The January FOMC assembly, which noticed two dovish dissents, mirrored a deeply divided Federal Reserve (Fed).

Whereas policymakers largely endorsed the present stance, a number of officers expressed assist for “two-sided language” on future interest-rate strikes, signaling that fee hikes may return if inflation stays above goal.

Fed Minutes Reveal Hawkish Divide as Bitcoin Struggles

Current macroeconomic knowledge have strengthened Fed Chair Jerome Powell’s cautiously optimistic outlook.

Progress has stunned to the upside, inflation seems to be drifting decrease, and the job market exhibits indicators of steadying.

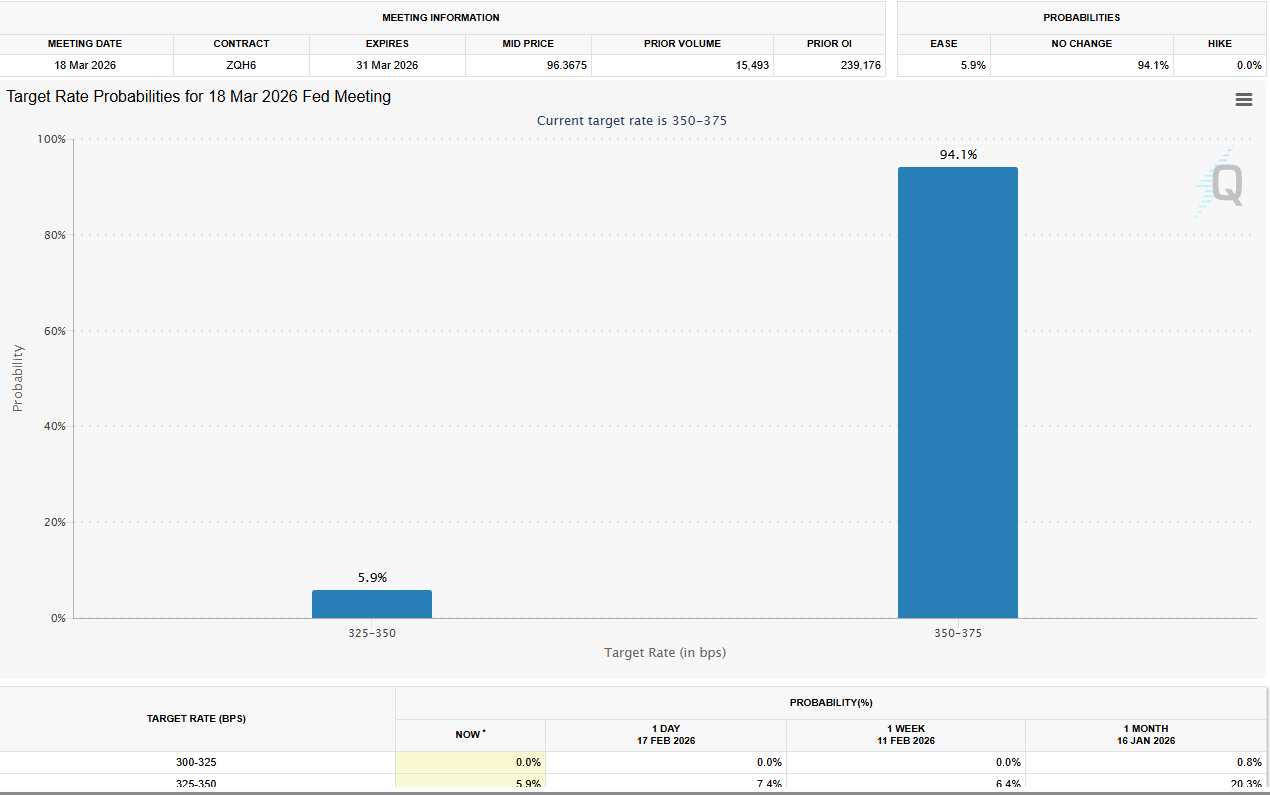

These developments have pushed 2026 rate-cut expectations larger, although a transfer in March is successfully off the desk following final week’s stronger-than-expected payroll report.

The minutes additionally revealed nuanced debates inside the Consumed inflation and productiveness:

- A number of officers cautioned that disinflation could proceed extra slowly than anticipated.

- Others indicated that further fee cuts could possibly be warranted if inflation declines as anticipated, however some warned that too many cuts would possibly entrench inflationary pressures.

- Productiveness good points had been highlighted as a possible issue to mood future inflation.

Market vulnerabilities had been additionally a focus, with a number of members noting dangers in non-public credit score and the broader monetary system.

Analysts recommend that these issues, mixed with the Fed’s hawkish undertones, have contributed to safe-haven shopping for in bonds and the greenback, whereas Bitcoin continues to face downward strain.

Bitcoin (BTC) Worth Efficiency. Supply: TradingView

“The minutes present a Fed nonetheless divided however attentive to each inflation dangers and development momentum,” mentioned a senior market strategist. “Bitcoin’s underperformance is partly a mirrored image of risk-off sentiment and the greenback’s continued energy.”

Buyers will now look ahead to any additional commentary from Fed officers as markets digest these minutes, weighing the steadiness between hawkish vigilance and dovish optimism in shaping 2026’s financial coverage trajectory.

The put up Bitcoin Falls, Greenback & Bonds Rally On Hawkish Fed Minutes appeared first on BeInCrypto.