New evaluation from banking information firm KlariVis discovered that 90% of group banks in its pattern had clients transacting with Coinbase. Throughout 53 banks the place transaction route may very well be decided, $2.77 flowed to the crypto change for each $1.00 returning, leading to a web $78.3 million deposit shift over 13 months.

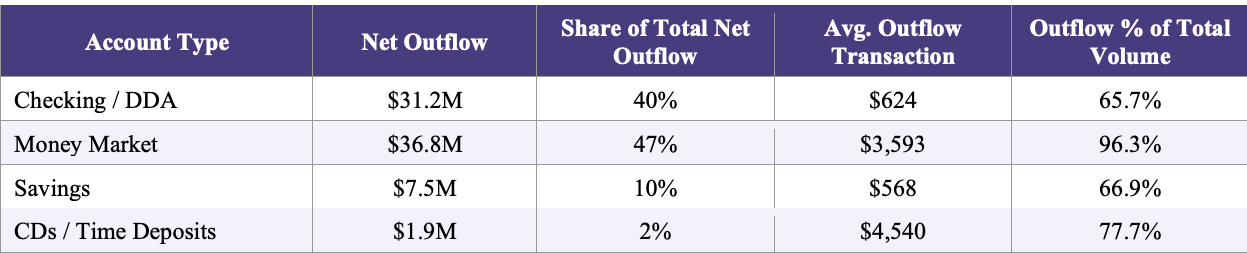

The examine reviewed 225,577 Coinbase-related transactions throughout 92 group banks and located that transfers had been closely concentrated in cash market accounts, the place 96.3% of identifiable transaction quantity represented funds leaving banks for the change.

“On the whole, group banks might be outlined as these owned by organizations with lower than $10 billion in belongings,” the Federal Reserve says on its web site.

KlariVis mentioned that if the patterns noticed within the pattern maintain nationally, greater than 3,500 of the nation’s roughly 3,950 group banks might have comparable buyer exercise tied to Coinbase transfers.

The dimensions of the 53 banks with directional information ranged from $185 million to $4.5 billion in deposits, with smaller establishments exhibiting increased relative publicity. At banks with lower than $1 billion in deposits, 82% to 84% of Coinbase-related transactions represented funds transferring out, in contrast with about 66% to 67% at banks above $1 billion.

Throughout these banks, complete outflows reached $122.4 million in contrast with $44.2 million in inflows. The common outbound switch was $851, whereas inbound transfers averaged $2,999 however occurred far much less continuously.

Supply: KlariVis report

Cash market accounts accounted for $36.8 million of the online outflow, with common transfers of $3,593, considerably increased than checking account actions.

Neighborhood banks maintain about $4.9 trillion in deposits and fund about 60% of small enterprise loans underneath $1 million and 80% of agricultural lending, in keeping with the report, which argues sustained deposit migration might have an effect on native credit score availability.

Utilizing educational estimates that small banks cut back lending by about $0.39 for each $1 decline in deposits, KlariVis mentioned the $78.3 million web outflow might translate into about $30.5 million in decreased lending capability.

Associated: Coinbase’s Base transitions to its personal structure with eye on streamlining

CLARITY Act stalled by debate over stablecoin yield

The examine comes because the US Congress, banks and crypto-native corporations debate the CLARITY Act, which goals to outline the regulatory framework for digital asset markets and decide whether or not crypto exchanges and stablecoin intermediaries can supply yield on buyer holdings.

Whereas the GENIUS Act, handed in July 2025, bars stablecoin issuers from paying curiosity, it doesn’t prohibit third-party intermediaries similar to Coinbase from providing yield on stablecoin balances, which has change into a significant level of rivalry between monetary establishments and crypto corporations.

In August, Banking teams, led by the Financial institution Coverage Institute, urged lawmakers to handle what they describe as a “loophole” within the regulation, warning that permitting exchanges to supply oblique yield might speed up deposit outflows, disrupt credit score flows and shift as much as $6.6 trillion from the normal banking system.

Final month, Financial institution of America CEO Brian Moynihan echoed that sentiment, saying interest-bearing stablecoins might draw as much as $6 trillion from the US banking system, citing US Treasury-backed analysis suggesting deposits might migrate if issuers are allowed to pay yield.

In the meantime, Coinbase CEO Brian Armstrong has pushed again towards restrictions on stablecoin rewards. In January, he withdrew help for a model of the invoice, writing on X: “We’d fairly don’t have any invoice than a foul invoice.” He raised a number of considerations in regards to the draft, certainly one of which was that it will remove stablecoin yield and shield banks from competitors.

Supply: Brian Armstrong

Regardless of ongoing tensions between banks and crypto corporations, US Senator Bernie Moreno mentioned on Wednesday he thinks the CLARITY Act might advance by way of Congress by April. Prediction market Polymarket presently reveals an 83% probability that the laws will likely be signed into regulation this 12 months.

Journal: Bitcoin’s ‘largest bull catalyst’ can be Saylor’s liquidation: Santiment founder