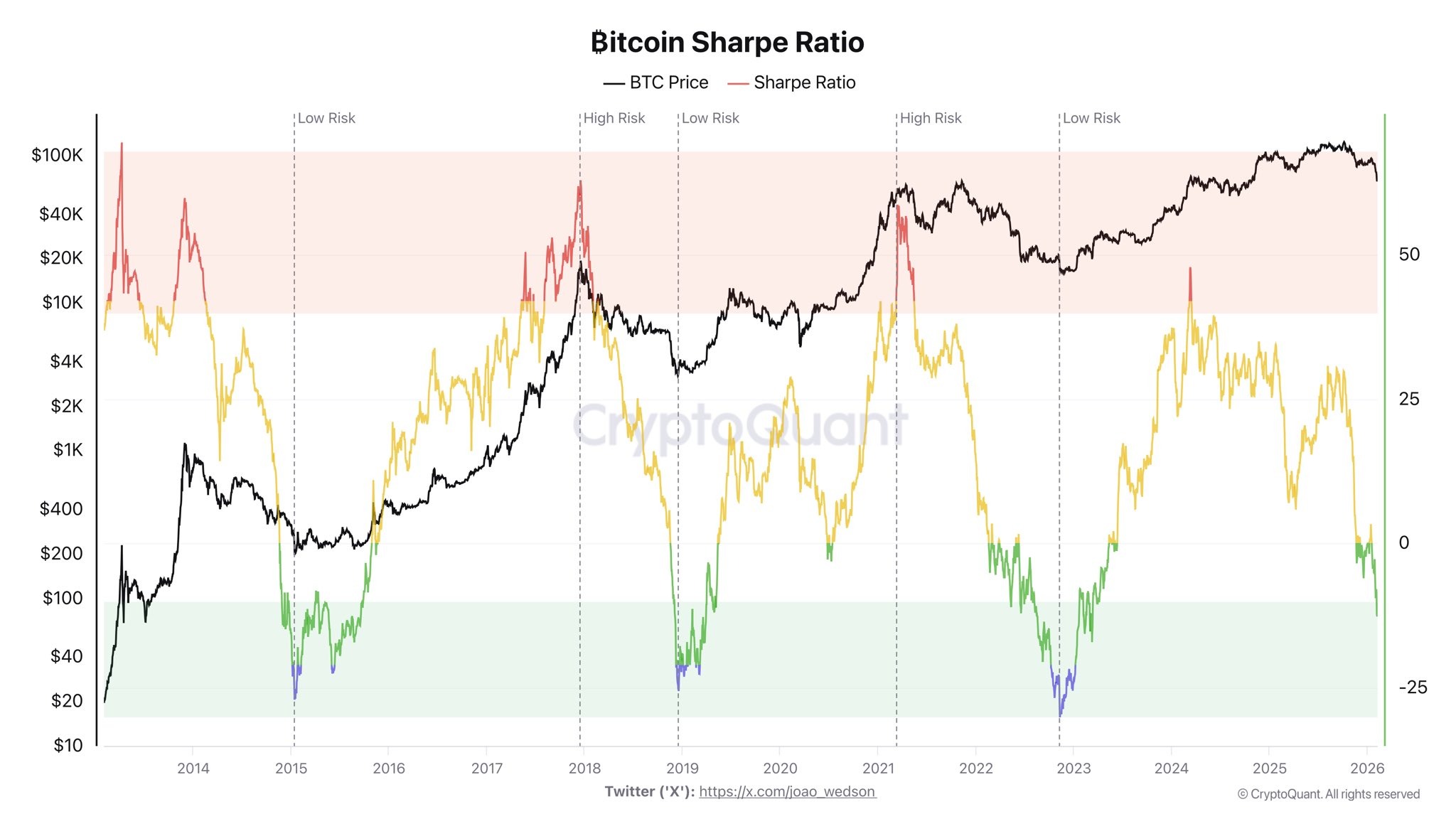

The Bitcoin Sharpe ratio, which measures threat/reward potential, is in detrimental territory that’s usually related to the tip of bear markets, in line with CryptoQuant analyst Darkfost.

“The Sharpe ratio has simply entered a very attention-grabbing zone, one which has traditionally aligned with the ultimate phases of bear markets,” mentioned the analyst on X on Saturday.

They added, nonetheless, that it isn’t a sign that the bear market is over, “however relatively that we’re approaching some extent the place the risk-to-reward profile is turning into excessive.”

The Sharpe ratio has fallen to -10, its lowest degree since March 2023, in line with CryptoQuant.

The ratio measures Bitcoin ($BTC) efficiency relative to the chance taken, indicating how a lot return an investor can count on for every unit of threat.

Damaging ratio indicators market turning level

The ratio was decrease in late 2022 to early 2023, and late 2018 to early 2019 — each durations marking the depths of the bear market cycle. The metric fell to zero in November 2025 when $BTC costs hit an area low of $82,000.

The analyst mentioned that in sensible phrases, “the chance related to investing in $BTC stays excessive relative to the returns not too long ago noticed.”

“The ratio remains to be deteriorating, exhibiting that $BTC’s efficiency just isn’t but engaging in comparison with the chance being taken,” they added.

Associated: Bitcoin bear market not over? Dealer sees $BTC value ‘actual backside’ at $50K

Nevertheless, a detrimental Sharpe ratio often indicators market turning factors, they mentioned.

“However this sort of dynamic is exactly what tends to look close to market turning zones. We’re regularly approaching an space the place this development has traditionally reversed.”

True reversal could possibly be months away

The analyst cautioned that this part “could final a number of extra months, and $BTC may proceed correcting earlier than a real reversal takes place.”

Analysts at 10x Analysis additionally expressed warning in a market replace on Monday, stating:

“Whereas sentiment and technical indicators are approaching excessive ranges, the broader downtrend stays intact. Within the absence of a transparent catalyst, there may be little urgency to step in.”

$BTC tanked to $60,000 on Friday however recovered to $71,000 by Monday. Nevertheless, it stays down 44% from its October peak of $126,000, and sentiment stays firmly in bear market territory, analysts say.

Journal: 6 weirdest units folks have used to mine Bitcoin and crypto