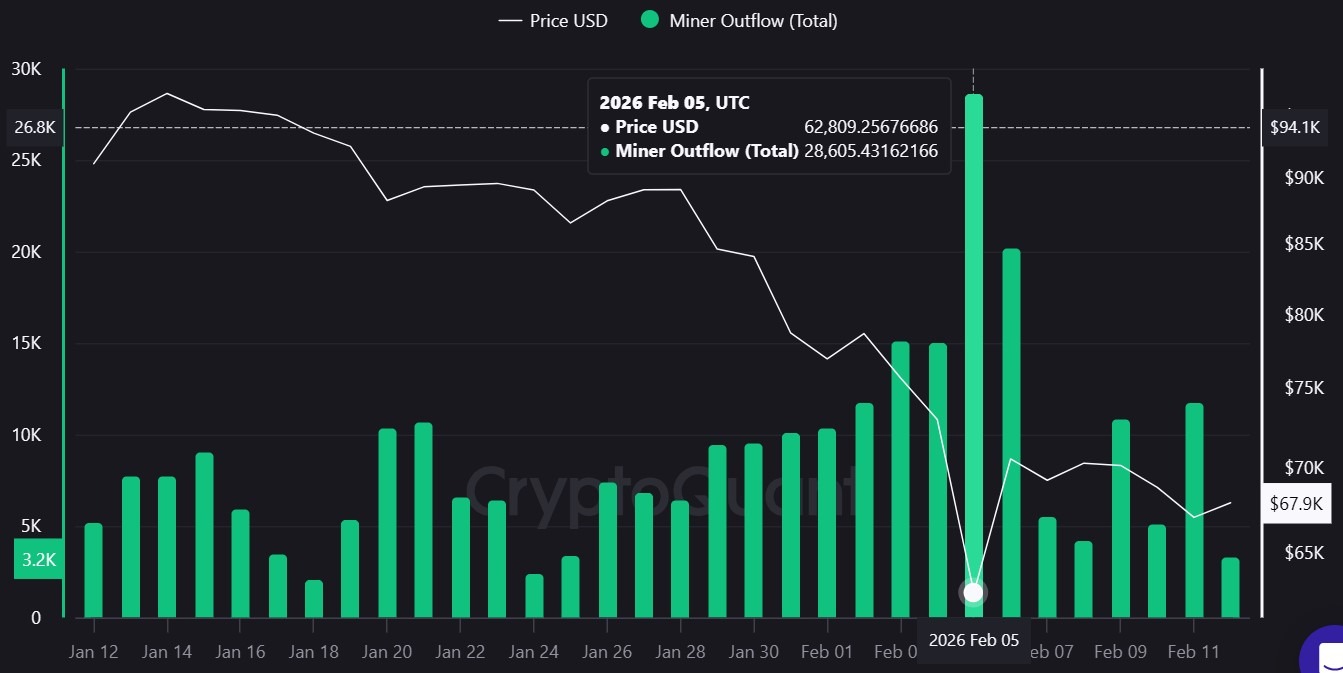

Bitcoin miner outflows jumped to twenty-eight,605 $BTC, price about $1.8 billion, on Feb. 5, one of many largest single-day transfers since November 2024, as costs swung sharply throughout a unstable buying and selling session.

One other 20,169 Bitcoin ($BTC), price about $1.4 billion, left miner-linked wallets on Feb. 6, in line with knowledge from CryptoQuant. The final comparable spike occurred on Nov. 12, 2024, when outflows reached 30,187 $BTC.

The spike coincided with sharp worth swings, with $BTC buying and selling at about $62,809 on Feb. 5 earlier than rebounding to $70,544 a day later. Massive miner pockets transfers throughout unstable periods typically draw scrutiny as a result of they’ll sign potential promoting stress.

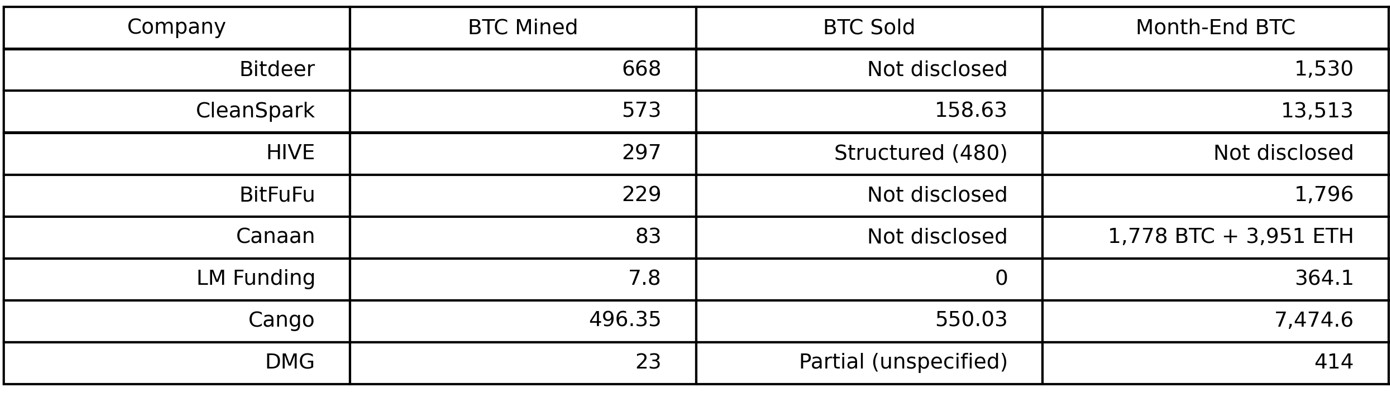

Eight miners disclosed January figures to this point: CleanSpark, Bitdeer, Hive Digital Applied sciences, BitFuFu, Canaan, LM Funding America, Cango and DMG Blockchain Options. They reported a mixed manufacturing of roughly 2,377 $BTC for the month. That whole is much beneath the 28,605 $BTC transferred in a single day on Feb. 5.

Outflows doubtless replicate broader ecosystem flows

The dimensions of the Feb. 5 and Feb. 6 outflows exceeds the January manufacturing of the publicly reporting companies reviewed by Cointelegraph.

Even combining disclosed January gross sales from CleanSpark, Cango and DMG, confirmed promoting quantities stay a fraction of the 28,605 $BTC transferred in a single day.

Nonetheless, miner outflows don’t robotically equate to capitulation or instant spot-market promoting.

In accordance with CryptoQuant, miner outflow consists of transfers to exchanges in addition to inside pockets actions and transfers to different entities, that means the metric doesn’t by itself verify that cash had been bought on the open market.

Given the dimensions of the transfers relative to disclosed public miner gross sales, the actions could replicate exercise past massive, listed companies.

Bitcoin Miner Outflow 30-day chart. Supply: CryptoQuant

Public miner disclosures present combined treasury strikes

CleanSpark reported mining 573 $BTC and promoting 158.63 $BTC in the course of the month, ending January with 13,513 $BTC on its steadiness sheet.

Cango mined 496.35 $BTC and disclosed promoting 550.03 $BTC, stating it could proceed to promote newly mined Bitcoin to assist the growth of its synthetic intelligence and inference platform.

On Feb. 9, the corporate bought an extra 4,451 $BTC for about $305 million to partially repay a Bitcoin-collateralized mortgage and fund its AI pivot.

Associated: Bitcoin issue drops by over 11%, sharpest drop since 2021 China ban

Different companies took a special method. Canaan mined 83 $BTC and elevated its reserves to 1,778 $BTC and three,951 ETH. LM Funding mined 7.8 $BTC and reported no gross sales, lifting its treasury to 364.1 $BTC.

In the meantime, Hive used structured pledge mechanics tied to 480 $BTC to protect liquidity whereas sustaining operations.

Whereas some miners report month-to-month manufacturing outcomes persistently, others solely report intermittently or have shifted to quarterly disclosures.

January miner knowledge compiled by Cointelegraph. Supply: Cointelegraph

Associated: Bitcoin miners IREN, CleanSpark shares plunge as earnings fall brief

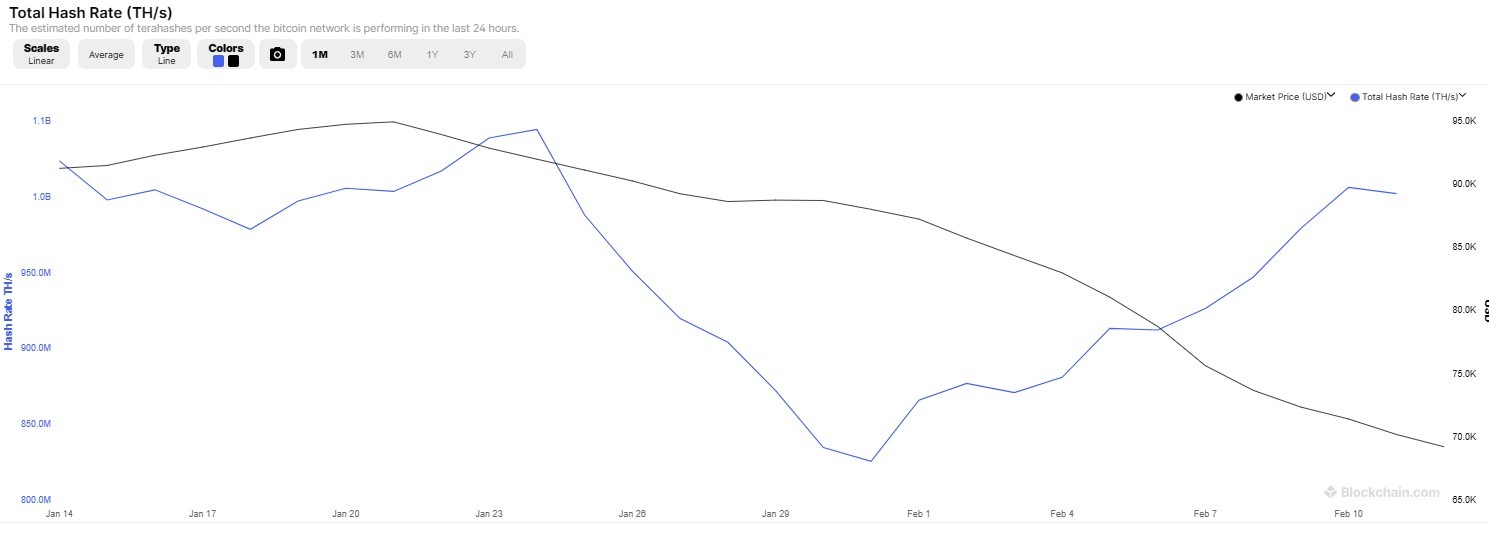

Winter storms have an effect on US miner hashrates

Community hashrate additionally fluctuated sharply in late January as extreme winter storms hit elements of the US. On Jan. 27, Bitcoin’s hashrate fell to 663 exahashes per second over two days, marking a greater than 40% drop.

Whole mining hashrate. Supply: Blockchain.com

The short-term decline got here as miners curtailed operations to stabilize regional energy grids throughout excessive chilly and surging vitality demand. US-based companies reported diminished uptime, together with Marathon Digital Holdings and Iren, which noticed sharp short-term drops in every day manufacturing.

Blockchain.com knowledge confirmed that hashrate recovered in early February after the drop over the last week of January.

Journal: 6 weirdest gadgets individuals have used to mine Bitcoin and crypto