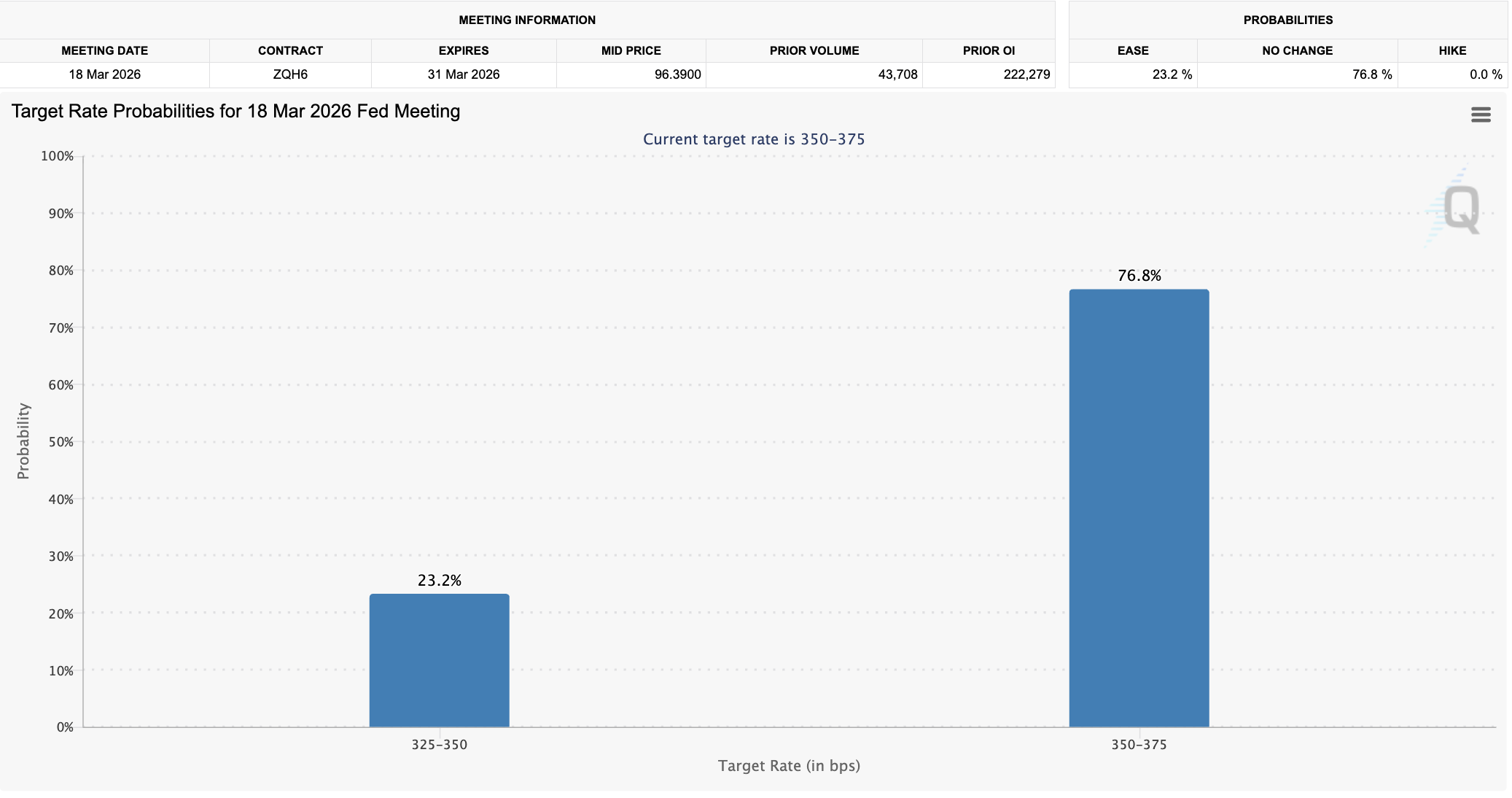

The variety of merchants anticipating an rate of interest lower on the March Federal Open Market Committee (FOMC) assembly has risen to 23%, following investor fears of a hawkish stance from Kevin Warsh, US President Donald Trump’s Federal Reserve chair nominee.

Traders and merchants forecasting a fee lower surged by almost 5% from Friday, when solely 18.4% signaled they have been anticipating an rate of interest lower, based on knowledge from the Chicago Mercantile Change (CME) Group.

These anticipating a fee lower in March forecast a 25 foundation level (BPS) lower, with no traders anticipating a fee lower of fifty BPS or extra.

Rate of interest goal possibilities for the March 2026 FOMC assembly. Supply: CME Group

President Trump nominated Warsh in January as a substitute for Federal Reserve Chairman Jerome Powell, whose time period is over in Could.

Rate of interest coverage can affect crypto asset costs, with easing liquidity circumstances seen as a constructive value catalyst, and tightening liquidity circumstances by greater charges impacting asset costs negatively, as entry to financing dries up.

Associated: Bitcoin’s subsequent bull market could not come from extra ‘accommodative insurance policies’

Markets and traders spooked by Warsh’s nomination

“The nomination of Kevin Warsh as the following Fed Chair has shaken markets to the core,” crypto market analyst Nic Puckrin stated in a message shared with Cointelegraph.

Puckrin attributed the sharp decline in valuable metals towards the top of January and early days of February to investor perceptions of Warsh, who’s considered as extra hawkish, that means he’s in favor of maintaining rates of interest greater for longer. He stated:

“Markets are digesting Warsh’s views on future Fed coverage, most notably the central financial institution’s steadiness sheet, which he says is ‘trillions bigger than it must be’. If he does undertake insurance policies to shrink the steadiness sheet, markets should reckon with a lower-liquidity setting.”

Thomas Perfumo, a worldwide economist at cryptocurrency alternate Kraken, instructed Cointelegraph that Warsh’s nomination sends a ‘blended’ macroeconomic sign to traders.

The nomination of Warsh could sign that liquidity and credit score will stabilize within the US, reasonably than develop, as crypto traders had anticipated, Perfumo stated.

Journal: If the crypto bull run is ending… it’s time to purchase a Ferrari: Crypto Child