U.S. equities traded modestly decrease late Thursday as rising oil costs, geopolitical tensions, and cautious Federal Reserve indicators tempered momentum from the prior session’s AI-fueled advance.

Shares Ease in Late Buying and selling as Oil Hits Six-Month Excessive

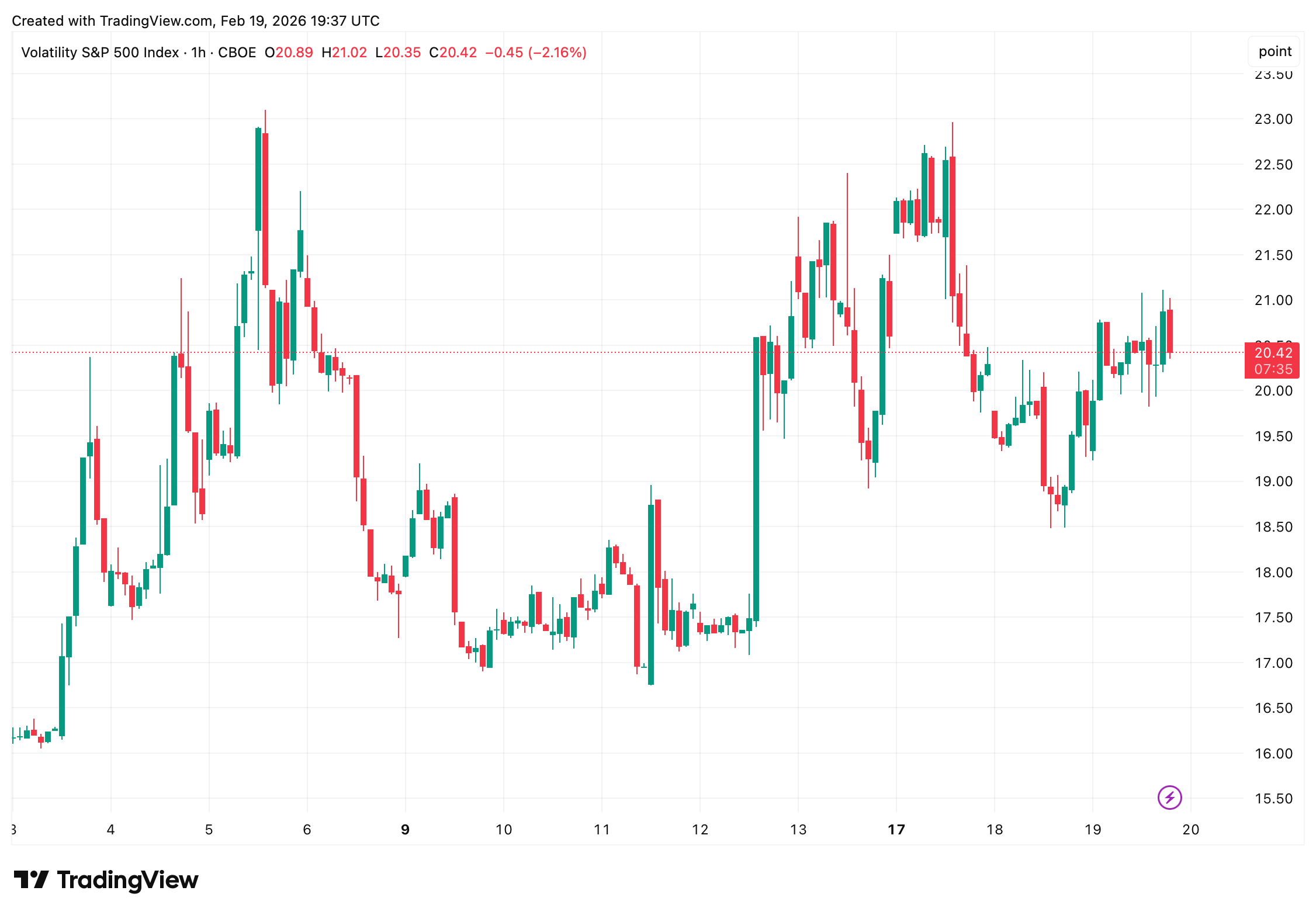

As of three:30 p.m. EST on Feb. 19, simply earlier than Wall Avenue’s shut, the Dow Jones Industrial Common stood at 49,349, down 314 factors, or 0.63%. The S&P 500 fell 28 factors, or 0.41%, to six,853, whereas the Nasdaq Composite declined 107 factors, or 0.47%, to 22,646. The CBOE Volatility Index rose about 4% to twenty.41, reflecting elevated uncertainty heading into the shut.

Cboe’s VIX on Feb. 19, 2026.

The pullback follows Wednesday’s rally, when synthetic intelligence-linked optimism lifted technology shares and drove the S&P 500 up 0.6% and the Nasdaq 0.8%. Market breadth was combined throughout that session, with fewer than two-thirds of Dow parts ending larger.

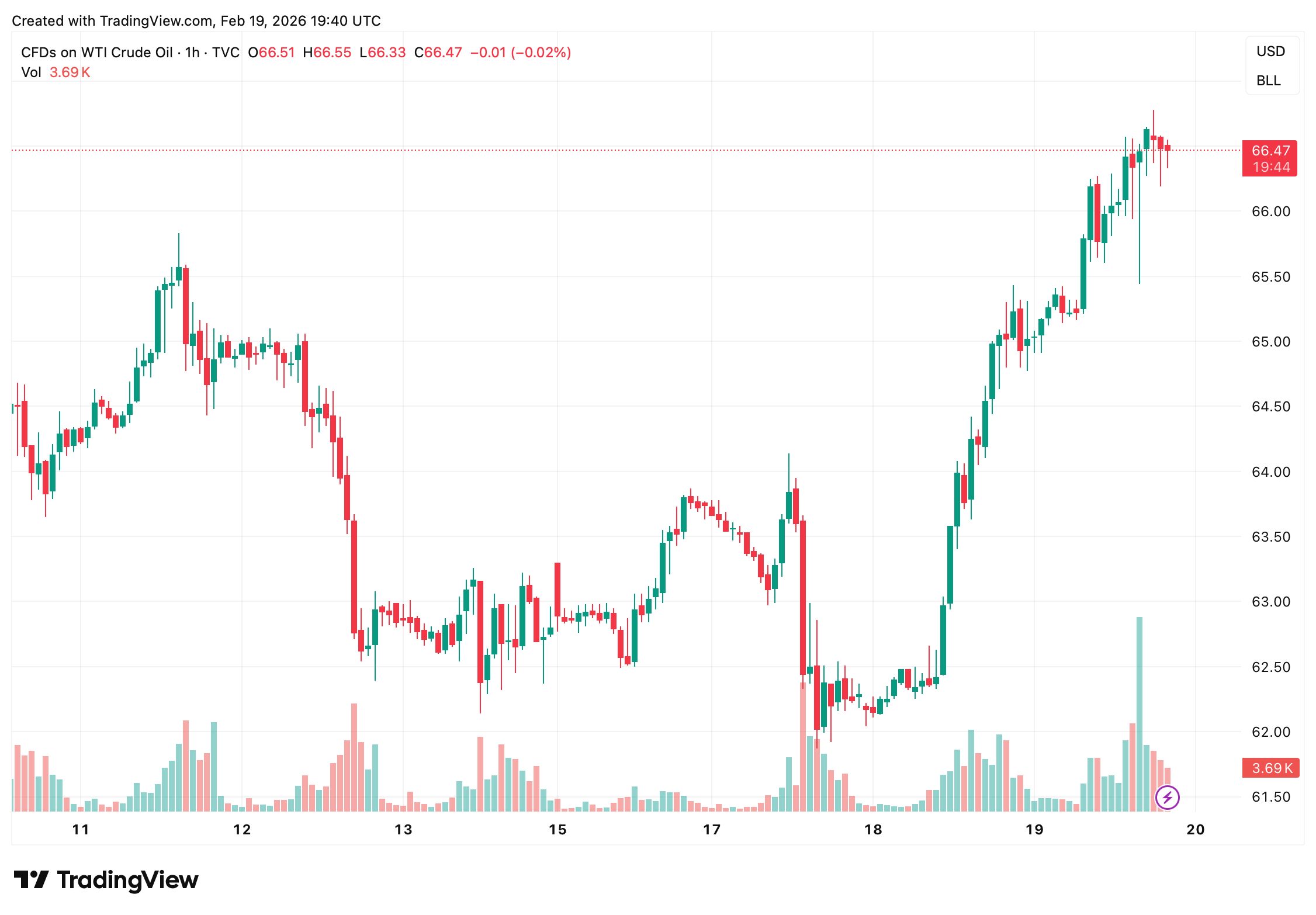

Power markets have been a central driver on Thursday. U.S. crude oil climbed greater than 2% to about $66.52 per barrel, reaching a six-month excessive amid studies that President Donald Trump may resolve inside 10 days on potential army motion tied to escalating U.S.-Iran tensions. The transfer supported vitality shares however dampened broader danger urge for food.

Company earnings additionally formed buying and selling. Walmart reported better-than-expected fourth-quarter outcomes however issued full-year adjusted earnings steering of $2.75 to $2.85 per share, beneath the $2.96 consensus estimate. Shares edged decrease. Deere rose greater than 11% after topping revenue expectations, citing enhancing demand in building and smaller agricultural tools segments.

Financial information continued to sign resilience. January manufacturing output rose 0.7%, whereas housing begins elevated 6.2%. Preliminary jobless claims got here in at 223,000. Nevertheless, minutes from the Federal Reserve’s January assembly indicated officers stay open to further fee will increase if inflation fails to reasonable.

The ten-year Treasury yield held close to 4.07%, whereas the U.S. greenback index rose 0.2% to 97.90. Futures markets at present worth in two quarter-point fee cuts in 2026, although stronger information may alter that outlook.

Consideration now turns to Friday’s Private Consumption Expenditures report, the Fed’s most popular inflation gauge. Core PCE is anticipated to rise 3% 12 months over 12 months, reinforcing expectations that coverage easing could proceed steadily.

After-hours earnings from Reserving, Block, Intuit and Rivian are anticipated to affect expertise, journey and consumer-related shares. Broader themes, together with AI funding traits and pending Supreme Courtroom choices on tariffs, add further variables for buyers.

With geopolitical danger elevated and inflation information pending, markets seem positioned for continued volatility into the week’s shut.

FAQ ⏱️

- Why are U.S. shares decrease on Feb. 19, 2026?Shares are modestly down attributable to rising oil costs, geopolitical tensions, and warning forward of key inflation information.

- What’s the Dow Jones stage in late buying and selling?The Dow Jones Industrial Common was at 49,349, down 314 factors, as of two:30 p.m. EST.

- What’s core PCE anticipated to point out?Core Private Consumption Expenditures inflation is forecast at 3% year-over-year.

- How are oil costs affecting markets?Crude oil above $66 per barrel is supporting vitality shares however weighing on broader danger sentiment.