February 25, 2026 is a date most Nvidia buyers have already circled on their calendars. The chipmaker will report its fiscal 2025 This fall outcomes after market shut that day, and Wall Avenue broadly expects one other blowout quarter. The consensus This fall income estimate sits at $65.6 billion, with a median adjusted earnings estimate of $1.52 per share — each reflecting year-over-year development of roughly 71%, per S&P International. And but, some analysts are predicting that Nvidia inventory will drop proper after the report, even when the numbers beat. It’s a contrarian name, however not with out precedent — and the Nvidia inventory value goal knowledge and the broader Nvidia This fall forecast image recommend the short-term commerce is extra sophisticated than it seems.

Submit Earnings Nvidia Inventory Drop, 2026 Value Targets & This fall Forecast

Why a Drop Is Being Predicted Even If Earnings Beat

The prediction doesn’t depend on Nvidia lacking estimates. The corporate has crushed Wall Avenue’s numbers in every of the final 4 quarters, and it’ll accomplish that once more when Nvidia earnings are reported on February 25. The issue is that beating the official consensus isn’t all the time sufficient.

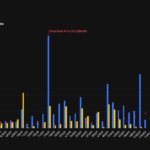

Analysts pointed to so-called “whisper numbers” — casual, increased estimates that flow into amongst merchants and institutional buyers properly above the official figures. On high of that, markets have a tendency to cost in loads of excellent news earlier than Nvidia earnings even arrive, which implies even a robust beat can depart buyers underwhelmed. Trying on the chart, Nvidia inventory fell after three of the final 4 quarterly reviews, all of which have been beats.

One particular challenge that might rattle buyers in the course of the name is the reminiscence scarcity. If administration indicators that HBM reminiscence availability may have an effect on GPU gross sales later in 2026, the inventory may take a success no matter what the headline numbers say.

The AI Spending Skepticism Issue

There’s additionally a broader concern that’s been weighing available on the market heading into the Nvidia This fall forecast report. Microsoft beat its most up-to-date quarterly estimates and nonetheless noticed its inventory bought off — largely due to elevated AI infrastructure spending. Alphabet posted stable This fall 2026 outcomes on February 4 and in addition dropped the next day, once more over capital expenditure issues. Amazon’s capex forecast of over $200 billion for this yr added much more nervousness.

All three are main Nvidia prospects. And the fear being utilized by some buyers proper now’s pretty easy: if the most important AI spenders are being punished for spending an excessive amount of, that creates a headwind for Nvidia, which relies upon closely on that spending. An Nvidia inventory drop on this atmosphere, in response to Speights, wouldn’t be a shock in any respect.

The place Analyst Value Targets Stand for 2026

The short-term warning apart, the Nvidia inventory value goal 2026 image from Wall Avenue seems broadly constructive proper now. Out of 61 analyst scores, 57 are Purchase, 3 are Maintain, and simply 1 is Promote. The common 12-month value goal is $253.88, implying round 35% upside from present ranges. The excessive goal is $352, and the low is $140.

A number of main companies have not too long ago maintained or up to date their positions. Stifel and Goldman Sachs each maintain a $250 Purchase ranking. Jefferies and Baird are extra bullish at $275. Citi’s goal is $270. UBS raised its Nvidia inventory value goal to $245 on February 11, 2026, additionally sustaining its Purchase ranking.

Financial institution of America analyst Vivek Arya and his group up to date their estimates forward of Nvidia earnings, elevating the AI knowledge heart whole addressable market estimate to roughly $1.4 trillion by 2030, up from $1.2 trillion beforehand. Cloud capex for 2026 is now anticipated to succeed in $748 billion — a 56% year-over-year improve — which is seen as a direct tailwind for Nvidia’s knowledge heart enterprise. The group additionally estimated a rise of roughly $120 billion in potential compute chip gross sales this yr, in keeping with their new outlook of a $110 billion improve in knowledge heart compute gross sales.

The Lengthy-Time period Case Stays Intact

Analysts acknowledged that his Nvidia inventory drop name may very well be flawed — and that if any firm can ship a really spectacular quarter even in a troublesome atmosphere, it’s Nvidia. In addition they argued {that a} pullback, if it does occur, would really be a shopping for alternative for long-term buyers. Nvidia’s Rubin structure ramp later in 2026 is anticipated to function a significant catalyst, and the ROI for AI spending ought to grow to be so much clearer over time.

Trevor Jennewine additionally weighed in, noting that Nvidia leads the AI accelerator market with 80% to 90% income share, with its GPUs persistently outpacing rivals on the MLPerf benchmarks. On valuation, Jennewine wrote that Wall Avenue estimates Nvidia’s earnings will improve at 38% yearly within the subsequent three years, and that “the present valuation of 45 instances earnings look[s] comparatively low-cost.” For affected person buyers, he argued, the inventory is price proudly owning at present costs.

Whether or not or not an Nvidia inventory drop materializes after February 25, the Wall Avenue consensus on the inventory’s longer-term trajectory is tough to argue with. Sturdy Nvidia This fall forecast numbers, a dominant market place, and a broadly bullish Nvidia inventory value goal throughout analysts — all of it factors in the identical course. The one actual query is what occurs within the days proper after Nvidia earnings land.