Ethereum worth stays below stress after a pointy decline that unsettled buyers throughout the crypto market.

Though Ethereum seems to be coming into a traditionally favorable accumulation zone, on-chain indicators reveal blended conviction amongst completely different holder cohorts.

Ethereum Is In a Prime Accumulation Vary

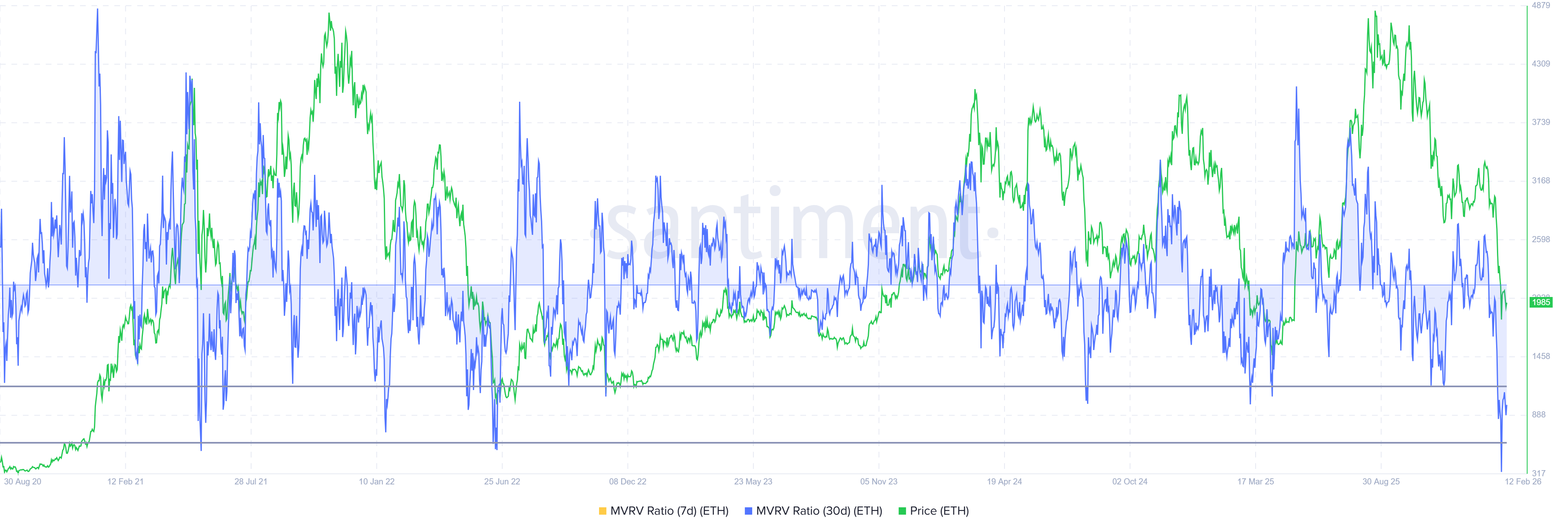

Ethereum’s Market Worth to Realized Worth, or MVRV, ratio signifies that $ETH has entered what analysts describe as an “alternative zone.” This vary lies between detrimental 18% and detrimental 28%. Traditionally, when MVRV falls into this band, promoting stress approaches exhaustion.

Earlier entries into this zone typically preceded worth reversals. Traders sometimes accumulate when unrealized losses deepen. Such conduct can stabilize the Ethereum worth and provoke restoration phases. Nonetheless, historic likelihood doesn’t assure rapid upside.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

Present macro situations complicate the outlook. Liquidity constraints and cautious sentiment could delay accumulation. Whereas MVRV suggests undervaluation relative to realized price foundation, broader market weak point might suppress momentum and prolong consolidation earlier than any significant rebound begins.

Ethereum Holders Are Leaning In another way

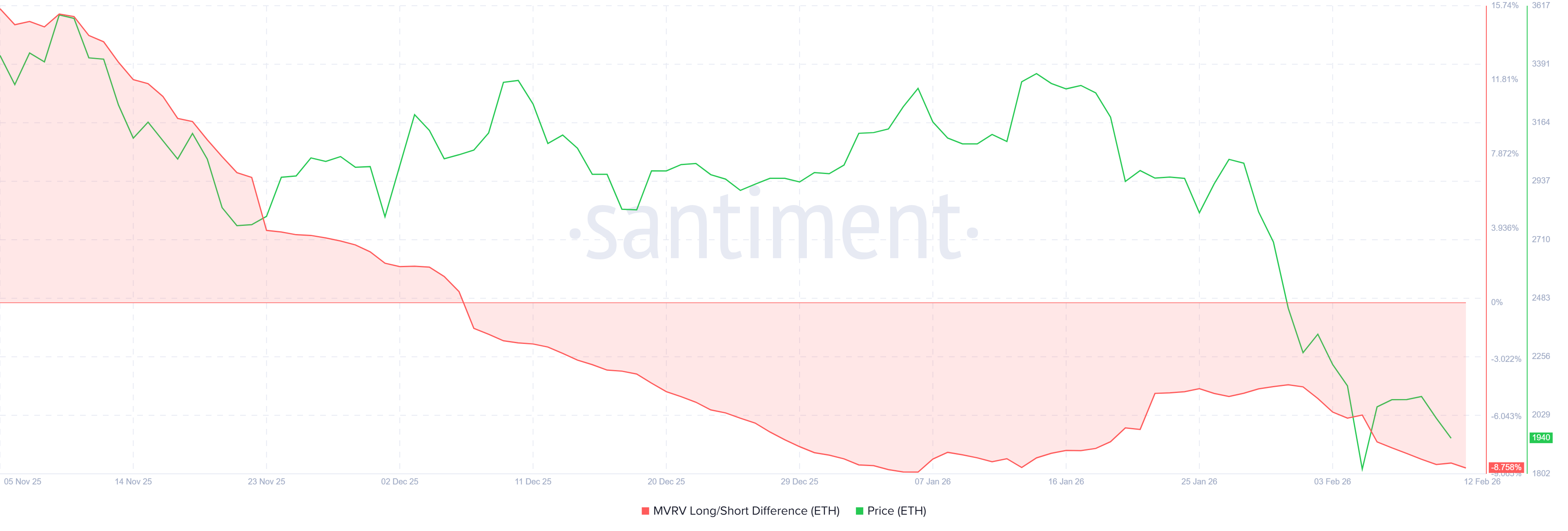

Quick-term holders are regaining affect over Ethereum worth motion. The MVRV Lengthy/Quick Distinction measures profitability between long-term and short-term holders. Deeply detrimental readings sign better profitability amongst short-term holders in comparison with long-term buyers.

Towards the tip of January, the metric prompt profitability was shifting away from short-term merchants. That pattern hinted at an enhancing construction. Nonetheless, the current decline reversed that dynamic, restoring short-term holder income. These buyers sometimes promote shortly, growing vulnerability to renewed draw back stress.

Ethereum MVRV Lengthy/Quick Distinction. Supply: Santiment

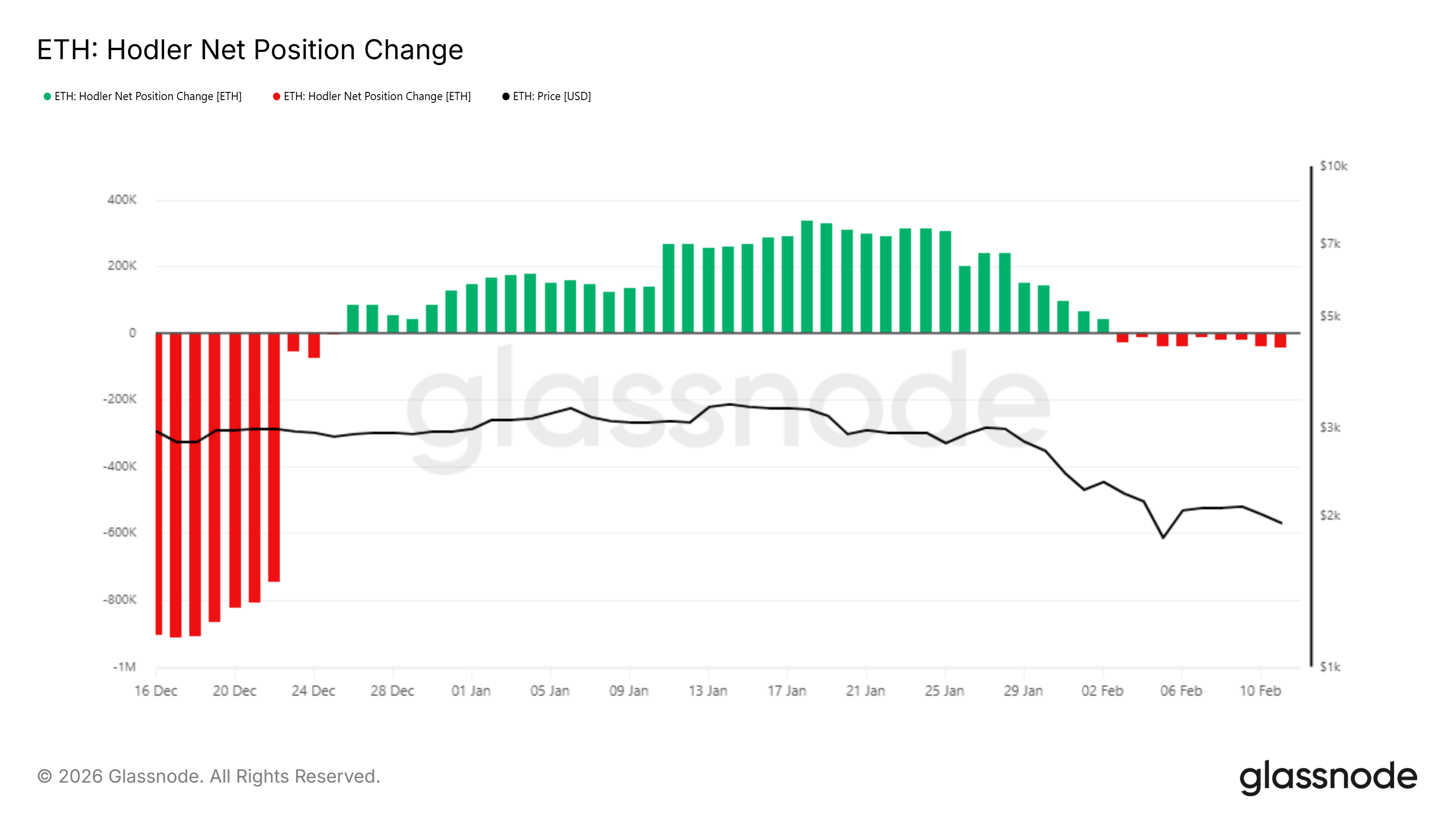

The HODLer internet place change metric reveals one other shift. Lengthy-term holders beforehand exhibited regular accumulation. In current days, the shopping for stress has transitioned into distribution, reflecting diminished confidence amongst strategic buyers.

Lengthy-term holder promoting provides structural threat. These members typically present foundational help throughout downturns. With out renewed accumulation from this cohort, the Ethereum worth could wrestle to soak up provide. Present knowledge exhibits restricted proof of robust counterbalancing demand.

Ethereum HODLer Internet Place Change. Supply: Glassnode

$ETH Worth Might Look At Consolidation

Ethereum worth trades at $1,983 and stays above the $1,811 help degree. Regardless of this stability, the altcoin just lately marked a nine-month low at $1,743. Sustaining $1,811 is crucial to stop deeper technical deterioration.

Given ongoing promoting from each short-term and long-term holders, restoration could face resistance close to $2,238. Continued weak point might maintain $ETH buying and selling nearer to help fairly than difficult overhead boundaries. A confirmed breakdown under $1,811 could expose Ethereum to $1,571.

Ethereum Worth Evaluation. Supply: TradingView

Alternatively, diminished promoting from short-term holders might ease stress. If long-term holders resume accumulation, Ethereum could try a stronger rebound. A decisive transfer above $2,238, adopted by a rally previous $2,509, would invalidate the bearish thesis and enhance the medium-term outlook.

The submit Ethereum Sitting In The “Alternative Zone“ Is Nonetheless Struggling At Worth Restoration appeared first on BeInCrypto.