The $40,000 put choice has emerged as one of the crucial important positions in bitcoin’s market forward of the Feb. 27 expiry, highlighting sturdy demand for draw back safety after a bruising selloff.

Choices are derivatives that give holders the appropriate, however not the duty, to purchase or promote bitcoin at a predetermined worth earlier than expiry. Put choices act as insurance coverage towards worth declines, paying out if $BTC falls beneath a set strike.

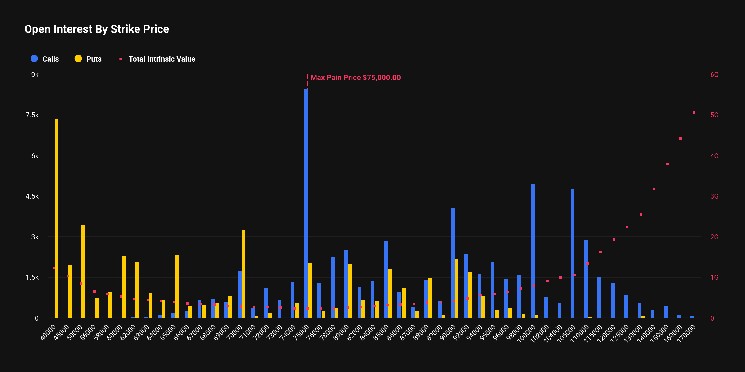

The $40,000 put is the second-largest strike by open curiosity, with roughly $490 million in notional worth tied to that degree, underscoring urge for food for deep tail-risk hedges. $BTC has declined by as much as 50% from its October highs and is now buying and selling round $66,000, reshaping positioning throughout the board as merchants hedge towards additional losses.

Knowledge from Deribit, the Dubai-based change owned by Coinbase, exhibits that roughly $7.3 billion in bitcoin choices notional worth is ready to run out on the finish of the month.

In the meantime, $566 million sits on the $75,000 strike, which additionally represents the max ache degree. Max ache refers back to the worth at which the best variety of choices expire nugatory, minimizing payouts to consumers. With the spot worth buying and selling beneath $75,000, a transfer greater into expiry may cut back losses for name sellers.

Though calls outweigh places general, with 63,547 name contracts versus 45,914 places, positioning is just not purely bullish. The put-to-call ratio of 0.72 signifies that upside bets nonetheless dominate, however the focus of sizeable put open curiosity at decrease strikes highlights clear demand for draw back insurance coverage.

Merchants retain publicity to a rebound, however are concurrently hedging towards the danger of one other sharp leg decrease.