Whereas nonetheless within the capitulation zone, historical past exhibits that Bitcoin is approaching ranges at which it reaches its worth backside and begins to get better.

This may come as a reduction to diamond-handed customers who’ve held via the a number of months of worth correction. Notably, $BTC has been in a 4-month downtrend, and all indications level to a fifth until the momentum shifts dramatically earlier than the tip of February.

Key Factors

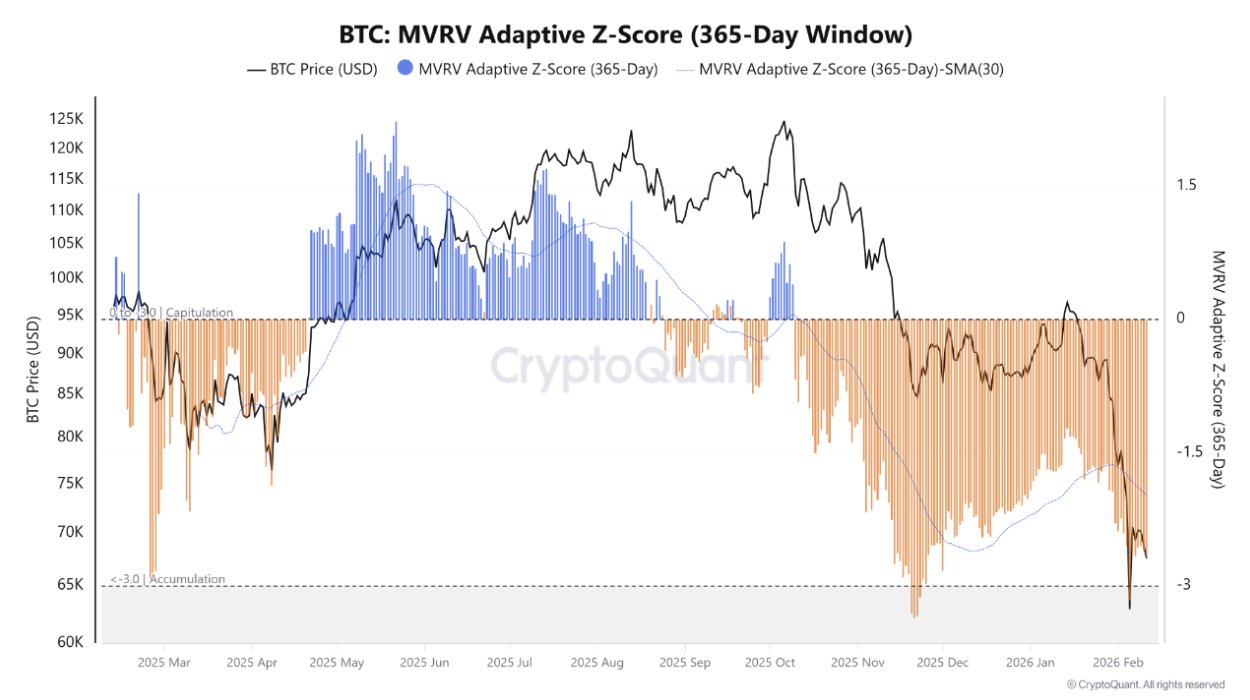

- The Bitcoin Market Worth to Realized Worth (MVRV) Adaptive Z-Rating dictates that $BTC is within the capitulation section.

- On the time of the evaluation, this metric lies at -2.66, which is inside the capitulation band.

- Regardless of this, the MVRV Adaptive Z-Rating signifies we’re approaching a historic accumulation section, the place Bitcoin bottoms.

- If true, this can be a robust shopping for alternative for Bitcoin, as a swing in momentum might spark a bullish worth turnaround.

Bitcoin within the Capitulation Part

A current evaluation from on-chain analytics supplier CryptoQuant recognized an optimistic improvement for $BTC as its correction persists. The evaluation shared by verified writer GugaOnChain makes use of the Bitcoin Market Worth to Realized Worth (MVRV) Adaptive Z-Rating to dictate which section the pioneering cryptocurrency is available in the market cycle.

It recognized that Bitcoin is within the capitulation section, marked with intense volatility and a predominant bearish pattern. Though it’d see a reduction rally at instances, just like the leap from $60,000 to $70,000 between February 5 and 6, the construction stays bearish.

Notably, the $BTC MVRV Adaptive Z-Rating measures whether or not Bitcoin is undervalued or not. It compares the market worth to the asset’s realized worth, which displays the final worth at which customers moved their bitcoins.

On the time of the report, this metric lies at -2.66, inside the capitulation band. For the uninitiated, an MVRV rating between 0 and -3.0 is capitulation, whereas a rating lower than -3.0 is accumulation.

$BTC MVRV Z-Rating/CryptoQuant”>

$BTC MVRV Z-Rating/CryptoQuant”>

$BTC MVRV Z-Rating/CryptoQuant

However There’s a Catch

The evaluation highlighted that, whereas the capitulation zone stays in play, the MVRV Adaptive Z-Rating signifies we’re approaching a historic accumulation section. In easy phrases, Bitcoin is nearing its worth backside, signaling vendor exhaustion.

Apparently, this can be a robust shopping for alternative for Bitcoin, as a swing in momentum might spark a bullish worth turnaround. Throughout the accumulation section, the sharp worth correction ends, and consumers step in to reclaim management of the market.

Bitcoin Backside, Actually?

Though this would possibly sound optimistic, a number of different analysts share a conflicting view. Lately, XWIN Analysis highlighted that Bitcoin is in an early bear market and the present retracement just isn’t a brief sideways pattern in a bull market.

Different analysts additionally count on $BTC to slip farther from the present ranges. Veteran dealer Peter Barndt sees the asset’s backside round $42,000, citing his well-known banana chart. Merchants are additionally more and more betting on a decline to $48,000 by the tip of the 12 months, based on Kalshi information.

The robust arguments from each side of the camp additional add to the uncertainty within the crypto market. In the meantime, the following course $BTC will take will grow to be clearer within the coming days.