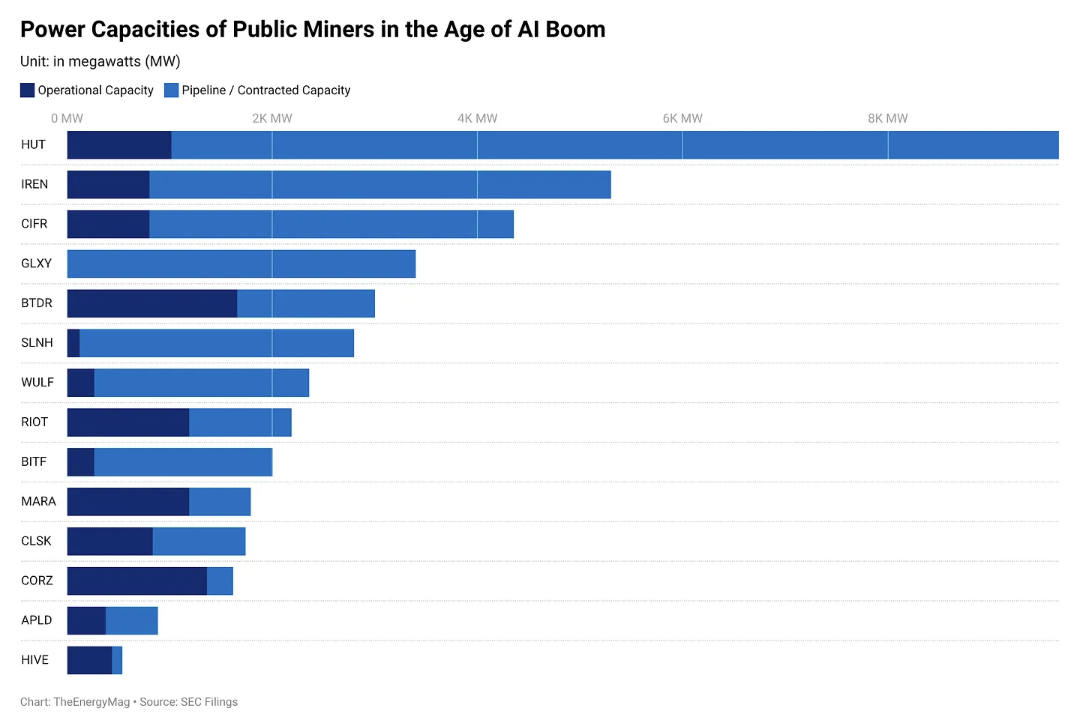

Public Bitcoin miners are planning about 30 gigawatts of recent energy capability aimed toward synthetic intelligence workloads, practically 3 times the 11 GW they at present have on-line, as they race to offset shrinking mining margins and reposition for the subsequent development cycle.

The buildout, compiled by TheEnergyMag throughout 14 publicly traded Bitcoin (BTC) miners, underscores how aggressively the business is pivoting away from conventional hashpower amid persistently weak hashprice circumstances.

On paper, the deliberate growth quantities to what TheEnergyMag described as “a small nation’s value of energy infrastructure.” In actuality, a lot of the 30 GW sits in growth pipelines, interconnection queues or early-stage plans, quite than operational services.

Present and proposed energy capacities of public Bitcoin miners. Supply: TheEnergyMag

The widening hole suggests competitors is shifting from ASIC effectivity to securing energy, financing and delivering information facilities on time.

“That is the megawatt arms race of the AI growth,” TheEnergyMag stated, including that monetization in the end is determined by whether or not AI demand stays robust sufficient to justify the size of funding.

Associated: The true ‘supercycle’ isn’t crypto, it’s AI infrastructure: Analyst

AI pivot delivers early income features for some miners

The shift towards synthetic intelligence infrastructure displays an more and more hybrid technique amongst established Bitcoin miners, with some firms already reporting significant income contributions from AI and high-performance computing (HPC) workloads.

One instance is HIVE Digital, which just lately posted document quarterly income pushed partly by its AI and HPC enterprise traces. The corporate reported fourth-quarter gross sales of $93.1 million, up 219% yr on yr, at the same time as Bitcoin costs declined through the interval.

Buyers, too, are attuned to the shift. Earlier this week, Starboard Worth went public with its suggestion to Riot Platforms administration that they speed up the miner’s growth into HPC and AI information facilities.

The push to diversify comes as mining earnings have taken a success for the reason that 2024 Bitcoin halving, which reduce block rewards and squeezed margins throughout the business.

Circumstances have gotten even more durable for the reason that fourth quarter, when heavy promoting stress despatched Bitcoin tumbling from its document excessive above $126,000. Costs ultimately stabilized in February, after briefly falling to under $60,000.

Regardless of these headwinds, US-based miners confirmed resilience initially of the yr, with output rebounding after a extreme winter storm briefly disrupted operations.

Supply: Julien Moreno

Associated: Paradigm reframes Bitcoin mining as grid asset, not vitality drain