- The Bitcoin value wavering in consolidation revealed the formation of a bearish continuation sample referred to as inverted pennant.

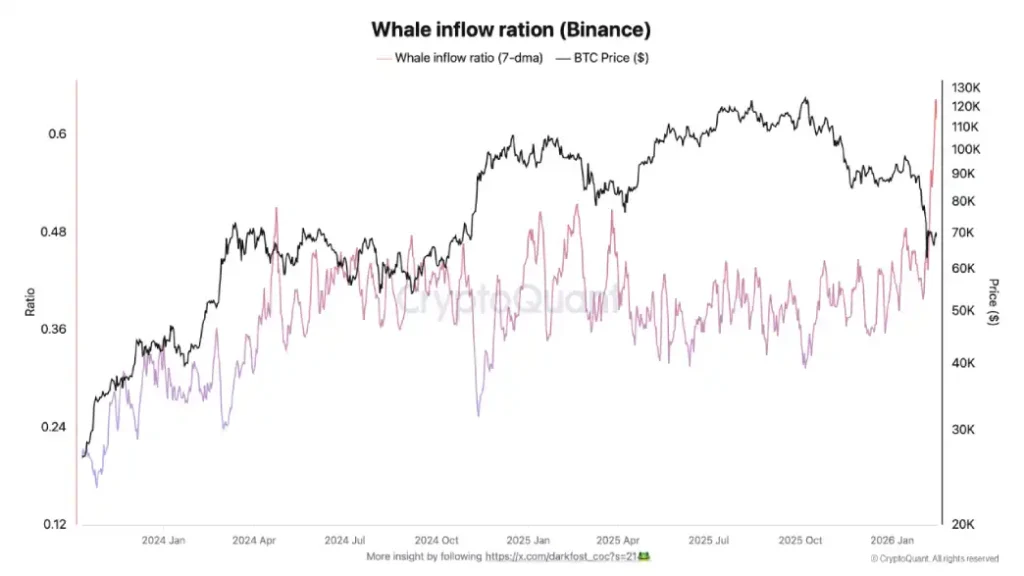

- Binance data a notable spike in whale influx, suggesting an elevated provide of cash accessible for buying and selling.

- Crypto concern and greed index at 10% point out a pessimistic sentiment amongst market individuals.

The Bitcoin value is down roughly 2% throughout Tuesday’s U.S. market hours to change arms at $67,521. The downtick tracked declines in tech shares and gold amid renewed geopolitical pressure, indicating a shared macro-driven transfer. The promoting strain retains $BTC wobbling in a slim vary round $70,000 projecting lack of initiation from patrons or sellers. As well as, the on-chain knowledge reveals a decisive spike in Whale Influx Ratio, suggesting a heightened large-holder exercise and danger for extended correction forward.

Whale Transfers to Exchanges Counsel Potential Volatility Forward for $BTC

On-chain metrics from CryptoQuant present fascinating spikes within the exercise of huge holders on Binance through the present Bitcoin market downturn. A measure referred to as whale influx ratio – which divides Bitcoin deposits from the ten largest transactions by total inflows to the change, then smoothes with a seven-day shifting common – jumped from about 0.40 to 0.62 between February 2 and February 15.

This shift reveals {that a} considerably bigger quantity of incoming $BTC for that point interval got here from main wallets, on scales not seen in over two years. Such patterns are sometimes correlated with elevated availability of cash to commerce on the platform as massive individuals switch belongings from private storage to change accounts.

Analysts attribute the uptick to various components. One particular person who involves thoughts is a pockets belonging to Garrett Jin, typically known as the “19D5” or “Hyperunit whale,” who transferred nearly 10,000 $BTC to Binance in latest weeks. Past this solitary participant, wider knowledge exists of assorted important transfers flowing to the change due to its excessive liquidity amidst risky situations.

The surge comes as Bitcoin has pulled again from earlier highs, with costs lingering round $67,000-$68,000 in mid-February after testing decrease ranges. Buyers in all classes appear to be adjusting positions in opposition to uncertainty, leading to excessive change deposits from large holders.

Traditionally, whales shifting $BTC to change has coincided with main market corrections and heightened promoting strain.

Bitcoin Value Evaluation Reveals Key Bearish Continuation Sample

The Bitcoin value has been wavering round $70,000 for the previous two weeks. The consolidation struggles to maintain an extended divergence from the aforementioned degree, suggesting insecurity for patrons or sellers.

Nevertheless, a deeper evaluation of the 4-hours chart reveals that value motion has been resonating inside two converging trendlines which revealed the formation of inverted pennant sample. The prevailing downtrend displayed with an extended downsloping trendline and a triangle formation reveals the sample formation.

$BTC/USDT -1d Chart

Theoretically, this triangle acts as a respiratory interval for sellers to replenish bearish momentum earlier than the following breakdown. If the chart setup holds true, the Bitcoin value is poised for a bearish breakdown from the sample’s backside trendline at $67,200, and the post-breakdown fall might push the asset one other 18% right down to hit $55,000.