Valentine’s Day might ship greater than goodies for Bitcoin ($BTC) buyers, as ChatGPT’s newest $BTC projection is elevating the stakes for short-term merchants.

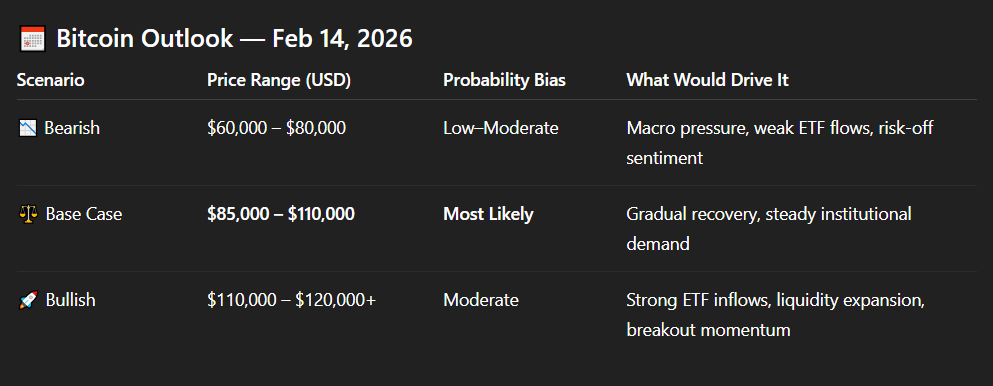

Particularly, when prompted by Finbold to set a median $BTC value for Valentine’s Day, February 14, OpenAI’s main machine studying algorithm predicted some situations would see ‘digital gold’ buying and selling above $120,000.

ChatGPT predicts Bitcoin value for February 14

In fact, it will take a variety of bullish developments to see Bitcoin practically double in value in simply two days. Based on synthetic intelligence (AI), these primarily embody distinctive institutional strikes, supportive macro situations, and liquidity enlargement.

A extra seemingly, base-case state of affairs comes with a value vary of $85,000–$110,000. This determine, ChatGPT reasoned, can be the central chance vary for February 2026 on the whole, if $BTC continues to get well and breaks key resistance ranges whereas institutional demand stays regular.

If issues go south, that’s, if Bitcoin ETF flows flip weak, macro strain continues, and risk-off sentiment turns bitter, the worth might stay caught between $60,000–$80,000.

Of all of the attainable targets, probably the most possible vary for Bitcoin this Saturday, ChatGPT argued, is $85,000–$110,000. Based on the algorithm, this prediction displays probably the most lifelike upside potential whereas accounting for volatility considerations.

Will Bitcoin double in worth?

ChatGPT’s prediction is discernibly bullish and doesn’t seem to mirror investor concern this yr, which has not been alleviated by the continuing indicators of stabilization.

Certainly, whereas Bitcoin is up round 2% on the every day chart on Thursday, February 12, transferring toe-to-toe with the broader crypto market over the identical interval, the Crypto Worry & Greed Index, which measures market sentiment on a scale from “Excessive Worry” to “Excessive Greed,” at the moment sits at 8 out of 100.

Whereas this isn’t the bottom studying on file (it plunged to five on February 6), the present degree nonetheless displays near-historic pessimism. In different phrases, the quantity suggests merchants are extremely reluctant to deploy capital and could also be fast to exit positions on the first signal of renewed weak point.

This casts doubt on extra optimistic projections resembling that given by ChatGPT and, for instance, Bernstein’s forecast that Bitcoin might rally to a brand new all-time excessive of $150,000 in 2026. Accordingly, the present value motion suggests stabilization reasonably than robust restoration momentum.

Featured picture through Shutterstock