Kyle Samani stepped down from Multicoin Capital on February 5, 2026, after almost a decade as co-founder. In the present day, he’s publicly criticizing Hyperliquid ($HYPE) as on-chain knowledge reveals Multicoin bought over $40 million in $HYPE tokens.

The shut timing has fueled hypothesis that inner conflicts over funding technique prompted the departure of some of the notable Solana advocates within the crypto business.

Multicoin, Hyperliquid, and Kyle Samani: Coincidence or Conflict?

Samani’s departure announcement on February 5 marked a big shift for Multicoin Capital, a number one pressure in institutional crypto funding.

Regardless of his departure, Samani said he would stay engaged in cryptocurrency, particularly throughout the Solana ecosystem.

1/ I’ll stay in my function as Chairman of Ahead Industries.

As a part of the redemption request that I intend to undergo Multicoin’s Grasp Fund for March 31, 2026, I’ll request an in-kind redemption in FWDI shares and warrants moderately than in USD, pending Multicoin’s…

— Kyle Samani (@KyleSamani) February 4, 2026

The announcement got here solely days after MLM analysts flagged wallets believed to be linked to Multicoin accumulating giant quantities of Hyperliquid’s $HYPE token in late January.

They highlighted purchases totalling tens of tens of millions of {dollars}. Further evaluation means that substantial $ETH flows have been rotated into $HYPE over a number of days through middleman wallets.

Appears to be like like wallets linked to Multicoin Capital are rotating a considerable amount of $ETH into $HYPE.

Since January 22, wallets despatched 87.1K $ETH ($220M) to a Multicoin-linked Galaxy Digital deposit tackle. On January 23, at some point after the primary deposit, a Multicoin-linked pockets began… https://t.co/LrJyoCTQ3m

— MLM (@mlmabc) February 4, 2026

Notably, no official affirmation has linked the trades on to Multicoin’s inner technique selections.

In the present day, February 8, simply three days after his formal exit, Samani is criticizing Hyperliquid on social media, making his place unmistakably clear.

“Hyperliquid is, in most respects, every thing incorrect with crypto. The founder actually fled his dwelling nation to construct Overtly, which facilitates crime and terror. Closed supply Permissioned,” wrote Samani in a put up.

This sturdy criticism stands in direct distinction to Multicoin’s high-profile funding in $HYPE tokens. Consequently, observers puzzled if Samani’s views clashed with the agency’s latest selections, serving to drive his exit.

Solana Funding Philosophy Versus $HYPE Technique

Multicoin Capital earned its status as a vocal backer of Solana. In September 2025, the agency led a $1.65 billion personal funding into Ahead Industries, working with Bounce Crypto and Galaxy Digital to create what they referred to as “the world’s main Solana treasury firm.”

Samani was named Chairman of Ahead Industries’ Board, underlining his significance to Multicoin’s Solana focus.

The Solana funding technique centered on clear yields by way of staking, DeFi protocols, and capital effectivity. Multicoin highlighted Solana’s infrastructure as providing higher economics than Bitcoin treasury fashions, citing native yields of 8.05% as of September 2025.

The agency additionally launched analysis on Solana tasks like Jito, which by March 2025 powered over 94% of all Solana stake through customized block manufacturing know-how.

Hyperliquid, in the meantime, represents a contrasting strategy. The platform is a decentralized perpetual futures change with its personal blockchain.

It’s fashionable for top leverage and low charges, however faces criticism for its centralized validator system, closed-source code, and regulatory dangers. These options seem to oppose the ideas Samani promoted at Multicoin.

Tensions between methods turned extra evident as analysts speculated about inner dynamics.

“Does this imply that they couldn’t purchase $HYPE so long as Kyle was operating the fund, which is why his leaving coincides with Multicoin shopping for lots of $HYPE?” wrote one person.

Kyle Samani didn’t instantly reply to BeInCrypto’s request for remark.

Supporters Defend Hyperliquid as Samani’s Exit Sparks Ideological Debate

Some traders and merchants pushed again strongly in opposition to Samani’s criticism. They argue that Hyperliquid represents a return to crypto’s authentic ideas moderately than a departure from them.

Hyperliquid is in most respects every thing incorrect with crypto

> Rejected VC capital

> Democratized MMing through HLP

> Enriched neighborhood through largest token airdrop ever ($9B)

> As an alternative of pocketing some or all the $960M income HL has made, put all of them into buybacks of stated token https://t.co/XVk2NEDeyG— steven.hl (@stevenyuntcap) February 8, 2026

Hyperliquid’s determination to direct income towards token buybacks and neighborhood incentives displays a mannequin designed to extra intently align customers and infrastructure than many venture-backed tasks.

The divide highlights a deeper ideological break up rising inside crypto markets. On one facet are traders who prioritize transparency, decentralization, and neighborhood possession as defining ideas.

Alternatively, there are those that champion efficiency, liquidity depth, and institutional-grade infrastructure, even when these techniques require trade-offs in governance or structure.

In the event you’re questioning who the marginal purchaser can be at $20 billion, keep in mind that

– HL is quicker than Solana

– Has a greater UX than Drift

– Its current worth of future MEV is within the trillions

Hyperliquid is the end result of all of Multicoin Capital’s thought management. And…

— Kunal G (@kunalgoel) November 29, 2024

Samani’s departure itself has not been formally tied to any particular funding determination. Neither Multicoin nor Samani has publicly said that Hyperliquid or portfolio positioning performed any function within the transition.

Generally, management adjustments at enterprise corporations usually stem from long-term strategic shifts, private selections, or fund-structure concerns that will not be seen externally.

Nonetheless, the timing has confirmed troublesome for markets to disregard. In crypto, an business the place narratives journey rapidly, the mix of on-chain transparency and social media hypothesis usually fills gaps left by restricted official disclosures.

$HYPE) Value Efficiency”>

$HYPE) Value Efficiency”>

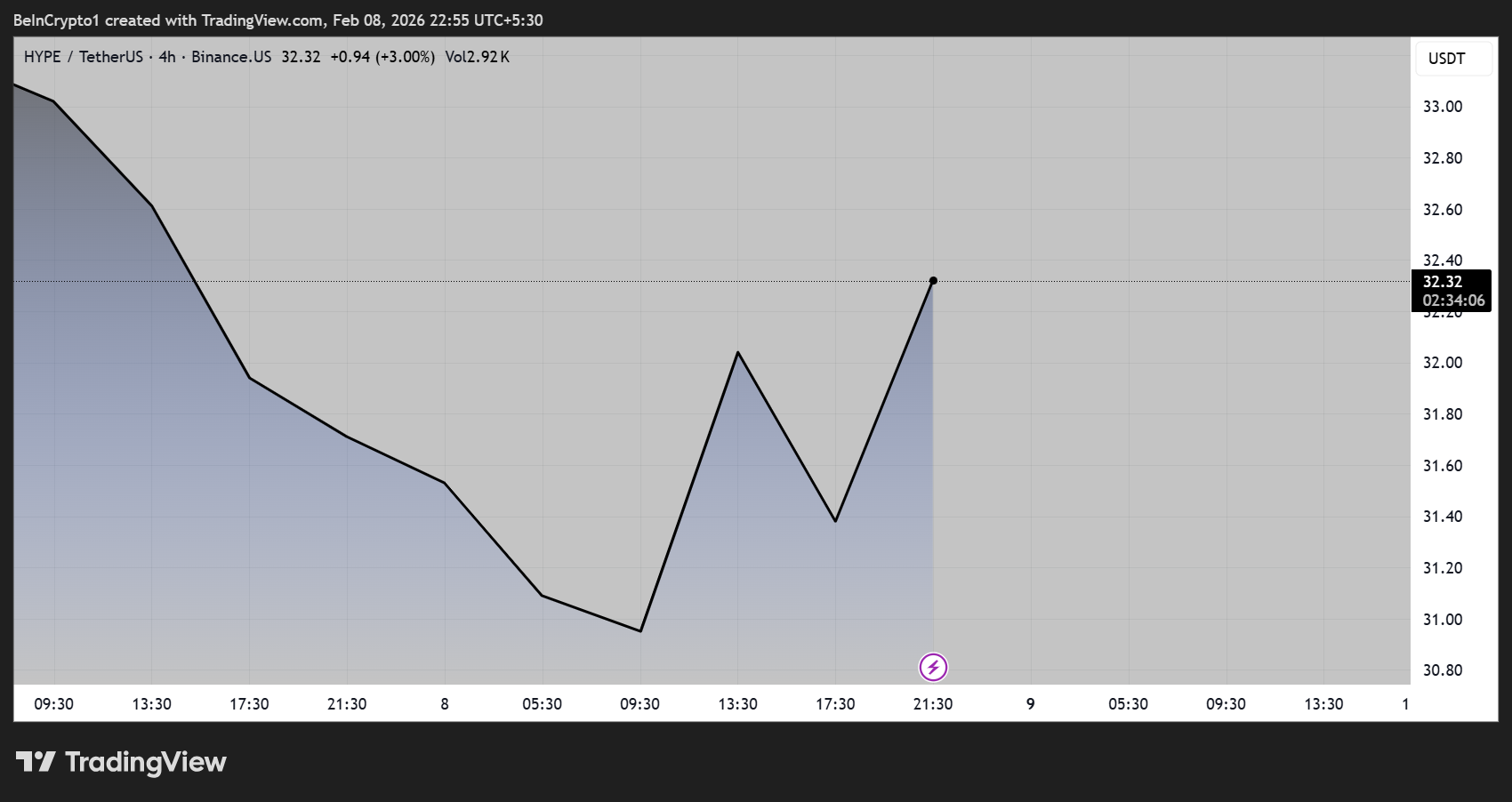

Hyperliquid ($HYPE) Value Efficiency. Supply: TradingView

In the meantime, the $HYPE token is nurturing a restoration, with the next low on the 4-hour timeframe, suggesting a development reversal if purchaser momentum sustains.

The put up Kyle Samani Slams Hyperliquid Days After Leaving Multicoin appeared first on BeInCrypto.