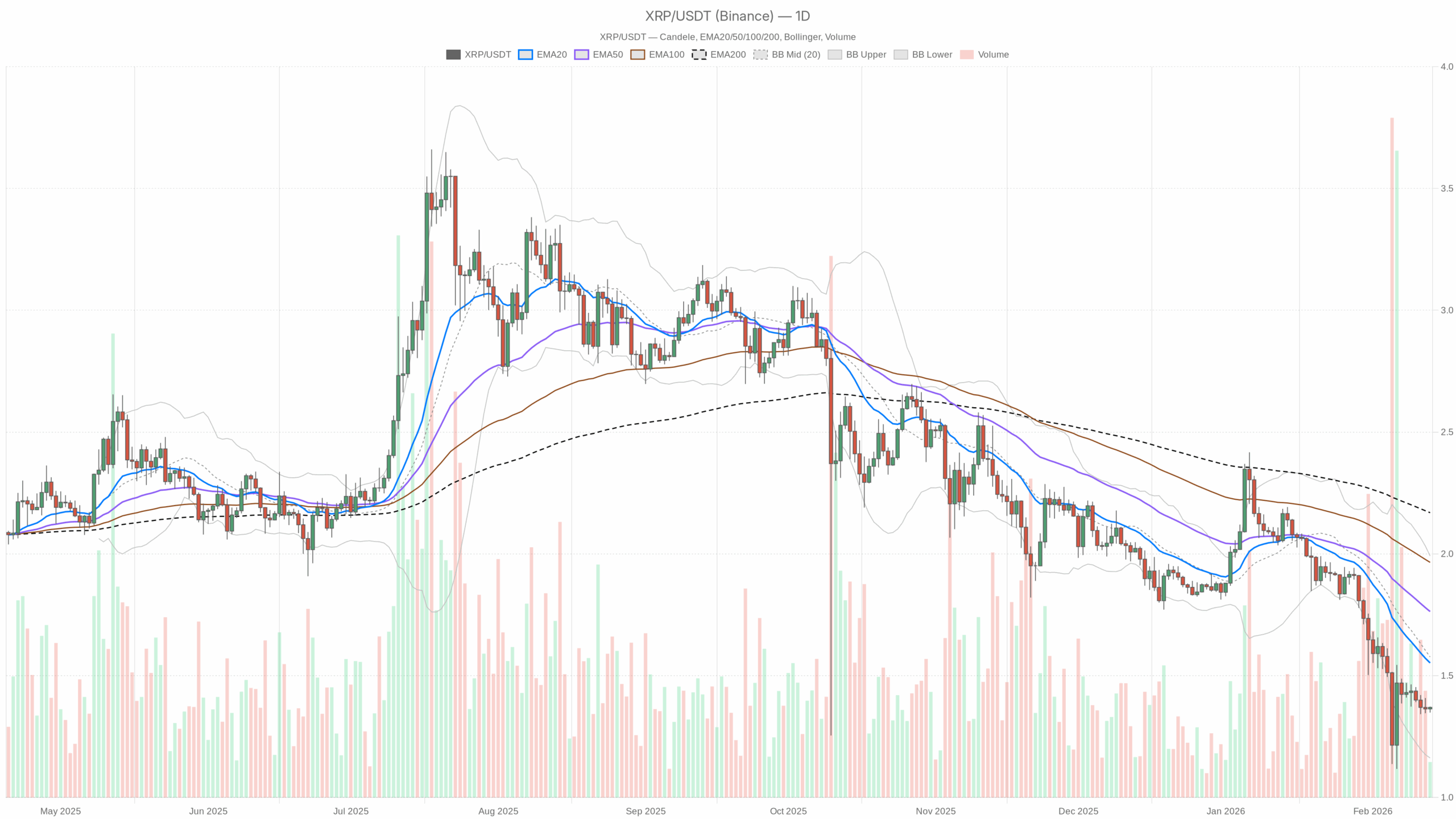

The broader crypto market sits in excessive worry because the Ripple worth presses towards native help, with XRPUSDT attempting to stabilize after a chronic downtrend.

Day by day Chart (D1): Macro Bias – Bearish, However Close to a Potential Assist Pocket

The principle state of affairs from the every day chart is bearish. XRPUSDT is in a downtrend, buying and selling underneath all main shifting averages and beneath the Bollinger midline, with momentum nonetheless weak. Nevertheless, the value is hovering simply above the decrease Bollinger Band and close to the every day pivot, hinting that we’re nearer to the late section of the present leg down somewhat than the center of it.

Day by day EMAs (Development Construction)

- Worth (shut D1): 1.37 USDT

- EMA 20: 1.55 USDT

- EMA 50: 1.76 USDT

- EMA 200: 2.17 USDT

Worth is effectively beneath the 20, 50, and 200 EMAs, and people EMAs are stacked in a textbook bearish order. This confirms a mature downtrend on the every day chart. Any bounce towards 1.55–1.76 would at present be a rally into resistance, not a confirmed pattern reversal.

Day by day RSI (Momentum & Exhaustion)

Day by day RSI is beneath 40 and leaning towards oversold, however not but at full capitulation. That often means bearish momentum remains to be in management, however sellers are not early; they’re urgent an already prolonged transfer. That is the place shorting blindly turns into much less enticing and the place snapback rallies can seem if information or liquidity shifts.

Day by day MACD (Development Momentum)

- MACD line: -0.15

- Sign line: -0.14

- Histogram: -0.01

MACD is detrimental and virtually flat with a tiny detrimental histogram. The downtrend is shedding momentum, not reversing but. Bears are nonetheless in cost, however the robust directional push seen earlier has cooled. This aligns with a market that’s drifting decrease greater than impulsively breaking down.

Day by day Bollinger Bands (Volatility & Worth Zone)

- Center band: 1.58 USDT

- Higher band: 1.99 USDT

- Decrease band: 1.16 USDT

- Worth vs Bands: 1.37 is beneath the mid, effectively above the decrease band

Worth is buying and selling within the decrease half of the band construction, underneath the midline at 1.58 however not hugging the decrease band at 1.16. That’s according to a mushy grind decrease somewhat than a panic flush. The decrease band round 1.16 stands out as a possible line within the sand for deeper capitulation: if XRP slides towards that area, volatility might spike as weak palms exit.

Day by day ATR (Vary & Volatility)

A mean every day vary of about 0.14 on a 1.37 asset factors to reasonable volatility. This isn’t a volatility blow-off; the market is shifting, however it isn’t in a frenzy. That matches the image of a managed downtrend in a fearful macro surroundings.

Day by day Pivot Ranges (Reference Assist/Resistance)

- Pivot level (PP): 1.36

- R1: 1.38

- S1: 1.35

Worth at 1.37 is sitting virtually precisely on the every day pivot, wedged between S1 at 1.35 and R1 at 1.38. That tells you the market is undecided at this exact spot. A sustained break underneath 1.35 would open the door to a recent draw back leg, whereas holding above 1.38 could be the primary small win for intraday bulls inside a broader bearish pattern.

1-Hour Chart (H1): Quick-Time period Bias – Impartial Stabilization

On the 1H timeframe, XRPUSDT is transitioning from weak spot right into a extra balanced, sideways posture. The H1 information reveals a impartial regime, with worth sitting proper on prime of short-term EMAs and momentum indicators flatlining. This doesn’t flip the every day pattern, however it does point out that promoting stress is pausing right here.

H1 EMAs

- Worth (shut H1): 1.37 USDT

- EMA 20: 1.37 USDT

- EMA 50: 1.37 USDT

- EMA 200: 1.42 USDT

Worth is glued to the 20 and 50 EMAs, whereas the 200 EMA sits greater at 1.42. Intraday, that could be a range-trading surroundings underneath a bigger bearish ceiling. Quick-term gamers are balancing patrons and sellers, however any push into the 1.40–1.42 zone will run into structural resistance.

H1 RSI

RSI on the 1H is mainly dead-center round 50, indicating no clear intraday edge. The impulsive promoting has cooled, and worth is catching its breath. From right here, both facet can take management, so the subsequent push away from this equilibrium will matter for path.

H1 MACD

- MACD line: 0

- Sign line: -0.01

- Histogram: 0

MACD on the 1H is flat on the zero line with the sign mainly matching. Development momentum is impartial intraday. There isn’t a robust push both up or down; this suits with a consolidating market sitting on the pivot.

H1 Bollinger Bands

- Center band: 1.36 USDT

- Higher band: 1.37 USDT

- Decrease band: 1.35 USDT

- Worth vs Bands: 1.37, hovering close to the higher/mid band space

The bands on 1H are tight, with worth close to the higher half. This displays a low-volatility squeeze, the place a breakout can observe as soon as one facet commits. Given the bearish every day backdrop, upside follow-through wants affirmation; in any other case, these tight bands can simply break decrease.

H1 ATR & Pivot

- ATR 14 (H1): 0.01

- Pivot (PP): 1.37

- R1/S1 (H1): each calculated close to 1.37 on this dataset

An ATR of 0.01 on 1H could be very small, indicating quiet tape and skinny intraday ranges. Mixed with worth hugging the pivot at 1.37, this reinforces the concept of a short-term equilibrium zone inside a bigger downtrend.

15-Minute Chart (M15): Execution Context – Quick-Time period Bid Inside a Vary

The 15m chart is helpful just for timing entries and exits. Right here, XRPUSDT reveals a slight bullish tilt however nonetheless inside a decent band.

M15 EMAs

- Worth (shut M15): 1.37 USDT

- EMA 20: 1.36 USDT

- EMA 50: 1.36 USDT

- EMA 200: 1.37 USDT

On 15m, worth is fractionally above the 20 and 50 EMAs and roughly consistent with the 200 EMA. That may be a modest intraday upward bias inside a sideways micro-structure. It’s helpful for scalpers on the lookout for fast mean-reversion longs, however not proof of a real pattern reversal.

M15 RSI

RSI leaning towards 60 on the 15m tells you short-term patrons are a bit extra aggressive. It is a native bid, not a macro shift. It does, nevertheless, help the concept pushing beneath 1.35 instantly would possibly require recent information or a broader risk-off spike.

M15 MACD & Bollinger Bands

- MACD line: 0

- Sign: 0

- Histogram: 0

- Bollinger mid: 1.36 USDT

- Higher band: 1.37 USDT

- Decrease band: 1.35 USDT

MACD is flat and bands are tight with worth close to the highest half, echoing the H1 image: short-term managed shopping for in a compressed volatility field. Any breakout transfer from right here is prone to be quick in contrast with the present tempo.

Placing It Collectively: Conflicting Timeframes

Day by day pattern is clearly bearish: worth is beneath all main EMAs, RSI is depressed, and MACD is detrimental. However, H1 and M15 are impartial to barely constructive, with worth stabilizing round 1.37, intraday momentum flat, and a modest short-term bid.

This battle often resolves in considered one of two methods:

- The upper timeframe reasserts, the every day downtrend resumes, and intraday consolidation breaks decrease.

- Intraday stabilization grows into a bigger bounce, and XRP mean-reverts greater towards the every day EMAs earlier than the market decides on the subsequent massive leg.

Given excessive worry throughout crypto, the market is susceptible to each a capitulation flush and a sharp short-covering bounce. Positioning must respect that binary danger.

Bullish State of affairs for Ripple Worth (In opposition to USDT)

The constructive path from here’s a mean-reversion rally from this consolidation zone. On this context, the ripple worth has room for a aid transfer if key ranges maintain.

For the bullish state of affairs:

- XRPUSDT must maintain above the 1.35–1.36 every day pivot/S1 space. That’s the speedy ground. Constant 1H closes above 1.37 would reinforce this view.

- On H1, worth ought to keep anchored above the 20/50 EMAs after which begin urgent towards the 1.40–1.42 resistance band, the place the H1 200 EMA sits.

- A decisive break and maintain above 1.42 could be the primary actual sign that the market needs to problem the every day Bollinger mid at 1.58 after which the EMA 20 at 1.55. That space (1.55–1.60) is the pure first goal zone for a aid rally.

- Momentum-wise, you’d wish to see every day RSI climb again above 40–45 and MACD histogram turning optimistic on decrease timeframes, then flattening on D1.

If this performs out, the narrative shifts from managed downtrend to oversold bounce inside a still-bearish macro construction. The larger pattern would stay down till every day closes reclaim and maintain above the EMA 50 (round 1.76). Bulls don’t want that for a tradeable aid leg, although.

What invalidates the bullish state of affairs? A transparent, sustained break beneath 1.35 on the every day shut with RSI failing to recuperate would undercut the concept of a direct bounce. That might indicate the consolidation was only a pause earlier than one other push decrease, seemingly towards the decrease Bollinger Band area round 1.16.

Bearish State of affairs for Ripple Worth

The bearish path is a continuation of the present pattern: intraday stabilization fails, and the upper timeframe downtrend resumes. Sellers would then look to press worth towards deeper help zones.

For the bearish state of affairs:

- Worth loses the 1.35 help with conviction, turning the present pivot zone into resistance as an alternative of help.

- H1 RSI rolls again underneath 45 and MACD on H1 dips extra firmly detrimental, confirming that sellers have retaken management of the short-term tape.

- On the every day chart, worth drifts or accelerates towards the decrease Bollinger Band at 1.16. In an excessive worry surroundings, a spike into or barely by way of that band would match a capitulation section.

- ATR on D1 might tick greater as ranges broaden, signaling a volatility growth to the draw back.

On this state of affairs, rallies again into 1.36–1.40 are prone to be handled as promoting alternatives by trend-followers, not less than till the every day construction adjustments meaningfully and key EMAs are reclaimed.

What invalidates the bearish state of affairs? A agency reclaim of the 1.42–1.45 zone on a closing foundation with intraday EMAs flipping into supportive roles would weaken the continuation case. If every day closes begin to stack above the EMA 20 round 1.55, the narrative shifts away from promote the rip and towards a extra balanced and even constructive medium-term bias.

Positioning, Danger and Uncertainty

XRPUSDT is at present a bearish-trend, low-volatility, high-fear market. The downtrend is undamaged on the every day chart, however intraday information reveals the primary indicators of steadiness and a gentle bid at 1.37. That mixture usually precedes both a last washout or the beginning of a grinding restoration.

For merchants, the secret is to acknowledge that:

- The macro bias stays bearish so long as XRP trades underneath the every day EMAs (1.55 / 1.76 / 2.17).

- The tactical battleground proper now’s the 1.35–1.38 band, the place pivots and short-term EMAs cluster.

- Excessive worry and compressed intraday volatility imply that when the subsequent transfer comes, it may be sharper than present ranges indicate.

Whether or not merchants lean bullish or bearish, the surroundings requires respecting each draw back continuation danger and the potential of a pointy mean-reversion rally. Place sizing, leverage, and cease placement matter greater than typical right here as a result of the market can transfer shortly as soon as it chooses a path out of this consolidation zone.