XRPUSDT is buying and selling in a technically weak spot, with the broader market risk-off and the Ripple crypto value weighed down by Bitcoin dominance and excessive concern.

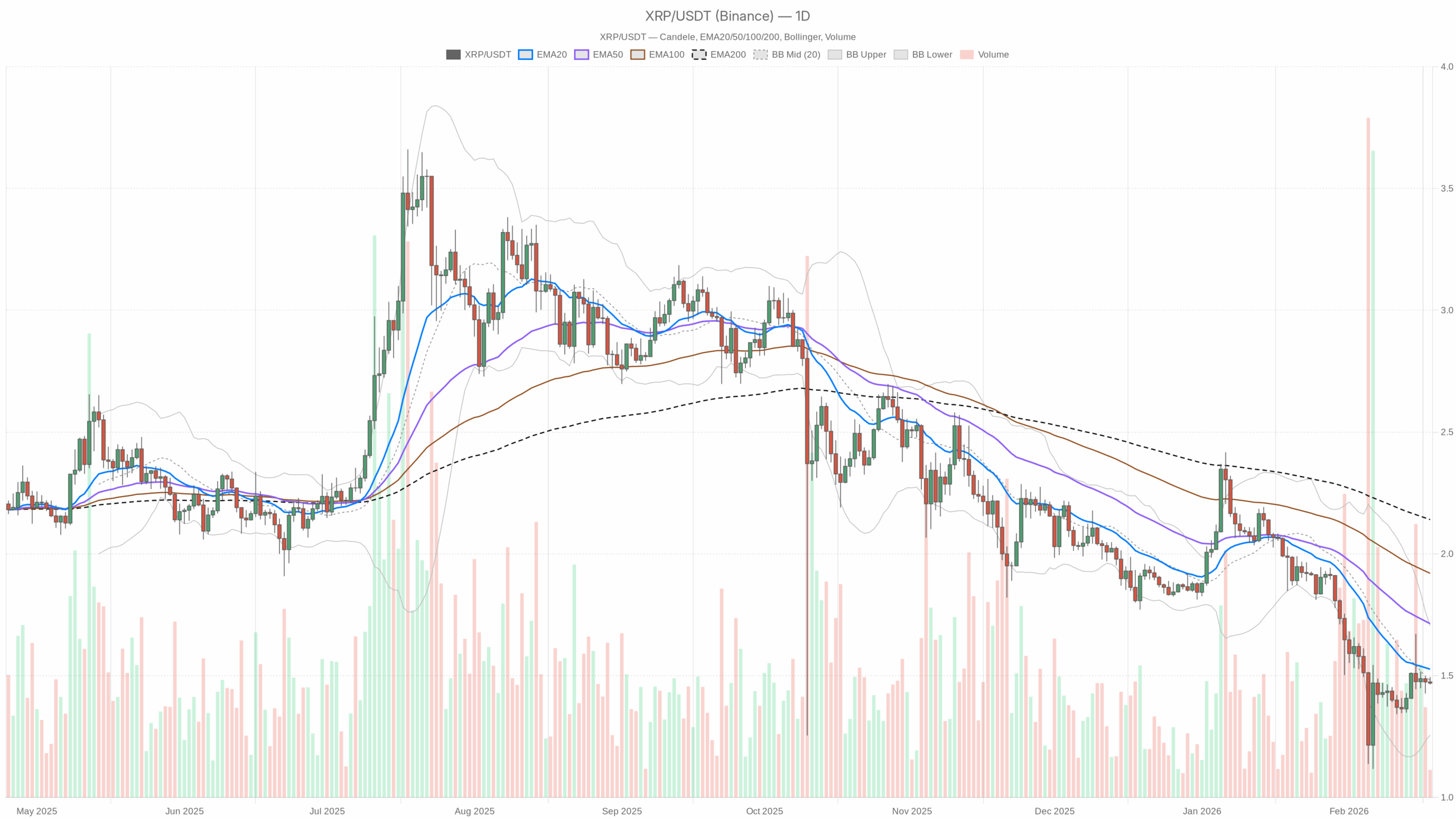

Day by day Timeframe (D1) – Macro Bias: Bearish With Gentle Stabilization

The upper timeframe defines the primary state of affairs. Proper now, XRPUSDT’s major bias is bearish, however there are some early indicators the draw back stress is easing, not accelerating.

Development Construction: EMAs

Day by day shut: 1.47

EMA 20: 1.53

EMA 50: 1.71

EMA 200: 2.14

Value is buying and selling beneath all three each day EMAs, and the shorter EMAs sit effectively underneath the 200-day. That could be a textbook bearish construction: the market is buying and selling underneath current worth (20/50-day) and effectively beneath the longer-term development (200-day). The space to the 200-day EMA additionally highlights how prolonged the broader downtrend nonetheless is; XRP would wish a large rally simply to retest that long-term line.

In follow, this implies rallies towards 1.53–1.71 are at present rallies into resistance, not right into a pleasant development. Furthermore, any bullish stance right here is, by definition, a countertrend or mean-reversion play till value can reclaim at the least the 20-day EMA on a closing foundation.

Momentum: RSI (14)

RSI (14) Day by day: 41.62

Day by day RSI is sitting beneath 50 however comfortably above classical oversold territory. That strains up with a managed downtrend moderately than panic promoting. Bears nonetheless have the higher hand, however they aren’t driving value into exhaustion but. For merchants, this implies there’s room for one more leg decrease if the construction breaks, but additionally sufficient gas for a technical bounce if assist continues to carry.

Momentum Affirmation: MACD

MACD line: -0.10

Sign line: -0.12

Histogram: 0.02

The MACD is unfavourable, in keeping with the prevailing bearish regime, however the line is barely above the sign and the histogram has ticked into optimistic territory. In plain language, the downtrend remains to be there, however the draw back momentum is fading and short-term promoting stress is not accelerating. That is typically how a market begins transitioning from a straight-down transfer into both consolidation or a reversal try.

Nevertheless, that is an early signal solely. With out value reclaiming key ranges, MACD easing off will not be sufficient to declare a development change.

Volatility & Vary: Bollinger Bands and ATR

Bollinger Bands (20,2):

Mid band: 1.48

Higher band: 1.71

Decrease band: 1.26

ATR (14) Day by day: 0.13

Value is hugging the center band at 1.48, just below it, moderately than driving the decrease band. That tells us the current promote stress has cooled and value is oscillating across the 20-day common band. The higher band sits close to 1.71, proper across the 50-day EMA, which reinforces that 1.70–1.71 space as a severe resistance cluster for any upside transfer.

ATR at 0.13 means the standard each day swing is underneath 10% of value. For XRP, that’s average volatility, not a volatility spike related to capitulation, but additionally not a lifeless market. Merchants can fairly count on intraday swings, however nothing just like the type of blow-off ranges that often mark development extremes.

Key Day by day Reference Ranges: Pivots

Pivot level (PP): 1.48

Resistance R1: 1.49

Assist S1: 1.46

The each day pivot sits precisely round the place value is buying and selling now. Buying and selling barely beneath PP and underneath R1 retains XRP in a marginally bearish intraday posture on the upper timeframe: sellers are nonetheless leaning on rallies towards 1.48–1.49. S1 at 1.46 is the primary line of protection; if that breaks with quantity, the door opens for a transfer towards the decrease band space, with 1.40–1.35 as a pure extension zone.

Hourly Timeframe (H1) – Brief-Time period Bias: Impartial / Vary-Sure

On the 1-hour chart, XRPUSDT seems extra like a market catching its breath than one in free fall.

Development and Construction: EMAs

H1 shut: 1.47

EMA 20: 1.48

EMA 50: 1.48

EMA 200: 1.44

Regime: Impartial

Value is sitting slightly below the 20 and 50-hour EMAs, however nonetheless above the 200-hour EMA. This offers us a really totally different image versus the each day chart: within the brief time period, the longer intraday development (200 EMA) remains to be intact, and value is consolidating a bit above it whereas failing to convincingly reclaim the shorter intraday EMAs.

In easy phrases, the hourly construction says: downtrend on the larger chart, sideways on the intraday. That’s in keeping with consolidation inside a bigger bearish context and infrequently precedes both a continuation drop or a aid bounce.

Momentum and Volatility: RSI, MACD, Bands, ATR

RSI (14) H1: 45.65

MACD H1: line 0, sign 0, histogram 0

Bollinger mid: 1.48 (up 1.49, low 1.46)

ATR (14) H1: 0.01

The hourly RSI beneath 50 however not oversold confirms a slight bearish tilt with out capitulation. MACD at zero with a flat histogram reveals a market in stability, the place neither patrons nor sellers are strongly in management on this timeframe proper now.

Value is buying and selling inside a really tight band between roughly 1.46 and 1.49, with an hourly ATR of 0.01. That could be a slim intraday vary, pointing to short-term indecision and compression. Vary compression in a bearish macro context typically resolves with a directional transfer; the hourly construction shall be key to recognizing which approach that breaks.

Hourly Pivots

H1 Pivot (PP): 1.47

R1: 1.48

S1: 1.46

On the hourly, 1.47 is the rapid battleground. Buying and selling proper on the pivot retains the intraday stance impartial. A sustained push above 1.48 would tilt the very brief time period in favor of a bounce, whereas repeated failures at 1.48 adopted by a clear transfer underneath 1.46 would hand management again to sellers.

15-Minute Timeframe (M15) – Execution Context Solely

The 15-minute chart will not be for macro selections right here; it simply tells us how clear or uneven the execution atmosphere is round these ranges.

Brief-Time period Construction: EMAs and RSI

M15 shut: 1.47

EMA 20: 1.48

EMA 50: 1.48

EMA 200: 1.49

RSI (14) M15: 34.92

Regime: Impartial

On M15, value is wedged beneath all three EMAs, together with the 200-period, and RSI is dipping into the mid-30s. That could be a short-term intraday bearish skew, that means native stress is to the draw back even because the hourly chart is impartial. If you’re very tight entries or exits, remember the microstructure at present favors sellers on small timeframes.

Micro Volatility: Bands, ATR, and Pivot

Bollinger mid M15: 1.48 (up 1.50, low 1.47)

ATR (14) M15: 0.01

M15 Pivot: 1.47 (R1 1.47, S1 1.47 – successfully flat)

The 15-minute bands are extraordinarily tight, and the pivot ranges are successfully compressed across the identical value. This confirms a very short-term squeeze with low realized volatility, the place small orders can transfer value inside the micro-range. It’s a uneven execution zone higher suited to scalpers than place merchants.

Placing It Collectively – Principal State of affairs and Key Paths

The dominant state of affairs based mostly on the each day chart is bearish. XRP is in a downtrend underneath all main each day EMAs, with sentiment within the wider market extraordinarily fearful and BTC dominance excessive. The decrease timeframes don’t strongly contradict this: the hourly chart is impartial and compressing, and the 15-minute leans mildly bearish.

Bullish State of affairs – Imply Reversion From Assist

For bulls, this can be a potential mean-reversion setup moderately than a trend-following purchase.

What must occur:

- Day by day assist at 1.46 holds. Value ought to defend S1 on each the each day and hourly charts and keep away from a clear shut beneath 1.46. Ideally, any dips beneath are shortly purchased again, leaving decrease wicks on intraday candles.

- Reclaim of 1.48–1.49 and the each day mid-band. A sustained transfer and each day shut again above the Bollinger mid (1.48) and R1 (1.49) would present patrons are regaining some management. That may possible be accompanied by each day RSI curling again towards 50 and the MACD histogram staying optimistic or increasing.

- Goal zone into the EMA cluster. If these steps happen, the upside mean-reversion goal band sits round 1.53–1.71, spanning the 20-day EMA up into the higher band and 50-day EMA convergence. That space is the place short-term bulls would possible face robust promoting curiosity once more.

What invalidates the bullish case: A decisive break and shut beneath 1.46 on the each day, particularly if accompanied by rising ATR and RSI dropping into the low 30s, would argue the bounce has failed and the downtrend is resuming. In that state of affairs, treating the transfer as a mean-reversion lengthy turns into low likelihood.

Bearish State of affairs – Development Continuation After Compression

The extra simple play with the present construction is a trend-continuation brief on weak point within the Ripple crypto value.

What must occur:

- Breakdown beneath 1.46 with follow-through. A clear push underneath S1 (1.46) on each each day and hourly charts, adopted by acceptance (no rapid reclaim), would point out sellers have gained the present vary battle.

- Hourly EMAs roll over and value stays beneath them. On H1, you’ll need to see value rejected from the 20/50-hour EMAs round 1.48 and begin utilizing them as dynamic resistance, aligning intraday construction with the bearish each day development.

- Momentum re-energizes to the draw back. Day by day RSI breaking underneath 40 and heading towards mid-30s, with MACD rolling decrease and the histogram flipping again deeper into unfavourable, would affirm that the temporary easing in draw back momentum is over.

In that case, the subsequent logical technical magnets sit towards the decrease Bollinger Band at 1.26, with intermediate psychological ranges (1.40, 1.35) alongside the way in which. Volatility (ATR) would possible broaden in that transfer as merchants exit late longs and contemporary shorts pile in.

What invalidates the bearish case: A each day shut again above roughly 1.53 (20-day EMA) could be the primary clear warning signal. A transfer above 1.53 that holds, particularly if accompanied by an hourly construction flipping bullish, with value above the 200-hour EMA and rising RSI, would suggest the market is transitioning from a easy corrective downtrend right into a broader base or perhaps a new up-leg.

Positioning, Threat, and Uncertainty

XRPUSDT is in a downtrend with indicators of short-term stabilization. The each day chart nonetheless says respect the bearish regime, whereas the decrease timeframes present compression moderately than capitulation. That mixture often favors persistence: forcing trades inside a good 1.46–1.49 vary is usually noise until you use on very brief horizons.

For directional positioning, the cleaner performs have a tendency to come back after this compression resolves, both by way of a convincing reclaim of the 1.48–1.53 band for countertrend longs or a transparent break and acceptance beneath 1.46 for trend-following shorts. In each instances, volatility and slippage can enhance across the break, so utilizing the ATR numbers as a tough gauge of anticipated each day swing is smart danger administration.

As all the time in a market dominated by macro risk-off flows and excessive concern sentiment, headline and cross-asset volatility, particularly from Bitcoin, can shortly disrupt these technical buildings. Any place round XRP right here has to account for the opportunity of quick strikes and false breaks, notably whereas the market trades underneath all main each day EMAs.

In brief, the Ripple crypto value is sitting at an ungainly spot, technically weak on the upper timeframe however not but in panic mode. Merchants who respect the upper timeframe downtrend whereas ready for cleaner affirmation from the present vary will typically be higher aligned with how this tape is behaving.