Whereas crypto markets stay defensive, the Ethereum worth is trying a short-term rebound inside a broader downtrend that also dominates the larger image.

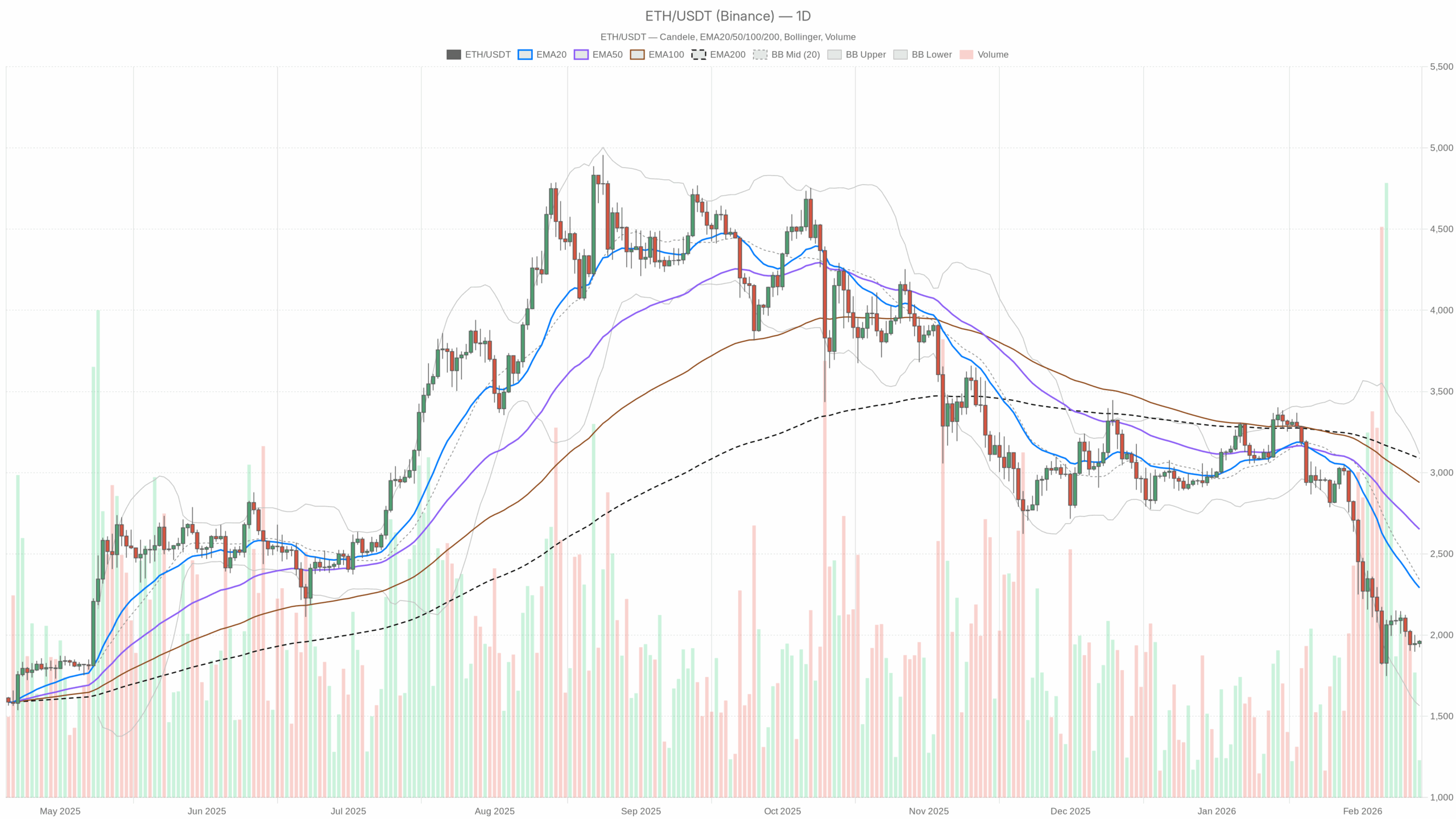

ETH/USDT each day chart with EMA20, EMA50 and quantity”

ETH/USDT each day chart with EMA20, EMA50 and quantity”loading=”lazy” />

Market Thesis: Heavy Every day Downtrend vs Intraday Aid

Ethereum worth in opposition to USDT is buying and selling round $1,960, deep inside a mature downtrend. The important thing level proper now: the each day construction is clearly bearish, however short-term timeframes try to stage a rebound. That is traditional bear-market motion — violent countertrend bounces inside a broader down-leg.

This second issues as a result of the each day chart is now oversold whereas macro crypto sentiment is at Excessive Concern (9) and BTC dominance is excessive at about 56.6%. In different phrases, the market is defensive, capital is hiding in Bitcoin and stablecoins, and Ethereum is being de-risked. The massive query: does this oversold backdrop set off a tradable mean-reversion rally, or is it only a pause earlier than one other leg decrease?

Every day Timeframe (D1): Dominant Bias is Bearish

On the each day chart, the bias is unambiguously bearish. Development, momentum, and volatility all line as much as present a market that has been underneath regular promoting strain, now approaching exhaustion however not but displaying a correct pattern reversal.

EMAs (Development Construction)

Every day worth is at $1,962, nicely under all key shifting averages:

- EMA 20: $2,291.05

- EMA 50: $2,651.67

- EMA 200: $3,088.74

All three EMAs are stacked bearishly above worth, with a large hole from the 200-day. This can be a mature downtrend the place rallies have loads of overhead resistance. It tells you the trail of least resistance remains to be down, and any bounce into the 20-day EMA could be a take a look at of the sellers resolve slightly than proof of a brand new bull leg.

RSI (Momentum)

RSI 14 (Every day): 29.62

Every day RSI has slipped under 30, which implies the transfer is now technically oversold. This aligns with how washed-out the chart seems to be. In sensible phrases, it typically precedes a bounce or consolidation. Nevertheless, in a robust downtrend oversold can keep oversold longer than folks count on. So the bears are in management, however they’re getting prolonged.

MACD (Development Momentum)

MACD Line: -269.62 | Sign: -254.44 | Histogram: -15.18

The MACD line is under the sign, deep in unfavourable territory, with a small unfavourable histogram. The pattern draw back momentum remains to be there, however the histogram being comparatively modest suggests the promoting impulse could also be slowing slightly than accelerating. That matches with the thought of a drained downtrend, not a contemporary breakdown.

Bollinger Bands (Volatility & Positioning)

Center Band (20 SMA proxy): $2,340.59 | Higher: $3,116.33 | Decrease: $1,564.84

Worth is buying and selling under the center band and comparatively nearer to the decrease band, nicely underneath the midline at $2,340. The bands themselves are huge, reflecting elevated volatility. Being on the decrease half of the bands confirms a strain zone the place sellers have dominated. Nevertheless, the gap to the decrease band additionally means the rapid crash danger is barely much less acute than if worth have been pinned to the band.

ATR (Volatility)

ATR 14 (Every day): $206.86

Every day ATR above $200 on a roughly $2,000 asset is sizeable. Swings of round 10% in both course are on the desk briefly order. This isn’t a quiet grind; it’s a high-volatility downtrend the place each squeezes and flushes may be violent. Place sizing issues right here greater than typical.

Every day Pivot Ranges (Reference Ranges)

Every day pivot ranges are:

- Pivot Level (PP): $1,952.04

- R1: $1,979.36

- S1: $1,934.82

Ethereum is hovering virtually precisely on the each day pivot round $1,952–$1,962. Buying and selling close to the pivot after a selloff typically signifies a short-term pause or an space the place intraday merchants are preventing for management. A push and maintain above R1 would sign intraday patrons taking the higher hand. A decisive transfer underneath S1 would present the downtrend reasserting itself.

1-Hour Chart (H1): Brief-Time period Aid Rally Inside a Bearish Context

The 1-hour timeframe is attempting to stabilize after the dump. The system flags the regime as impartial, which is smart: we’re seeing a short-term bounce however nothing structurally bullish but.

EMAs (Intraday Development)

On H1:

- Worth: $1,960.64

- EMA 20: $1,947.95 (worth barely above)

- EMA 50: $1,960.17 (worth proper on it)

- EMA 200: $2,046.70 (nicely above)

Worth reclaiming and hovering across the 20- and 50-hour EMAs is an indication of a short-term stabilization or reduction rally. Nevertheless, the 200-hour EMA stays far overhead close to $2,047, marking the boundary of the bigger downtrend on this timeframe. Intraday bulls have room to push increased with out touching the higher-timeframe downtrend line within the sand.

RSI (Intraday Momentum)

RSI 14 (H1): 54.64

Hourly RSI is barely above impartial, reflecting modest bullish momentum after the prior drop. This seems to be extra like a countertrend bounce than an aggressive new shopping for cycle. Momentum is enhancing, however not euphoric.

MACD (Intraday Momentum Shift)

MACD Line: -0.90 | Sign: -4.59 | Histogram: 3.69

The MACD line is under zero however has crossed above the sign with a constructive histogram. That may be a traditional short-term bullish cross inside a broader bearish discipline. Sellers are backing off, and short-term merchants try to select the lows. However, so long as MACD stays under zero, the bounce remains to be technically in opposition to the dominant pattern.

Bollinger Bands (H1 Positioning)

Center Band: $1,937.70 | Higher: $1,969.48 | Decrease: $1,905.92

Worth is close to the higher band at round $1,960–$1,969. That exhibits the bounce has pushed Ethereum to the highest of its latest intraday vary. Usually, hugging the higher band on the 1-hour can result in both a continuation grind increased or a fade again to the imply. In a bearish higher-timeframe regime, these upper-band tags are usually promoting alternatives for swing merchants.

ATR & Pivot (H1 Micro-Vary)

ATR 14 (H1): $16.64

An intraday ATR of round $16 suggests typical 1-hour bars have significant vary however are manageable in comparison with the each day swings. For merchants, that’s sufficient volatility for alternative with out being completely chaotic.

Hourly pivot ranges are:

- PP: $1,962.20

- R1: $1,967.70

- S1: $1,955.14

Worth is principally sitting on the hourly pivot and slightly below R1. Holding above $1,955 and breaking cleanly above $1,968 would cement the intraday bounce. Shedding $1,955 after which $1,945–$1,935 opens the door for one more draw back rotation.

15-Minute Chart (M15): Execution Context

The 15-minute chart is there for timing, not for macro bias. It at present exhibits a extra energetic push increased, in step with the H1 bounce.

EMAs (Micro-Construction)

On M15:

- Worth: $1,960.65

- EMA 20: $1,951.29

- EMA 50: $1,946.58

- EMA 200: $1,956.66

Worth is above all three EMAs, and the shorter EMAs are tilting upward. This can be a short-term uptrend contained in the broader intraday and each day downtrend. For scalpers and day merchants, dips towards the 15-minute 20 EMA are at present being defended. Nevertheless, this will flip rapidly if the higher-timeframe promoting resumes.

RSI & MACD (Brief-Time period Momentum)

RSI 14 (M15): 61.27

RSI on the 15-minute is above 60, reflecting wholesome short-term shopping for strain. It isn’t but at a blow-off degree, however you might be firmly in bounce mode slightly than bottom-fishing.

MACD Line: 5.20 | Sign: 3.59 | Histogram: 1.61

The MACD on M15 is constructive and above its sign with a inexperienced histogram — momentum is plainly up within the very quick time period. That is the timeframe the place the bounce seems to be the strongest, which is exactly why it’s harmful to extrapolate it with out respecting the each day downtrend.

Bollinger Bands & Pivot (M15)

Center Band: $1,946.82 | Higher: $1,969.61 | Decrease: $1,924.03

Worth is close to the higher band once more, mirroring the H1 image. Brief-term patrons have pushed ETH to the highest of its micro-range. That’s typically the place late longs chase and extra affected person gamers begin trimming or fading.

15-minute pivot ranges:

- PP: $1,960.17

- R1: $1,963.64

- S1: $1,957.18

With worth sitting on the 15-minute pivot, micro-structure is finely balanced. A pop via $1,964 may prolong towards the Bollinger higher band zone. A break again under $1,957 would trace that the micro-bounce is shedding steam.

Broader Market & Sentiment Context

The broader crypto backdrop shouldn’t be pleasant to Ethereum proper now:

- BTC dominance: ~56.6% — capital is crowding into Bitcoin, not ETH.

- Complete market cap 24h change: -1.31% — broad risk-off tone.

- Concern & Greed Index: 9 (Excessive Concern) — danger urge for food is extraordinarily low.

Current information headlines speak about crypto gloom, ETF outflows from Bitcoin and Ether, and risk-off habits. That strains up cleanly with what the charts are saying: it is a defensive surroundings the place rallies are being offered, not chased.

Eventualities for Ethereum Worth

Foremost State of affairs (Based mostly on D1): Bearish with Oversold Threat of Sharp Bounces

The dominant state of affairs stays bearish as outlined by the each day chart: worth nicely under all main EMAs, unfavourable MACD, and an oversold RSI. The important thing nuance: we’re within the late stage of this down-leg, the place sharp countertrend rallies turn into extra possible, however, by default, they’re nonetheless rallies to promote slightly than a brand new uptrend.

Bullish State of affairs

For the bullish case, Ethereum wants to show this oversold backdrop right into a sustained mean-reversion transfer:

- Step 1: Maintain above the each day pivot (round $1,952) and construct a base above $1,930–1,940. Shedding that band cleanly retains management in bearish arms.

- Step 2: Use the intraday energy (H1 and M15 up-momentum) to interrupt and maintain above the short-term resistance cluster round $1,980–2,000 (close to intraday R1s and higher Bollinger areas).

- Step 3: Lengthen towards the each day 20 EMA round $2,290. That’s the first critical take a look at of whether or not sellers are keen to reload. A powerful push towards this degree with RSI climbing again towards 45–50 on the each day would mark a real corrective rally.

What invalidates the bullish state of affairs?

If ETH fails to carry above roughly $1,930, and particularly if it closes a each day candle nicely under the each day pivot and S1, the notion of a sustained bounce weakens. A contemporary breakdown with each day RSI staying caught under 30 would present that the market shouldn’t be able to mean-revert but.

Bearish State of affairs

The bearish path assumes this intraday bounce is a traditional dead-cat rally inside a robust downtrend:

- Ethereum worth struggles to carry above $1,960–1,980 and fails to reclaim the $2,000 deal with with conviction.

- Intraday indicators (H1 and M15 RSI/MACD) roll over from their present mildly overbought ranges whereas each day RSI stays oversold, pointing to a different leg decrease.

- Worth breaks under $1,930–1,940 assist and drives towards the decrease each day Bollinger area, with room down towards the mid-$1,600s if promoting accelerates once more.

What invalidates the bearish state of affairs?

A decisive reclaim of the $2,050–2,100 space, the place the H1 200 EMA at present sits, could be the primary critical crimson flag for bears. If worth can push above that zone and each day RSI recovers above 40 with MACD draw back momentum fading additional, the argument for a easy continuation down turns into a lot weaker. The true structural win for bulls could be a sustained reclaim of the each day 20 EMA close to $2,290; till that occurs, the bearish thesis stays structurally intact.

Positioning, Threat, and Uncertainty

Throughout timeframes, the message is evident: each day is bearish and oversold, whereas intraday is attempting to bounce. That rigidity is the place merchants often get chopped up. They might chase short-term inexperienced candles into a much bigger downtrend, or quick into the opening proper earlier than a squeeze.

In an surroundings with elevated each day ATR, excessive worry sentiment, unfavourable information circulate, and ETH sitting nicely under its key EMAs, place sizing and timeframe self-discipline matter greater than directional conviction. Brief-term merchants may work with the M15 and H1 uptrend for tactical longs, however they’re buying and selling in opposition to the each day bias and have to be fast. Swing merchants leaning with the each day bear pattern will typically look to fade energy into resistance zones slightly than promote each low.

Nothing on this chart guidelines out a brutal quick squeeze increased or an extra capitulation leg decrease; each match inside the present volatility regime. The one factor the market is clearly saying is that we’re in a defensive part for Ethereum, and any publicity ought to be sized with the understanding that the Ethereum worth can transfer tons of of {dollars} in little or no time.