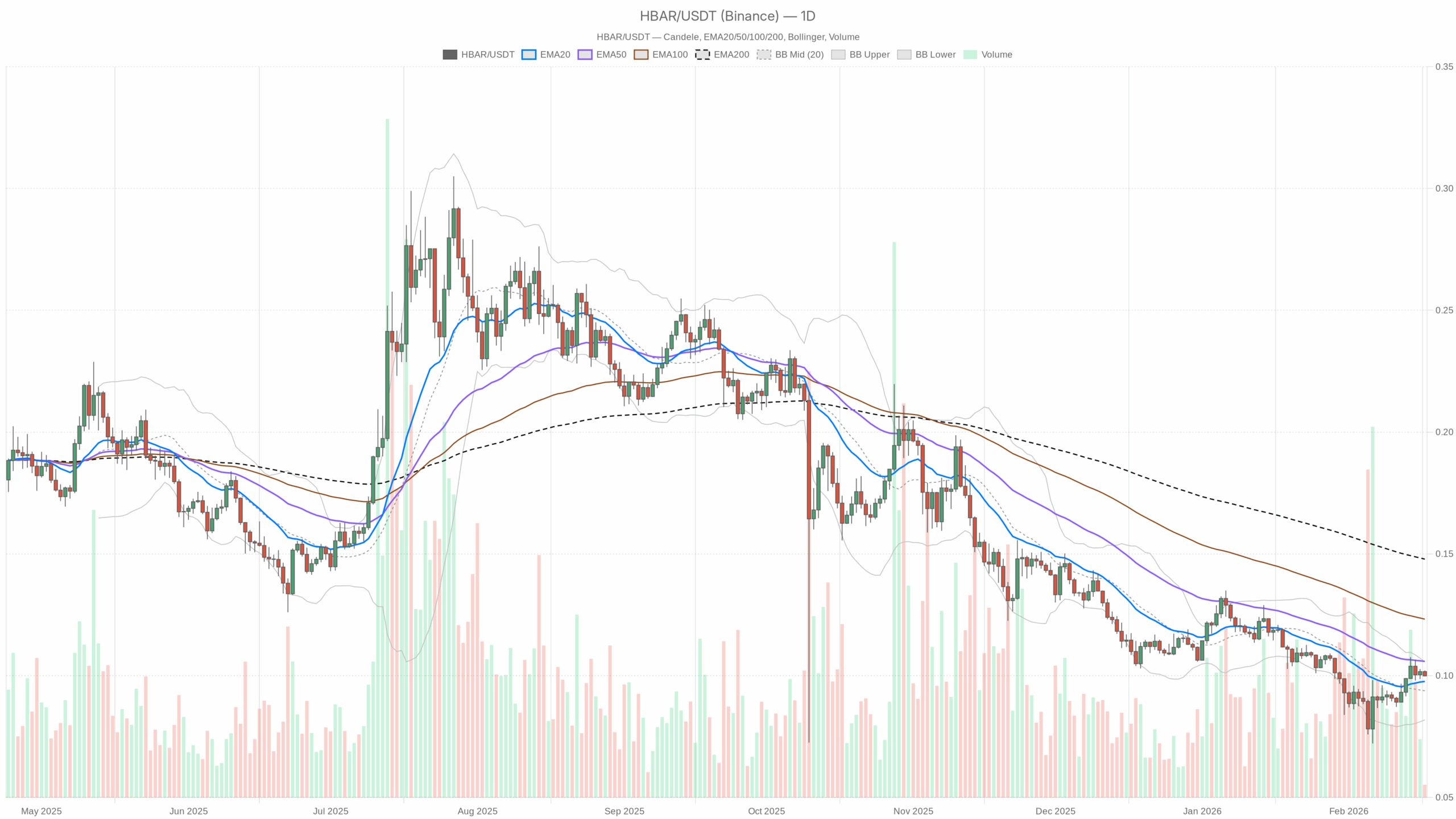

The market across the HBAR Hedera crypto worth is locked close to $0.10 as broader sentiment turns defensive and volatility compresses throughout a number of timeframes.

Day by day (D1): Impartial Bias with Structural Overhang

Development & EMAs

Information: Shut $0.10; EMA20 ≈ $0.10; EMA50 ≈ $0.11; EMA200 ≈ $0.15.

Learn: Value is glued to the 20-day EMA, however nonetheless decisively under the 50- and 200-day EMAs. That’s not lively bearish momentum, nevertheless it is a downtrend hangover. HBAR is making an attempt to stabilize underneath older, heavier resistance. Nonetheless, till worth reclaims and holds above the 50-day EMA (~$0.11), this stays a restoration try inside a broader, broken construction moderately than a confirmed new uptrend.

RSI (Momentum)

Information: RSI14 ≈ 50.9.

Learn: Momentum is dead-center impartial. There isn’t any robust shopping for strain, but additionally no clear exhaustion on the draw back. In different phrases, the market is undecided right here; each bulls and bears are on standby, ready for a catalyst. In a fearful macro setting, a impartial RSI can rapidly roll over if sellers reappear.

MACD (Development Momentum)

Information: MACD line ≈ 0, sign ≈ 0, histogram ≈ 0.

Learn: MACD is actually flatlined. There isn’t any actual directional edge from development momentum, with no robust bullish crossover and no lively bearish enlargement. This reinforces the concept HBAR is in a pause part, coiling for its subsequent impulsive transfer moderately than trending strongly in both path proper now.

Bollinger Bands (Volatility & Vary)

Information: Mid-band ≈ $0.09; higher band ≈ $0.11; decrease band ≈ $0.08. Shut at $0.10, barely above the mid-band.

Learn: Value is within the higher half of the every day band vary, however not hugging the highest. That could be a delicate optimistic tilt: help holds, however there is no such thing as a robust breakout strain. Furthermore, bands are comparatively slim, which normally means volatility has been compressed. The longer HBAR sits on this tight band, the upper the percentages of a volatility enlargement transfer forward, both up or down.

ATR (Volatility)

Information: ATR14 ≈ $0.01.

Learn: Day by day swings of about 10% relative to a $0.10 worth are reasonable for an altcoin, not excessive. Volatility is contained however not useless. That’s per a market that’s cautious moderately than panicked on this particular title, even whereas broader sentiment is extraordinarily fearful.

Day by day Pivot Ranges

Information: Pivot level ≈ $0.10; R1 ≈ $0.10; S1 ≈ $0.10 (compressed, reflecting a really tight current vary).

Learn: With pivot, help, and resistance all clustering across the identical degree, the market is principally treating $0.10 because the battleground. There isn’t any well-defined native ladder of helps and resistances on the every day, only a exhausting line within the sand. Sustained buying and selling above this space would begin to favor the bulls; a clear break and acceptance under it will give bears the higher hand.

Day by day takeaway: The HBAR Hedera crypto worth sits in a impartial zone, structurally capped by larger EMAs however not underneath aggressive promoting. The chart is in wait-and-see mode, and the following important enlargement in volatility is prone to outline the following leg.

1-Hour (H1): Impartial, However Leaning Mushy

Development & EMAs

Information: Shut ≈ $0.10; EMA20 ≈ $0.10; EMA50 ≈ $0.10; EMA200 ≈ $0.10.

Learn: All intraday EMAs are stacked on prime of one another. That’s basic short-term equilibrium, with no clear intraday development. It normally follows a interval of uneven imply reversion, the place each breakouts and breakdowns have did not observe by means of.

RSI

Information: RSI14 ≈ 41.9.

Learn: RSI is barely under impartial, hinting at a gentle intraday bearish bias. Patrons will not be aggressively stepping in on the decrease time-frame, however this isn’t oversold both. It’s extra like a tender drift downward moderately than a pointy selloff.

MACD

Information: MACD line ≈ 0; sign ≈ 0; histogram ≈ 0.

Learn: Once more, there is no such thing as a dominant intraday development. Quick-term momentum has been washed out, matching the flat EMAs. Any robust push in both path from right here will seemingly be the beginning of a recent H1 transfer, not the continuation of an current one.

Bollinger Bands & ATR

Information: Bands mid ≈ $0.10 with higher and decrease bands successfully at $0.10; ATR14 ≈ 0 on H1.

Learn: That is ultra-compression on the hourly chart, as volatility has quickly collapsed. While you see ATR this low and bands pinched, it normally precedes a breakout from the vary. Path is unknown; nonetheless, merchants ought to count on volatility to come back again, not keep at this degree.

H1 Pivot

Information: Pivot ≈ $0.10; R1 ≈ $0.10; S1 ≈ $0.10.

Learn: The market is rotating precisely across the identical degree, reinforcing $0.10 as a serious intraday resolution level. Any sustained transfer away from this degree on quantity could be significant.

Hourly takeaway: Quick-term motion is impartial to barely tender, with excessive compression. The following impulsive transfer on the 1H chart is prone to be sharp relative to present noise.

15-Minute (M15): Bearish Regime, However Inside a Tight Field

Development & EMAs

Information: Shut ≈ $0.10; EMA20, EMA50, EMA200 all ≈ $0.10; regime flagged as bearish.

Learn: Structurally, the mannequin classifies M15 as bearish, however the EMAs being on prime of one another on the identical worth level point out a micro-range, not an lively dump. Most probably, there was a current short-term selloff adopted by sideways cooling, which retains the bearish tag however with out ongoing draw back strain but.

RSI

Information: RSI14 ≈ 30.9.

Learn: Right here we see some actual strain. M15 RSI flirting with oversold signifies short-term sellers have been in management. In a broader impartial every day context, this type of micro-oversold can both be the beginning of a deeper breakdown or the realm the place scalpers search for a bounce again towards the imply.

MACD, Bands & ATR

Information: MACD ≈ 0 flat; Bollinger Bands compressed round $0.10; ATR14 ≈ 0.

Learn: Even with M15 marked bearish, there is no such thing as a robust development follow-through. Volatility is sort of nonexistent, and MACD is flat. That normally means the transfer that created the oversold RSI has stalled, and the market is pausing earlier than deciding whether or not to increase decrease or revert larger.

15m takeaway: Execution context is short-term heavy however caught in a field. Sellers have an edge on the smallest timeframe, however the transfer isn’t increasing but.

Market Context: Threat-Off, Altcoins on the Again Foot

Macro information round Hedera isn’t pleasant to altcoin outperformance proper now:

- Bitcoin dominance above 56% alerts capital focus in BTC, not in secondary names.

- Complete crypto market cap is down within the final 24 hours, with quantity additionally shrinking, which is basic de-risking conduct.

- Worry & Greed Index at 10 (Excessive Worry) displays broad danger aversion; speculative flows into initiatives like Hedera sometimes dry up in these phases.

For HBAR particularly, this implies even a technically clear setup will wrestle and not using a shift in total sentiment. Breakouts usually tend to be bought into until the broader market stabilizes.

Eventualities for HBAR Hedera Crypto Value

Instant Bias

Given the every day impartial regime, flat MACD, mid-range RSI, and worth trapped underneath the 50- and 200-day EMAs, the major situation proper now could be impartial with a slight draw back danger tilt, principally due to the macro worry and short-term M15 bearish tone.

Bullish Situation

For a constructive path, bulls want to show this impartial base at $0.10 into a correct higher-low platform.

What the bullish path may appear to be:

- HBAR defends the $0.10 zone on closing bases, with M15 and H1 RSI recovering again above 50, signaling consumers reclaiming short-term management.

- Value pushes by means of and holds above the 20-day EMA, then makes a sustained transfer above the 50-day EMA round ~$0.11.

- Day by day RSI grinds from about 51 towards the 55–60 area, whereas MACD edges right into a optimistic cross as a substitute of flatlining.

- Bollinger Bands begin to widen to the upside, with worth spending extra time close to the higher band (~$0.11+), indicating an early development moderately than range-bound noise.

In that situation, the following logical upside technical targets could be:

- First: higher every day band area round ~$0.11, primarily a take a look at of the 50-day EMA cluster.

- Subsequent: a transfer towards the $0.13–$0.15 zone, the place the 200-day EMA (~$0.15) turns into a key line separating a bear market rally from a real development reversal.

What would invalidate the bullish case?

A decisive break and every day shut under the $0.10 space, particularly if accompanied by:

- Day by day RSI slipping under 45 and heading decrease.

- ATR beginning to rise as purple candles lengthen, exhibiting sellers will not be simply successful however successful with power.

- HBAR buying and selling nearer to the decrease Bollinger Band round ~$0.08 and failing to bounce.

Bearish Situation

The bearish story banks on the concept this impartial consolidation is just a pause earlier than one other leg down, in sync with a risk-off macro setting.

How the bearish path would possibly unfold:

- HBAR loses the $0.10 pivot on intraday timeframes, turns it from help into resistance, and fails on retests.

- 15m and 1h RSI stay suppressed, staying under 45, whereas every day RSI drifts from about 51 towards the low 40s.

- Bands begin increasing downward, with worth strolling alongside or close to the decrease every day Bollinger Band (~$0.08), moderately than reverting again to the mid-band.

- Day by day MACD lastly suggestions detrimental, not flat, supporting a recent draw back development leg as a substitute of vary buying and selling.

In that situation, near-term help expectations would sit across the decrease band area close to ~$0.08. If worry intensifies or Bitcoin breaks decrease, a deeper sweep under that band wouldn’t be shocking, successfully looking for a brand new worth space.

What would invalidate the bearish case?

A convincing, high-volume reclaim of the 50-day EMA (~$0.11) would critically harm the bearish narrative, particularly if:

- Day by day RSI holds above 50 and pushes towards 60.

- MACD turns barely optimistic as a substitute of deepening into the detrimental.

- Value begins constructing intraday larger lows above $0.10–$0.11 moderately than rejecting from that zone.

Positioning, Threat, and Uncertainty

HBAR’s chart proper now could be the alternative of a high-conviction trending setup. The every day construction is impartial, intraday volatility is compressed, and momentum is flat, all whereas the broader crypto market leans defensive. In environments like this, place dimension and endurance normally matter greater than intelligent entries, as the large transfer tends to come back after durations like this, not throughout them.

Merchants ought to preserve three issues in thoughts:

- Volatility is prone to return. With ATR and intraday bands this tight, the following impulse is prone to be sharper than the present noise degree implies.

- Macro can override micro. Even when Hedera paints an honest native setup, a recent leg decrease in Bitcoin or a spike in market-wide worry can pull it down no matter its standalone chart.

- Key line is $0.10. On all timeframes, $0.10 is the pivot that retains reappearing. Above it, the market can argue for a base; under it, the argument shifts towards continuation of the prior downtrend.

For now, the HBAR Hedera crypto worth sits in a balancing act. The tape is quiet, however the context isn’t. The following break free from this $0.10 equilibrium is prone to outline the following a number of weeks of buying and selling for this asset.