Desk of Contents

The place Did Aster Come From?Why Did CZ Choose Aster as His Favourite?What is the CZ Impact Executed for Aster?What Makes Aster Completely different From Different Perp DEXes?Is There Any Draw back?

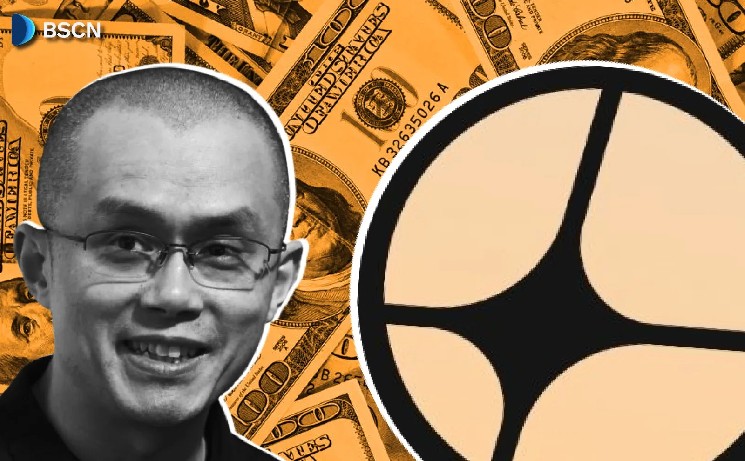

Aster is the decentralized perpetual futures trade that Changpeng Zhao (CZ) retains mentioning. The previous Binance CEO has publicly endorsed it, personally purchased over 2 million $ASTER tokens together with his personal cash, and maintains strategic ties by YZi Labs. For a perp DEX that solely totally rebranded in early 2025, that stage of backing from crypto’s most influential determine has turned heads throughout DeFi.

The place Did Aster Come From?

Aster is not precisely new. It is the results of a merger between APX Finance (previously ApolloX) and Astherus in late 2024, adopted by a full rebrand on March 31, 2025. The platform now affords non-custodial spot and perpetual buying and selling throughout crypto, foreign exchange, and even inventory derivatives. Leverage goes as much as 1001x on choose pairs in Easy mode, whereas Professional mode helps as much as 100x. It runs totally on BNB Chain but additionally helps Ethereum, Solana, and Arbitrum.

Why Did CZ Choose Aster as His Favourite?

CZ has been vocal about perp DEXes being the way forward for buying and selling. His principal concern with present platforms? Seen order books that expose giant positions to manipulation and front-running. On June 1, 2025, he posted on X proposing “darkish pool” model perpetuals on decentralized exchanges, arguing that merchants should not have their orders and liquidation factors seen in actual time.

Aster checked these packing containers. The platform launched Hidden Orders for stealth buying and selling, MEV-free execution in its easy mode, and yield-bearing collateral by liquid-staking tokens like asBNB and stablecoins like USDF. That is a direct match for what CZ described wanting.

His assist hasn’t been refined both. CZ posted a number of occasions on X praising Aster’s progress, writing issues like “Nicely executed! Good begin. Preserve constructing!” whereas highlighting its multi-chain assist and hidden order options. On November 2, 2025, he revealed he had bought 2,090,598 $ASTER tokens at a mean value of $0.91, stating: “I’m not a dealer. I purchase and maintain.“

By YZi Labs, his enterprise arm, there’s strategic funding and advisory involvement. Aster CEO Leonard has mentioned receiving direct recommendation from CZ in interviews.

There’s additionally a sensible angle right here. Since stepping down from Binance’s management after his plea deal, CZ has shifted his focus towards DeFi and investing. A privacy-focused, environment friendly on-chain trade like Aster suits squarely into that new course.

What is the CZ Impact Executed for Aster?

The numbers converse for themselves. After CZ’s first endorsement on the day of Aster’s TGE on September 17, 2025, $ASTER surged from its $0.08 launch value to an all-time excessive of $2.42 inside per week. His November private purchase triggered one other 30%+ pump inside hours.

Aster at the moment ranks among the many high perp DEXes by quantity, typically sitting at quantity two behind Hyperliquid. Based on Dune Analytics, the platform has processed over $4 trillion in cumulative buying and selling quantity, holds $1.1 billion in TVL, and has over 8.9 million whole customers. $ASTER trades round $0.53 with persistently excessive 24-hour quantity. The token is listed on Binance spot with a Seed Tag and built-in into Belief Pockets for perpetual buying and selling.

What Makes Aster Completely different From Different Perp DEXes?

Just a few issues stand out past the CZ connection. The platform runs two buying and selling modes. Easy mode affords one-click, beginner-friendly execution. Professional mode unlocks superior instruments like grid buying and selling and 24/7 inventory perpetuals.

Cross-chain liquidity is native usually, with minimal bridging required. Charge income will get partially allotted to token buybacks, and $ASTER holders obtain a reduction on buying and selling charges. On February 4, 2026, Aster kicked off its Stage 6 Buyback Program, committing as much as 80% of protocol charges towards $ASTER repurchases and burns. A privacy-focused Aster Chain L1 can also be in growth and is focused for Q1 2026.

Is There Any Draw back?

Honest query. Some locally query the extent of CZ’s affect versus the challenge’s true independence. Aster management has repeatedly addressed this, emphasizing operational separation regardless of ecosystem alignments. Worth motion has been unstable too, with the token correcting sharply from its $2.42 peak to present ranges round $0.53. CZ’s endorsements drive consideration, however consideration does not assure sustained worth.

Nonetheless, the mix of CEX-like pace, privateness instruments, sturdy quantity numbers, and essentially the most seen backer in crypto makes Aster exhausting to disregard should you’re buying and selling perpetuals on-chain.

Try Aster atasterdex.com and observe them on X @Aster_DEX.

Sources:

- Aster Official Web site — Platform documentation, function descriptions, and buying and selling information

- CZ’s X Profile (@cz_binance) — Public endorsements and $ASTER funding statements

- YZi Labs — Strategic funding and advisory particulars associated to Aster

- Dune Analytics — Aster Overview — On-chain information for TVL, buying and selling quantity, and person metrics