IREN has introduced that it is going to be added to the MSCI USA Index, a serious benchmark that tracks the efficiency of enormous and mid-cap US shares, by the tip of February.

The inclusion is predicted to spice up IREN’s visibility amongst institutional buyers and index-tracking funds, which can assist the corporate’s long-term value and capital-raising plans.

Many ETFs and funds observe the MSCI, and a brand new addition is unlikely to go unnoticed, as a brand new addition usually triggers automated shopping for by entities that observe the benchmark.

This will likely set off a short-term surge within the inventory. It additionally enhances the inventory’s visibility amongst institutional buyers, which can assist the corporate’s long-term value and capital-raising plans.

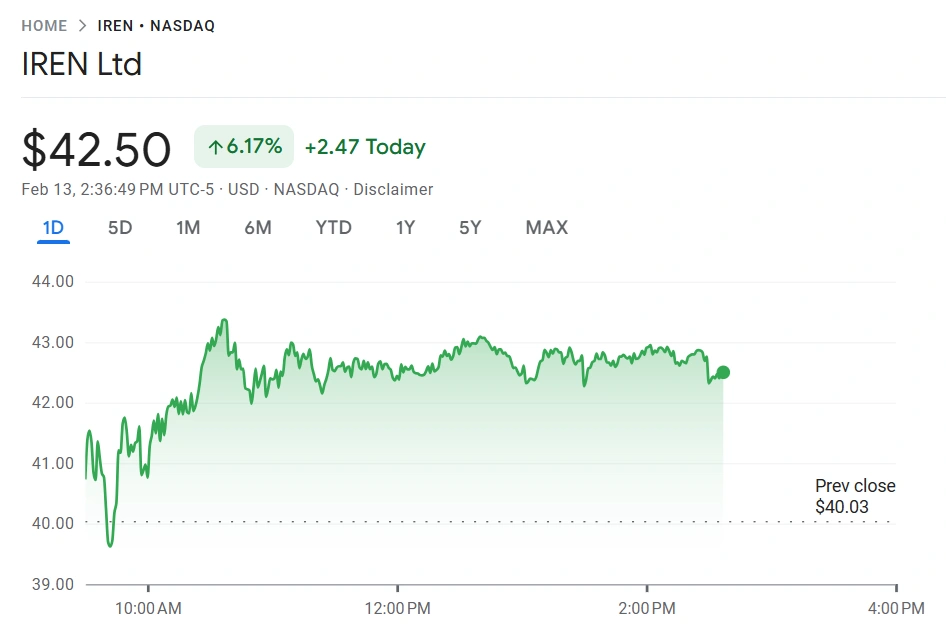

IREN’s inventory is within the inexperienced because it introduced its MSCI inclusion. Supply: Google Finance

Why an MSCI inclusion is an enormous deal for IREN

Daniel Roberts, Co-Founder and Co-CEO of IREN, says that the privilege of being added to the MSCI USA Index is a mirrored image of the dimensions and liquidity the corporate has constructed within the enterprise.

“We imagine this milestone will broaden institutional entry to IREN as we proceed to execute on our AI Cloud technique,” he stated.

The announcement comes as IREN continues its transformation from an organization centered purely on $BTC mining to a dual-purpose participant providing mining companies and AI cloud companies.

Notably, the agency is now extra invested in AI-centric property moderately than $BTC mining operations. In truth, reviews declare its present spending on gear and information facilities far outpaces what it earmarked for Bitcoin mining, and this has reportedly gone on since its IPO.

How the IREN inventory responded to the announcement

For the reason that announcement, IREN’s inventory has been within the inexperienced, exhibiting a constructive bounce that noticed it achieve roughly 7%. Nonetheless, the inventory continues to be struggling between institutional optimism and volatility.

Issues about its earnings stem from IREN’s weaker-than-expected fiscal quarterly outcomes, which noticed income falling to $184.7 million and losses widening. The efficiency has Wall Avenue divided, with some analysts centered on near-term earnings strain whereas others level to longer-term upside.

Many will proceed to watch the inventory within the days main as much as February 27, when it’s purported to be included within the MSCI, which is predicted to draw establishments and ETFs monitoring the index.

IREN’s Microsoft deal

IREN secured a five-year, $9.7 billion settlement with Microsoft in a deal that accounted for under 200 megawatts, whereas it wrapped up 2025 with about 3 gigawatts in its pipeline.

Because it revealed the contract settlement, buyers have been anticipating related offers and expressed preliminary disappointment when the corporate didn’t announce a brand new deal.

Fortuitously, CEO Daniel Roberts has knowledgeable buyers that the corporate is negotiating a number of contracts, together with a multibillion-dollar deal, which has put individuals comfy because it indicators that the long-term AI thesis stays intact.

Iren has additionally secured a 1.6 gigawatt information middle campus in Oklahoma

IREN has been positioning itself as an answer to one of many main bottlenecks affecting tech giants at the moment — vitality. The corporate boasts a capability to assist a number of huge offers because of its 1.4 gigawatt Sweetwater 1 facility, scheduled to be energized in April.

It has additionally secured a brand new 1.6 gigawatt information middle campus in Oklahoma, and energy scheduling for the information middle is about to ramp up in 2028, bringing Iren’s whole secured, grid-connected energy to 4.5 gigawatts.

As AI infrastructure retains scaling and demand for vitality rises, IREN is predicted to land extra offers just like its Microsoft association. The corporate already turned 200 megawatts into $1.94 billion in annual recurring income, and if it may obtain that very same price with its 4.5 gigawatts (4,500 megawatts), it may elevate its annual recurring income to billions.

This is likely one of the the explanation why Roberts referred to as IREN’s projected $3.4 billion in annual recurring income by the tip of 2026 “an early stage of monetization relative to the dimensions of our secured energy portfolio.”