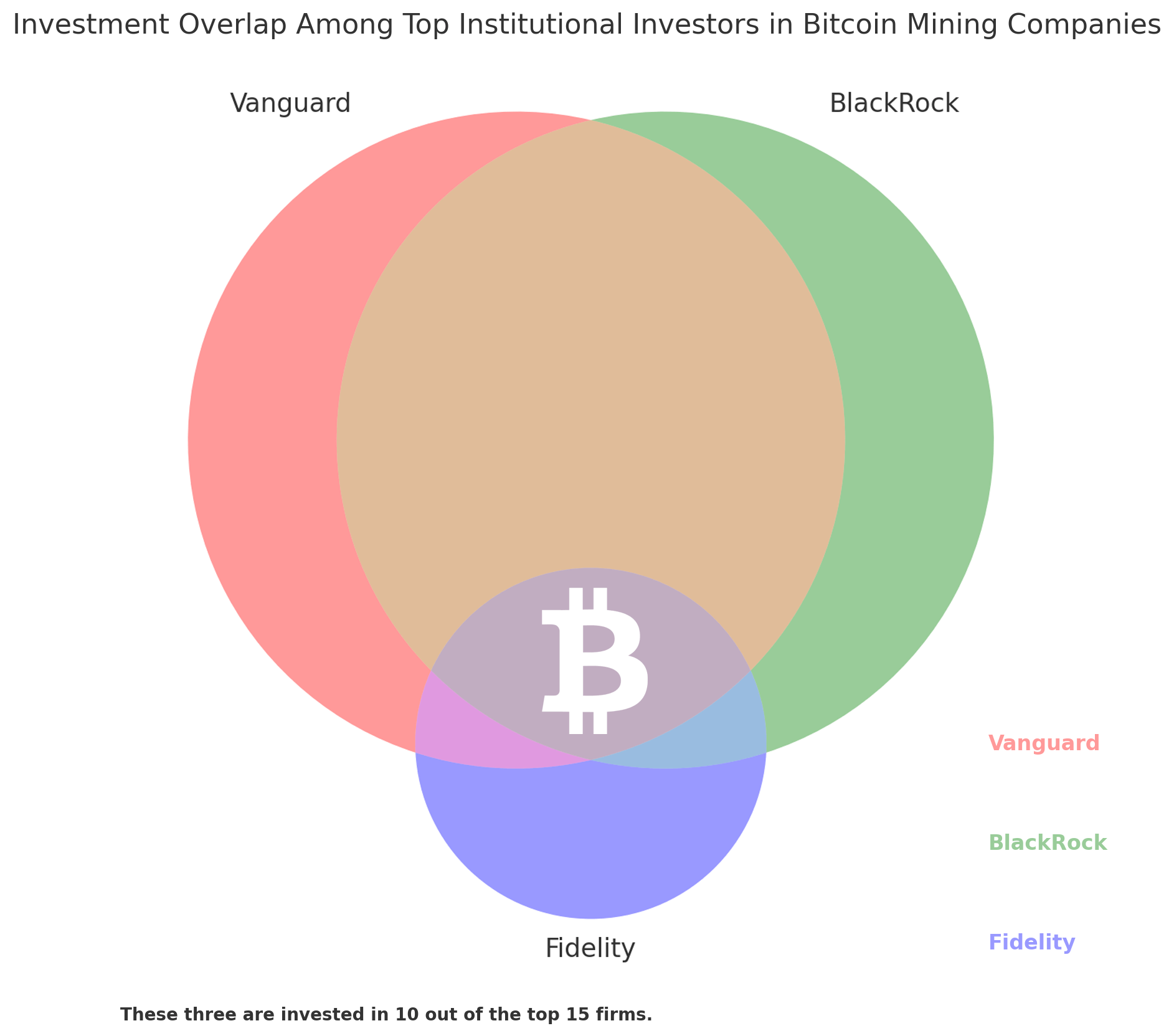

Institutional buyers now maintain pivotal stakes in 15 main cryptocurrency mining companies, with asset managers like Vanguard, Blackrock, and Constancy steering possession throughout an more and more aggressive sector.

Contained in the High 15 Bitcoin Mining Corporations Dominated by Finance Heavyweights

Institutional buyers are rewriting the principles of the cryptocurrency mining sector. Vanguard, Blackrock, and Constancy now command towering stakes in 15 main companies, reworking a once-niche sector right into a battleground for Wall Avenue’s billions.

From Tether’s billion-dollar dominance to retail’s fading foothold, possession charts reveal a seismic energy shift. Establishments maintain as much as 90% of shares in key gamers—staking claims on crypto’s subsequent frontier. This evaluation examines the foremost 15 publicly traded bitcoin (BTC) mining entities by market capitalization and the institutional stakeholders shaping their trajectories.

Galaxy Digital Holdings Ltd. (GLXY) is anchored by Constancy Administration & Analysis Co. LLC, which owns 14.88% of its shares. The agency’s institutional possession displays average affect, with retail buyers retaining a notable portion of the remaining fairness.

MARA Holdings, Inc. (MARA) sees Blackrock and Vanguard as its prime institutional backers, holding 13% and 11% of shares, respectively. Institutional buyers collectively management 44–49% of the corporate, whereas retail buyers and insiders account for almost all of the remaining stake.

Riot Platforms, Inc. (RIOT) is dominated by Vanguard and Blackrock, which maintain 9.8% and seven.0% of shares. Institutional possession totals roughly 40%, with Geode Capital Administration rounding out key stakeholders. Retail buyers retain vital affect over the corporate’s strategic path.

Core Scientific, Inc. (CORZ) stands out for its heavy institutional focus, with 90% of shares held by companies like Vanguard (19.4 million shares) and Beryl Capital Administration (18.2 million shares). This near-total institutional management underscores Wall Avenue’s confidence in its operational scale.

Bitdeer Applied sciences Group (BTDR) lists Yong Rong (HK) Asset Administration as its largest institutional investor, with a $65 million stake. Trivest Advisors, SC China Holding, and Vaneck Associates comply with, contributing to institutional possession ranging between 22.25% and 40.93%.

Northern Knowledge AG (NB2) is majority-owned by Tether Holdings Ltd., which holds a 39.29% stake valued at €1.176 billion. CEO Aroosh Thillainathan follows with 7.725%, whereas Vaneck Associates holds a smaller 0.98% place. Retail buyers personal 59.1% of the corporate.

Cleanspark, Inc. (CLSK) counts Vanguard (6.55%), Blackrock (6.15%), and Dimensional Fund Advisors amongst its prime institutional holders. Establishments collectively personal 43–46% of shares, leaving insiders and retail buyers with the rest.

Iris Vitality Restricted (IREN) options Fortress Hook Companions as its largest institutional shareholder, proudly owning 3.7% of shares. Moore Capital Administration, Morgan Stanley, and Vaneck Associates additionally maintain stakes, with establishments controlling 41–44% of the corporate.

Iris Vitality Restricted (IREN) options Fortress Hook Companions as its largest institutional shareholder, proudly owning 3.7% of shares. Moore Capital Administration, Morgan Stanley, and Vaneck Associates additionally maintain stakes, with establishments controlling 41–44% of the corporate.

Cipher Mining Inc. (CIFR) leans closely on retail buyers, who personal 40% of shares. Vanguard ($29 million stake) and State Avenue ($27 million) lead institutional possession, which spans 27–32%, whereas insiders maintain one other 32%.

Utilized Digital Company (APLD) is formed by CEO Wesley Cummins, who owns 10.39% of shares. Blackrock (6.37%) and Vanguard (5.72%) comply with, contributing to institutional possession of 65–75%—one of many sector’s highest concentrations.

Hut 8 Corp. (HUT) sees Blackrock (10%) and Vanguard (7%) as its prime institutional buyers. Retail buyers dominate with 57% possession, whereas establishments maintain 31–61% relying on market circumstances, reflecting fluctuating institutional curiosity.

Terawulf Inc. (WULF) has 62.3% institutional possession, led by Blackrock (8.2%) and Vanguard (6.5%). Retail buyers maintain 37.7%, highlighting a steadiness between Wall Avenue and particular person stakeholders.

Bitfufu Inc. (FUFU) stays firmly underneath insider management, with founders and associates proudly owning 82.9% of shares. Establishments like Morgan Stanley maintain a scant 1.37–1.49%, leaving retail buyers with lower than 10%.

Bitfarms Ltd. (BITF) lists Vanguard (12.5%), Blackrock (11.2%), and Constancy (9.8%) as its largest institutional holders. Institutional possession ranges between 25–30%, with retail buyers and insiders holding the bulk.

Cango Inc. (CANG) is exclusive for its retail-driven possession construction, with the general public controlling 51% of shares. Insiders maintain 28–36%, whereas establishments like Morgan Stanley personal simply 13–14%, reflecting restricted Wall Avenue engagement.

The rise of institutional capital in cryptocurrency mining marks a pivotal departure from its decentralized origins. As monetary titans carve deeper into the sector, questions emerge about innovation’s trajectory and whether or not blockchain’s egalitarian beliefs can coexist with Wall Avenue’s intentions.